The FPTS Securities Company’s analytical report on the beer industry assesses that the Vietnamese beer market is divided into three main consumption segments based on product pricing: the popular, mid-range, and premium segments.

Beers in the mid-range and premium segments are bottled and canned beers from companies such as Sabeco, Habeco, Heineken, and Carlsberg. Beers in the popular segment are mainly draught beers. Premium segment beers typically cost 30-40% more than those in the mid-range segment.

VIETNAMESE CONSUMERS ARE DEVELOPING A TASTE FOR PREMIUM BEER

According to FPTS, consumer preferences in the beer industry are evolving, with an increasing demand for better flavor and quality.

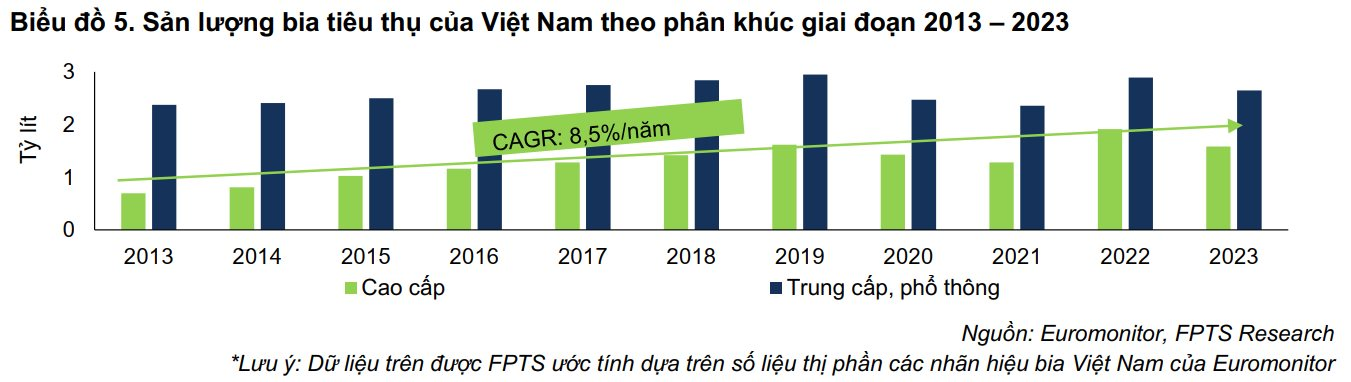

In the past, Vietnam’s beer consumption was mainly focused on the popular and mid-range segments (accounting for about 77% of total consumption in 2013) with well-established and popular brands such as Saigon, 333, Hanoi, Huda, and Larue. Nowadays, consumption is steadily expanding into the premium segment, offering better quality and flavor experiences.

In addition to familiar brands like Tiger, Heineken, Budweiser, and Saigon Special, there are also new entrants such as Heineken Silver, Edelweiss, Saigon Chill, Saigon Gold, Tuborg, and 1664 Blanc…

The consumption volume of premium segment beers achieved a CAGR growth rate of 8.5%/year (2013-2023), outpacing the industry’s CAGR of 3.2%/year. In 2023, the premium segment accounted for approximately 37.4% of total consumption volume, a significant increase from 22.7% in 2013.

HEINEKEN DOMINATES THE PREMIUM BEER MARKET

Consumer preferences in the beer market are evolving, and along with the familiar, affordably priced beer products, there is a growing demand for premium beers with diverse flavors.

To meet these changing preferences, foreign beer companies are continuously diversifying their product portfolios, especially in the premium segment.

New product launches and re-launches by beer companies:

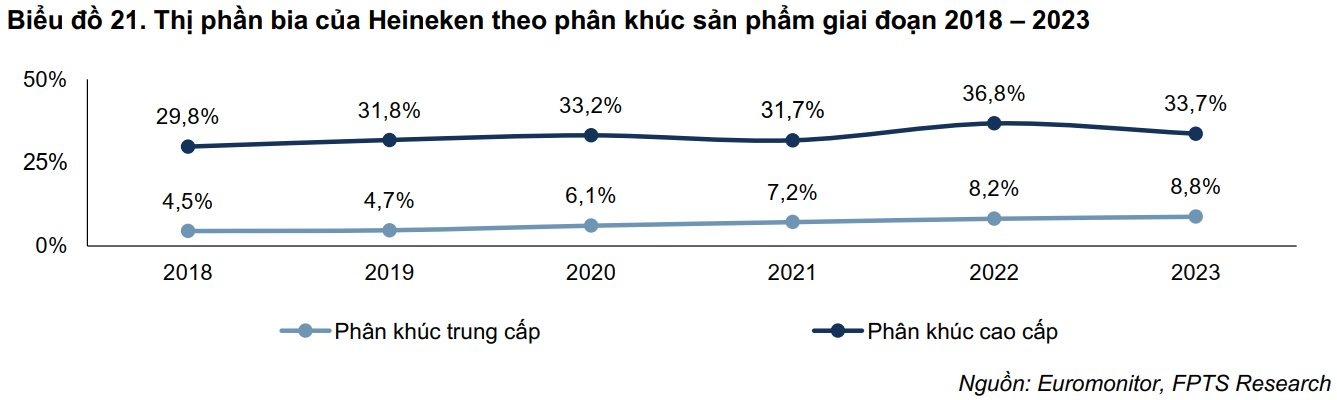

Heineken, the market leader in Vietnam’s beer market, has a portfolio dominated by its core and long-standing brands: original Tiger, original Heineken, and Larue, which together account for an estimated average of 90% of total consumption from 2018 to 2023.

Heineken Vietnam has been actively innovating and launching premium products such as low-alcohol Heineken Silver, non-alcoholic Heineken 0.0, and Tiger Platinum, a wheat beer infused with orange peel flavor…

As of 2023, the consumption volume of Heineken’s premium beer products has increased from 29.8% in 2018 to 33.7% of Vietnam’s total beer consumption .

Carlsberg has also been introducing premium beers such as 1664 Blanc, Carlsberg Danish Pilsner, and Tuborg Ice in 2022 and 2023.

Sabeco’s product portfolio is less diverse than that of foreign beer companies, with the mid-range segment, including long-standing brands like 333, Saigon Lager, and Saigon Export, accounting for an average of 98% from 2018 to 2023.

Only 2% of their portfolio falls into the premium segment, including brands like Saigon Chill, Saigon Special, Saigon Gold, and Saigon Export Premium. This limits their ability to cater to a diverse range of customers as consumer preferences evolve. On the other hand, the company has been actively researching and launching new products, but these are often existing products with unchanged flavors and only minor packaging modifications.

These factors have negatively impacted Sabeco’s market share, which has been on a downward trend from 2018 to 2023.

The quality of premium, mid-range, and popular beers depends on factors such as (1) the quality of raw materials (malt, hops, cereals…), (2) the ratio of malt to substitute cereals (premium beers typically have a higher malt content), (3) the brewing time (premium beers are usually brewed for longer), and (4) the type of yeast used.

When comparing the usage of raw materials in beer production, premium Vietnamese brands tend to have a higher proportion of malt compared to lower-tier brands.

Some premium brands like Heineken, Saigon Special, and Trúc Bạch even use 100% malt and no substitute cereals in their brewing process.

In addition to using fewer substitute cereals, some premium brands like Tiger Platinum, Tiger Soju, or 1664 Blanc also incorporate fruit flavors and other additives to create unique tastes.

The Dominant “Four Kings” Ruling the Vietnamese Beer Market: How Heineken, Sabeco, Carlsberg Earn Billions of USD Thanks to Vietnamese Drinking Culture?

With a year-round warm climate, a large population, high income, and a distinctive drinking culture, the Southern region accounts for over half of Vietnam’s total beer consumption. With the main market in the South, Sabeco generated over $1 billion in beer sales in 2023, a 12% decrease compared to the previous year.