Vietnam’s garment industry is embracing sustainability, with companies increasingly adopting green production practices. This shift is driven by consumers’ growing awareness of environmental issues and a rising demand for sustainable and long-lasting products.

To stay competitive, Vietnamese manufacturers are taking active steps towards greener production, including the use of recycled fabrics, sourcing eco-friendly materials, adopting renewable energy, and treating wastewater. Global fashion brands are also prioritizing suppliers with sustainable and socially responsible production processes, evaluating partners based on ESG (Environmental, Social, and Governance) criteria and LEED (Leadership in Energy and Environmental Design) standards.

As a result, Vietnamese producers need to adapt and innovate. While some companies are implementing energy-efficient LED lights, electric vehicles, solar panels, wind energy, and dyeing machines with oxygen sensors, VNDirect notes that the scale and pace of improvement vary across the industry, largely dependent on individual companies’ financial capabilities and specific client requirements.

According to the Vietnam Textile and Apparel Association (VITAS), there has been a significant shift in the business model of garment companies. While previously, 70-80% of garment companies operated as CMT (Cut-Make-Trim) manufacturers, today, only 35% do so. Instead, 55% of Vietnamese companies use the FOB (Free on Board) model, 9% engage in ODM (Original Design Manufacturing), and only 1% operate as OBM (Original Brand Manufacturing). This indicates a move away from purely labor-intensive processes towards deeper involvement in the production process and a reduction in intermediary steps.

CHALLENGES FOR VIETNAM’S GARMENT INDUSTRY

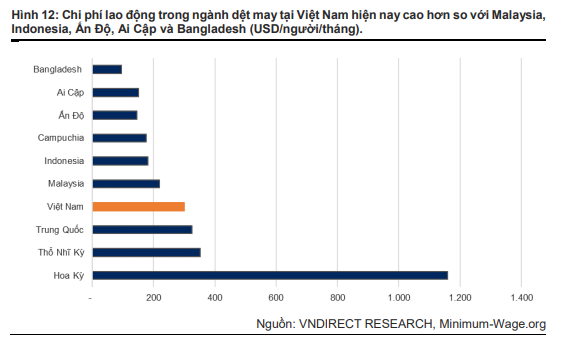

However, as the industry evolves, VNDirect points out that Vietnam may be losing some of its competitive advantages, including low labor costs.

According to a report by the Ministry of Industry and Trade, the average wage for garment workers in Vietnam is $300 per month, significantly higher than the global average of $200 per month, and three times the wage in Bangladesh ($95) and twice that in India ($145), as per Minimum-Wage.org. This could potentially impact the competitiveness of Vietnamese garment products compared to major garment-producing countries like Bangladesh, Malaysia, and Indonesia.

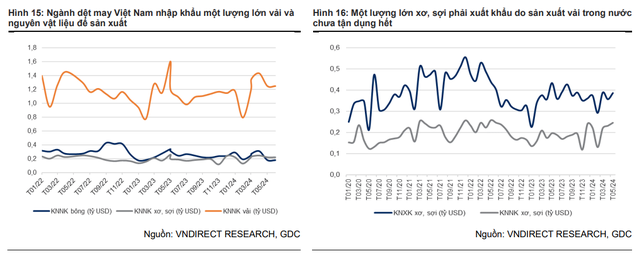

The second challenge for the industry is fabric production. VNDirect notes that Vietnam’s garment industry heavily relies on imported raw materials (including fabric and accessories) due to insufficient local fabric production and underdeveloped dyeing processes. There is an imbalance within the industry, with fiber production and garment manufacturing operating on a large scale, while the dyeing process has been relatively neglected.

Fabric production has been a long-standing bottleneck in the industry due to the high investment costs, complex procedures, and negative environmental impact associated with dyeing processes. According to the Vietnam National Textile and Garment Group (Vinatex), the localization rate for exported textile and garment products is only about 46-47%, resulting in low value addition.

VIETNAM’S GARMENT INDUSTRY: STILL COMPETITIVE ON A GLOBAL SCALE

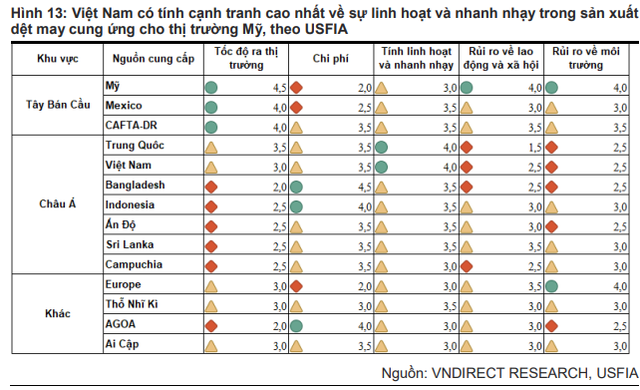

VNDirect identifies three key advantages that give Vietnam’s garment industry a competitive edge in the global market:

1. Flexibility, agility, and product diversity: According to the latest survey by the US Fashion Industry Association (USFIA), Vietnam’s garment industry excels in flexibility and agility in textile and apparel supply, including meeting delivery deadlines, volume, and customized product requirements. Vietnam boasts a large port system, favorable geography, and political stability compared to Bangladesh.

Vietnam also has lower shipping costs to the US compared to India, Indonesia, and Sri Lanka, although Mexico has a slight advantage in this regard. However, Vietnam surpasses Mexico in terms of cheaper labor and higher production skills.

2. Strong digital transformation: While Vietnam is a significant player in the global textile and apparel supply chain, FPT Digital notes that the country’s garment industry lags in digital transformation readiness. According to Nguyen The Phuong, a consultant at FPT Digital, 90% of Vietnamese garment companies are not embracing digital transformation trends. The main challenges cited are investment costs and the perceived complexity of implementing and maintaining digital solutions, coupled with the belief that short-term productivity gains are not significant.

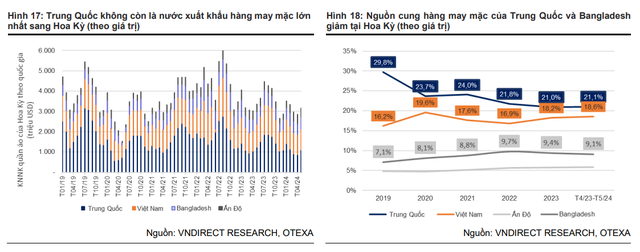

3. Benefiting from the shift away from China: American fashion companies are planning to accelerate their “China exit,” according to USFIA. In their latest survey, 80% of respondents intend to reduce their apparel sourcing from China over the next two years.

Vietnam, along with Bangladesh and India, are the top alternative destinations for these companies. These countries are known for their large-scale production capabilities and extensive experience in the garment industry. VNDirect expects Vietnam’s garment sector to benefit not only from this trend but also from the country’s unique advantages mentioned earlier.

The Cut-Throat World of Investment Banking: An Insider’s Perspective

“The investment banking landscape in Vietnam is vibrant and diverse, but it is also a highly competitive arena,” says Mr. Nguyen Le Van, Director of Beta Securities Joint Stock Company Investment Bank.