According to Mr. Nguyen Van Dinh, Vice President of the Vietnam Real Estate Association, the real estate market will show a clear recovery towards the end of the year. However, the recovery process will continue to diverge across segments and regions, with a more evenly distributed level of differentiation.

Specifically, regarding residential properties, the supply in the last few months of the year is expected to improve, estimated to increase by approximately 20% compared to the first six months. The supply will mainly consist of high-end and luxury apartments, as well as low-rise products, from projects in the outskirts of Hanoi and Ho Chi Minh City, and surrounding provinces.

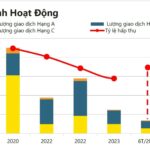

Mr. Dinh also stated that investment demand will recover by about 30%, and the demand for buying homes remains high. “The number of transactions is expected to increase by about 20% compared to the first half of the year due to a potential surge in supply towards the end of the year, mainly contributed by apartment complexes,” said Mr. Dinh.

For the segment of villas, adjacent houses, and townhouses, Mr. Dinh believes that there will be a significant improvement, especially in the secondary market. As for land plots, they have emerged as an attractive investment channel during this year’s festive season after hitting rock bottom. However, investors are only seeking land obtained through auctions, subdivided lots in areas with complete infrastructure, favorable legal conditions, and reasonable price levels.

The real estate market is not expected to boom towards the year-end. (Illustrative image: Minh Duc)

The industrial real estate segment continues to grow, with corporations acquiring land funds to develop industrial parks.

The tourism and resort real estate market will improve but won’t witness a significant surge. Many projects are still on hold due to legal and financial challenges.

Sharing his predictions about the real estate market in the coming months, Mr. Le Dinh Chung, CEO of SGO Homes Real Estate Investment and Development Joint Stock Company, stated that with the three laws on real estate, including the Land Law, Housing Law, and Real Estate Business Law, taking effect in the third quarter, the year-end market will witness a distinct transformation.

Regarding apartment complexes, Mr. Chung forecasted that prices would continue to rise. In the short term, there won’t be any changes in the supply of apartments. “Hanoi apartment prices currently range from 50 to 100 million VND per square meter, and those priced below 30 million VND per square meter are almost non-existent. This upward trend will persist in the coming months,” Mr. Chung assessed.

Concerning the land plot segment, Mr. Chung mentioned that the year-end would mark the recovery phase for land plots as they remain the “king” investment channel for investors. Additionally, according to new regulations, after January 1, 2025, land subdivision and sale will be prohibited in cities of grades I, II, and III, making these products even more attractive in the next one to two years.

Mr. Chung also predicted that well-invested urban products in the provinces or beach resort properties, particularly apartments priced below 2 billion VND, would appeal to investors. Furthermore, products in the suburbs of provinces such as Phu Tho, Hoa Binh, and Vinh Phuc, priced below 10 billion VND, would also recover and attract investors.

“Products in the suburbs will account for a higher proportion of investments in the coming months,” said Mr. Chung.

Sharing this viewpoint, Mr. Vo Hong Thang, Investment Director of DKRA Group, analyzed that the market, from now until the end of the year, will recover in the central areas of major cities such as Hanoi, Ho Chi Minh City, and Danang. Notably, there will be a noticeable shift in densely populated residential areas, new urban areas with complete utilities, or commercial real estate with a healthy cash flow from leasing activities.

“Additionally, affordable housing types with convenient connections to the center, adequate legal status, and clear construction progress will continue to be the bright spot in the coming months,” predicted Mr. Thang.

Also anticipating the impact of the three new laws on the year-end real estate market, Mr. Thang believed that these laws would need time to permeate, so the market would not undergo drastic changes or explosive development in the short term.

The Capital City’s Social Housing Boom: Over 6,300 Homes Nearing Completion in Hanoi

The Hanoi Department of Construction has announced that six social housing projects, comprising approximately 6,330 apartments, are expected to be completed by 2024. This significant development aligns with the city’s ambitious plans to meet its housing targets and underscores its commitment to providing accessible and affordable housing options for its residents.

“The Fear of Missing Out on Property Purchases”

As the year draws to a close, the “race” to meet deadlines, ensure legal compliance, and launch projects intensifies. The pressure is on to deliver, with developers racing to meet milestones and buyers eagerly awaiting new opportunities. It’s a busy time for the industry, and the finish line is in sight.