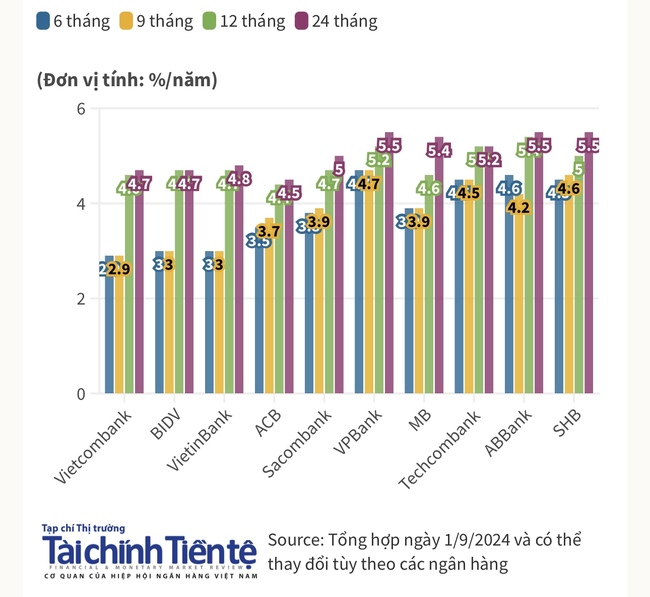

A quick look at the deposit interest rates offered by banks such as Agribank, Vietcombank, BIDV, VietinBank, VPBank, Techcombank, MB, ACB, Sacombank, HDBank, SHB, VIB, SeABank, BacABank, TPBank, NCB, KienlongBank, Saigonbank, and Vietbank as of the first day of September 2024 reveals that many banks have adjusted their interest rates. These adjustments range from 0.1% to 0.8% depending on the term and the bank.

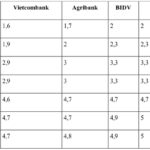

State-owned commercial banks’ interest rates remain unchanged from August 2024 to the beginning of September 2024. Specifically, Vietcombank’s interest rates for 6 and 9-month terms remain at 2.9% per annum, while the 12-month term is offered at 4.6%, and terms of 24 months and above are at 4.7%, the highest rate currently offered by the bank.

BIDV maintains stable interest rates, with 6 and 9-month terms at 3.0% per annum and 12 and 24-month terms, and above at 4.7%, the highest rate offered by BIDV.

VietinBank’s interest rates for 6 and 9-month terms remain at 3.0% per annum, while the 12-month term is offered at 4.7%, and the 24-month term is at 4.8%, the highest among the Big 4 banks.

In the joint-stock commercial bank group, there have been mixed movements in interest rates. MB increased its interest rates for 6 and 9-month terms by 0.1% to 4.0% per annum, the 12-month term by 0.2% to 4.8%, and the 24-month term by 0.3% to 5.7%. Sacombank raised its rates by 0.4% for 6 and 9-month terms, now at 4.2% and 4.3% per annum, respectively, while the 12-month term is at 4.9%. However, the 24-month term remains unchanged.

As of the National Day holiday on September 2, 2024, a total of 15 banks had increased their interest rates, with adjustments ranging from 0.1% to 0.8%. These banks include Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, Dong A Bank, Techcombank, VietBank, SHB, PVCombank, Cake by VPBank, and Nam A Bank. Notably, Sacombank, VietBank, Dong A Bank, and Techcombank have increased their interest rates twice.

While there were upward adjustments in August 2024, Techcombank’s interest rates on the first day of September compared to the first day of August showed a downward trend for 12 and 24-month terms. The 6 and 9-month terms remained unchanged at 4.5% per annum, while the 12 and 24-month terms decreased by 0.3% to 4.9%.

Commenting on the interest rate developments, MBS Research attributes the continued rise in savings interest rates in August to the recovering credit growth, prompting banks to adjust their rates to attract deposits. Additionally, the increase in non-performing loans (NPLs) – up by 5.77% as of June 2024 compared to the end of 2023 – has encouraged banks to ramp up their capital mobilization efforts to ensure liquidity. Specifically, interest rates for terms below 6 months and 24 months were adjusted upward by 0.1% per annum. MBS Research predicts that the 12-month term deposit interest rate of large joint-stock commercial banks may increase by 50 basis points by the end of 2024, given the expected acceleration in credit demand as production and investment pick up pace in the latter half of the year. However, they anticipate that lending rates will remain stable as regulatory authorities and commercial banks work to support businesses’ access to capital.

Should We Abandon the Credit Growth Target?

The State Bank has instructed credit institutions to focus on achieving healthy, efficient, and safe credit growth, in addition to their assigned credit targets.