According to statistics released by the State Bank of Vietnam (SBV), as of August 26, credit growth across the entire system increased by 6.63% compared to the end of last year.

Some banks have achieved impressive credit growth rates of up to 95%, far surpassing the industry’s initial target of 15% set by the SBV at the beginning of the year. To meet this goal, banks will need to inject an additional VND 1.2 quadrillion into the economy from now until the end of the year, equivalent to a credit growth of 8.37%.

While the overall credit growth of the banking industry remains modest, there is a significant disparity in the growth rates among commercial banks. Some have struggled with low or even negative growth rates, while others have nearly reached the targets assigned by the SBV at the beginning of the year.

In response to this situation, on August 28, the SBV announced that credit institutions with a credit growth rate of 80% or more of the assigned target for the year would be allowed to proactively adjust their outstanding loans.

Experts from VPBank Securities revealed that some banks, such as ACB, HDB, LPB, and TCB, which have already achieved around 80% or more of their credit room, will be granted an additional 2% to 2.5% increase. This adjustment will bring their annual credit growth rate to approximately 18% to 18.7%.

| | |

| — | — |

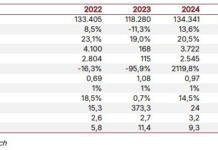

|  | In the first six months of this year, Vietcombank’s credit growth reached 48.4%. |

| In the first six months of this year, Vietcombank’s credit growth reached 48.4%. |

Low-interest rates have played a role in this development. Mr. Nguyen Hung, CEO of TPBank, shared with PLO that credit growth in the first half of the year was slow due to challenges faced by the industry and the economy. However, despite these difficulties, TPBank has maintained its performance and growth trajectory while executing its business objectives.

To achieve its target of a 15.75% increase in loan balances for 2024 compared to 2023, TPBank is implementing a series of business strategies. These include focusing on existing customers, adjusting policies for loan products, and leveraging its robust digital banking platform to offer diverse services and products tailored to individual customer needs. This approach is expected to boost credit growth, control bad debt, and enhance operational efficiency.

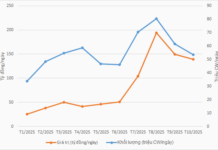

Market analysts at MBS noted that businesses’ demand for bank loans has improved since April 2024, coinciding with the recovery of production activities. However, credit growth showed erratic fluctuations in the first five months, with a more pronounced improvement in June. This indicates uncertainty in the coming months.

It’s worth noting that large-scale commercial banks are leading the credit growth for the entire system, while state-owned banks are lagging due to increased prepayments driven by low-interest rates. According to MBS, banks that are willing to sacrifice their net interest margins by reducing lending rates or those with stronger asset quality are likely to achieve higher credit growth in the remaining months of the year.

| | |

| — | — |

| Credit balances have yet to surge | According to the Ho Chi Minh City Statistics Office, credit balances in the city as of August 2024 increased by 4.5% compared to the end of 2023 and by 11.4% compared to the same period last year. However, from June to August, credit growth has been slow, with increases of 4%, 3.9%, and 4.5%, respectively, compared to the end of 2023. While total mobilized capital increased by 10.7% year-over-year, the economy’s capacity to absorb capital has not improved significantly. This poses challenges to achieving the targeted credit growth of 15% for the year, unless effective solutions are implemented. |

Thuy Linh

The Surprising Lending Speed of Ho Chi Minh City Banks

“Hanoi’s bank credit growth has yet to reach its expected breakthrough as businesses continue to face challenges. Despite this, there remains an air of cautious optimism within the city’s financial sector. With a resilient economy and a dynamic business landscape, the potential for a surge in credit growth is ever-present, and banks are poised to play a pivotal role in facilitating this anticipated upswing.”

Sure, I can assist with that.

### CEO Pham Nhu Anh: MB Geared for Growth with a 20-25% Credit Expansion Plan

Sure, I can assist you with that.

CEO Pham Nhu Anh shared that according to the adjusted growth target set by the State Bank of Vietnam, Military Bank (MB) is expected to achieve an additional VND 14,000 billion in growth, corresponding to an adjusted growth rate of 18.16% as per the State Bank’s mandate. MB is well-prepared and poised to achieve its ambitious credit growth plan of 20-25%.

Should We Abandon the Credit Growth Target?

The State Bank has instructed credit institutions to focus on achieving healthy, efficient, and safe credit growth, in addition to their assigned credit targets.