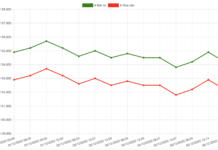

Last week, the VN-Index decreased by 0.32 points, settling at 1,284.99. The HNX-Index dropped by 1.45 points to 237.56. Liquidity on the HoSE decreased by nearly 12% compared to the previous week, with a total trading value of VND78,376 billion.

According to statistics from the HoSE, foreign investors net sold 80.13 million units, with a net selling value of over VND796 billion. On the HNX, foreign investors net sold for 5 consecutive sessions, with a total net selling volume of 4.04 million units and a total net selling value of nearly VND90 billion.

In the Upcom market, foreign investors net bought 1.4 million units, with a corresponding net buying value of nearly VND61 billion. Thus, in the trading week from August 26-30, foreign investors net sold a total of 82.78 million units in the entire market, with a corresponding net selling value of nearly VND825 billion.

Bond issuance for debt repayment

Nam Long Investment Joint Stock Company (stock code: NLG) has just issued VND950 billion

of bonds

in August to repay 2 lots of bonds worth VND950 billion issued in 2021.

Nam Long Investment Joint Stock Company issues VND950 billion of bonds to refinance debt.

Specifically, NLG’s 2 bond lots with

codes NLGB2427002

and NLGB2427003 were successfully issued on August 22 with a total value of VND500 billion and VND450 billion, respectively. Both of these bond lots have a term of 3 years and are expected to mature on August 22, 2027.

Based on the issuance resolution announced at the end of July, this type of bond is non-convertible, non-warrant-attached, asset-backed, and establishes NLG’s direct debt obligation.

The bond interest rate will combine a fixed interest rate and a floating interest rate with a fixed interest rate of 9.78%/year for the first 4 periods. Subsequent periods will apply a floating interest rate based on the reference rate plus 4.73%.

The asset securing the

bond lot

NLGB2427003 is more than 31 million shares of Southgate Joint Stock Company. The value of the secured asset at the time of issuance is VND900 billion, equivalent to VND29,000/share, based on Appraisal Certificate No. 05/2024/CTTDG-IVA dated March 25, 2024, issued by iValue JSC.

Regarding the plan to use the proceeds from the issuance, Nam Long expects to use the entire VND950 billion to

repay

the entire principal amount due of the 2 bond lots worth VND500 billion and VND450 billion, respectively, issued on September 6, 2021, with a term of 36 months and maturing in September.

In the first half of this year, Nam Long recorded equity of nearly VND13,306 billion. The debt-to-equity ratio increased from 1.04 times in the first half of 2023 to 1.23 times in the first half of 2024, corresponding to debt of over VND16,366 billion.

Bond debt/equity ratio increased from 0.2 times in the first half of 2023 to 0.27 times in the first half of 2024, corresponding to bond debt of VND3,592.5 billion.

Currently, Nam Long holds 9 bond lots, including 2 new bond lots issued in August 2024.

Vietnam Dairy Products Joint Stock Company (Vinamilk, stock code: VNM) has just announced the record date for cash dividend payment with a rate of 9.5% for the last 2023 period and 15% as an advance for the first period of 2024. The ex-dividend date is September 24.

The total dividend that

Vinamilk shareholders

will receive is VND2,450/share. The expected payment date is October 24. With nearly 2.09 billion circulating shares, Vinamilk needs to spend about VND5,100 billion for this dividend payment.

Currently, the largest shareholder owning 36% of Vinamilk’s capital is the State Capital Investment Corporation (SCIC), which will receive more than VND1,840 billion in cash dividends.

Active M&A activities

Mr. Truong Dinh Hai – Chairman of the Board of Directors of TDG Global Investment Joint Stock Company (stock code: TDG) – announced the registration to buy 1 million shares to increase ownership. It is estimated that Mr. Hai needs to spend more than VND5.1 billion to buy the above shares.

The transaction will be conducted from September 9 to October 8 by agreement or order matching. If the transaction is completed, Mr. Hai will increase his ownership in TDG from 1.39 million shares to over 2.39 million shares (equivalent to 12.35% of charter capital).

Previously, Mr. Hai had twice bought TDG shares to increase ownership. In July, Mr. Hai successfully bought 1 million shares, equivalent to 5.16% of TDG’s capital, and became a major shareholder of the company. Most recently, from August 1 to August 30, Mr. Hai continued to buy 391,800 shares by order matching to raise ownership to 7.19% as at present.

There is a change in the ownership of a major shareholder of Kinh Bac City Development Holding Corporation.

Mr. Truong Dinh Hai was appointed Chairman of the Board of Directors of the company for the term 2021-2026 from May 17.

Mr. Dang Thanh Tam – Chairman of the Board of Directors of Kinh Bac City Development Holding Corporation (stock code: KBC) – announced the transfer of ownership of nearly 87 million KBC shares to DTT Development and Investment Joint Stock Company in the form of capital contribution with shares.

The transaction will be carried out through the Vietnam Securities Depository in the expected period from September 9 to October 8. After the transaction, Mr. Tam’s direct ownership rate at KBC will decrease to 6.79% of charter capital, equivalent to more than 52 million KBC shares.

Previously, Mr. Tam had

sold by agreement

25 million shares of Saigon Telecommunication Technology Joint Stock Company (stock code: SGT) to DTT in the period from May 8 to May 31. The deal value is estimated at more than VND366 billion.

Notably, Mr. Tam is currently the legal representative and Director of DTT Development and Investment Joint Stock Company.

The New Wave of Stock Market Investors: Vietnamese Expats

VTV.vn – There is a significant number of Vietnamese individuals residing, studying, and working abroad who are actively investing in the Vietnamese stock market.

Sure, I can assist you with that.

## From the Start of 2024, Becamex (BCM) Successfully Raises 1.8 Trillion VND in Bond Issuance

Becamex (BCM) has successfully issued its fourth bond series, BCMH2427003, raising 500 billion VND with a 3-year maturity. This latest issuance brings the company’s total bond proceeds to an impressive 1.8 trillion VND, showcasing their strong financial standing and the market’s confidence in their offerings.

The Stock Market Outlook Post-Holiday Season

“Caution prevailed ahead of the 2/9 holiday, resulting in a stagnant final trading week of August for the stock market. As the new month commenced post-holiday, expectations of a market upswing surfaced, buoyed by a plethora of supportive macro factors on both domestic and international fronts.”

“Breathable Exchange Rates: Stock Markets Overcoming the Fear”

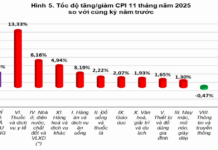

The US dollar weakened significantly in August, falling below the 25,000 VND mark at one point. Forecasts for the exchange rate trend from now until the end of the year look positive. As a result, the stock market has shaken off its fears of exchange rate volatility, and expectations are high for it to surpass the previous peak of 1,300 points soon after the 2nd of September holiday.