TMT Automotive Joint Stock Company (TMT Motor) has released its reviewed semi-annual financial statements, with UHY Audit and Advisory LLC emphasizing significant doubts about the company’s ability to continue as a going concern.

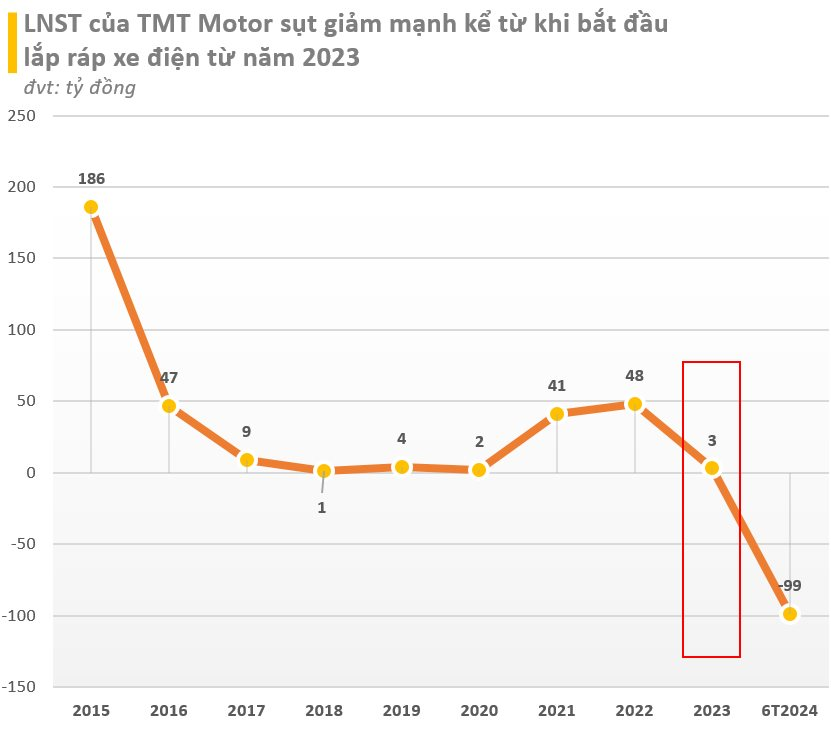

“For the first six months of 2024, TMT Motor reported a loss of VND 98.97 billion. As of June 30, 2024, the company’s short-term debt exceeded its short-term assets by VND 120.7 billion. These events, along with the issues described in notes 38.2 and 38.3, indicate the existence of significant uncertainty that may cast doubt on the company’s ability to continue as a going concern,”

the auditors emphasized.

According to the notes, TMT Motor revealed that during the second quarter of 2024, to ensure liquidity and reduce borrowing costs, the company had to lower prices to clear inventory. Additionally, the company reduced its workforce, cut costs, and decided to restructure its product lines, aiming for better new products.

TMT Motor also plans to dispose of fixed assets and investments and collect accounts receivable to supplement its operating capital and repay debts.

TMT Motor expects to be able to repay its maturing debts and continue operations in the next fiscal year. In the first half of 2024, the company reduced its staff by 140 employees, from 589 to 449 people (a 23.8% reduction in workforce).

In terms of business performance, TMT Motor recorded a 13.4% year-over-year decline in revenue to VND 1,323 billion for the first half of 2024. The company reported a post-tax loss of nearly VND 99 billion, compared to a profit of VND 1.18 billion in the same period last year. The gross profit margin also decreased significantly from 8.5% to 0.7%.

Explaining the loss, TMT Motor attributed it mainly to the challenging economic conditions faced by businesses and consumers. The economic downturn, frozen real estate market, reduced public investment, inflationary pressures, and tight consumer spending significantly impacted automobile sales, despite automakers’ efforts to slash prices to clear inventory.

“We are no exception. In 2024, to ensure liquidity and reduce borrowing costs, we had to offer deep price cuts to clear inventory, resulting in a negative gross profit of VND 48.7 billion. Additionally, we have decided to restructure our product lines, aiming for better new products,”

TMT Motor said.

TMT Motor is currently the distributor of the Wuling Mini EV electric car in Vietnam. In July, the company announced price adjustments for the 120 km and 170 km range versions of the Wuling Mini EV. Specifically, the LV2-120 is priced at VND 197 million, and the LV2-170 is VND 231 million.

This is the first time that the Wuling Mini EV has had its listed price adjusted since its launch on June 29, 2023. The price change is part of a plan developed by SGMW and TMT Motors to increase sales for vehicles produced from the second half of 2024.

“DIC Corp Reports 55% Drop in First-Half Year Profit After Audit”

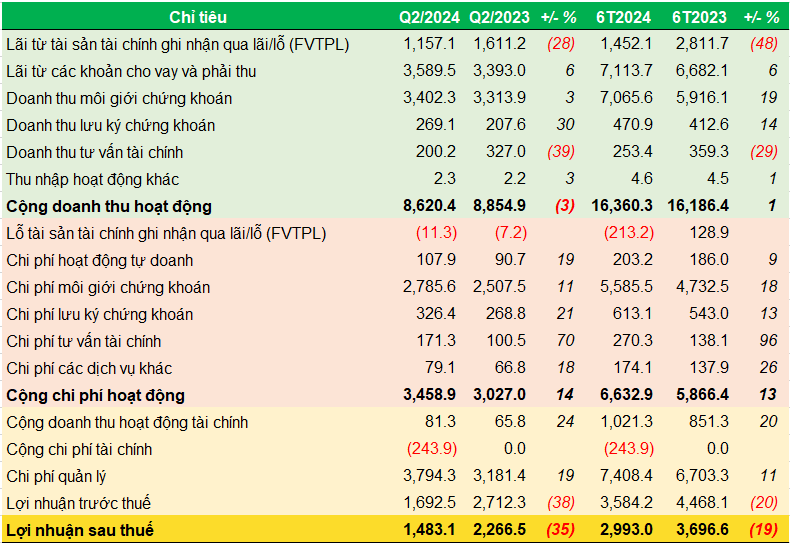

DIC Corp. is proud to announce that we have achieved 27.6% of our annual revenue target and approximately 2% of our annual profit goal. While we have a long way to go, this is a testament to the hard work and dedication of our team. With our innovative strategies and unwavering commitment, we are confident in our ability to surpass these milestones and achieve even greater success in the coming months. Stay tuned as we continue to strive for excellence and make our mark in the industry.

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”

The Future of HAGL: Overcoming Adversity and Forging Ahead.

The short-term debt exceeding short-term assets, coupled with an accumulated loss of over VND 957 billion, poses a significant “uncertainty factor” that may hinder HAGL’s ability to continue operating, according to the auditing firm.