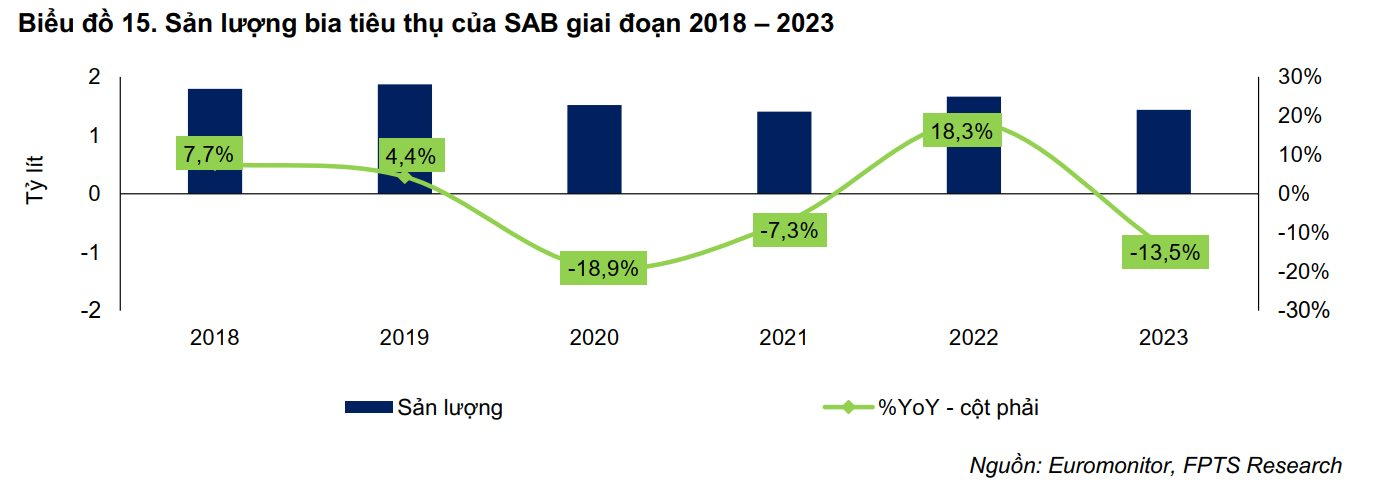

“Dancing in the rain” – that’s how Mr. Tan Teck Chuan Lester, CEO of Saigon Beer, Alcohol and Beverage Joint Stock Corporation (Sabeco, SAB) described the company’s strategy for 2024 to regain market share. Sabeco has lost 8% of its market share in just 5 years from 2018-2023 due to the rise of other beer brands.

To turn things around, Sabeco aims to revamp its strategies and embrace a more dynamic approach. Mr. Lester likened this new direction to “not just dancing, but rocking and rolling.”

A recent report by FPTS Securities pointed out the issues that have caused Sabeco to lose its foothold in the Vietnamese beer market.

SABECO: LIMITED PRODUCT RANGE, PRICE INCREASES WHILE COMPETITORS GAIN STRENGTH

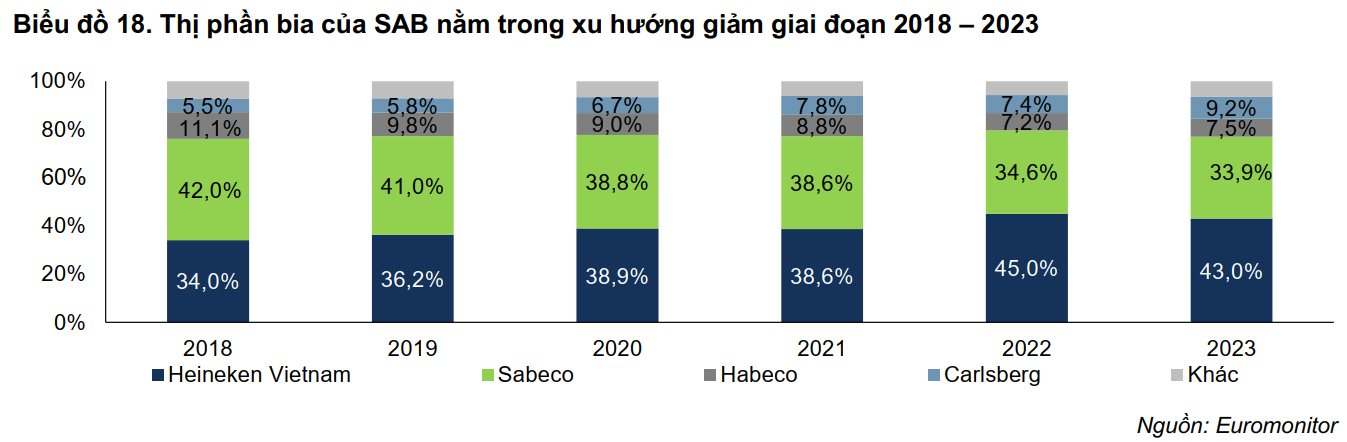

According to FPTS, the Vietnamese beer market is dominated by four major companies (Heineken, Sabeco, Carlsberg, and Habeco), accounting for an estimated 94% of the industry’s market share in 2023, with the remaining 6% held by smaller, locally-focused businesses.

Among these top players, Sabeco and Heineken hold the lion’s share, with 33.9% and 43.0% of the total beer consumption in the industry for 2023, respectively.

However, between 2018 and 2023, Sabeco’s market share dropped significantly from 42.0% to 33.9% due to intense competition from foreign beer companies.

FPTS attributed this decline partly to Sabeco’s decision to increase output prices to offset rising production costs. However, a more critical factor was the company’s limited product portfolio compared to its dynamic competitors.

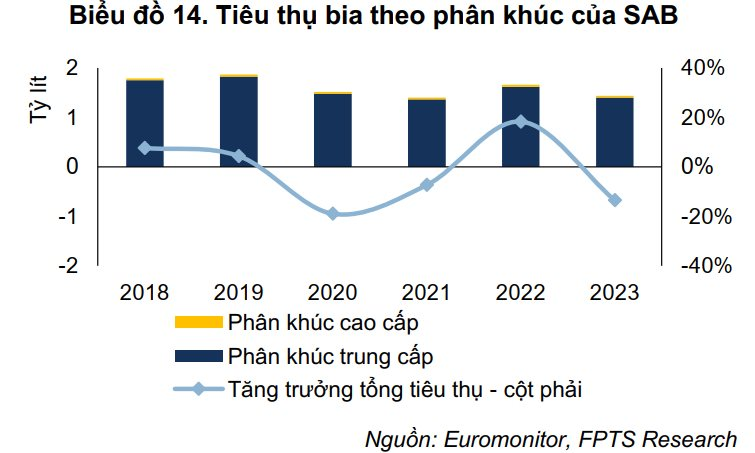

While Sabeco focused on its well-established mid-range segment, consisting of 333, Saigon Lager, and Saigon Export beers (averaging 98% between 2018 and 2023), its competitors expanded their reach. Only 2% of Sabeco’s portfolio was dedicated to the premium segment, including Saigon Chill, Saigon Special, Saigon Gold, and Saigon Export Premium. Meanwhile, Vietnamese consumers were increasingly favoring premium beers.

Additionally, Sabeco’s products were mainly consumed domestically, with less than 1% exported. This limited their ability to reach a diverse range of customers as consumer tastes evolved.

The company has introduced new products, but these were often existing beers with unchanged flavors and only minor packaging modifications.

The high barriers to entry in the beer industry are due to its concentrated nature and the strong presence of established players. New entrants find it challenging to compete with large, well-known companies that have extensive distribution networks and high brand recognition.

In such a concentrated market, intense competition among the leading companies in the Vietnamese beer industry revolves mainly around two factors: (1) product portfolio and (2) brand recognition.

THE RACE FOR BRAND RECOGNITION

Foreign beer companies have been investing heavily in advertising and marketing campaigns to enhance their brand recognition in Vietnam.

Heineken Vietnam has been at the forefront of this race, with numerous award-winning marketing campaigns such as “Creating the Peak of Beer Experience” for Heineken, integrating mobile interactive technology (2022), and “Smooth and Flavorful” for Heineken Silver (2022). They also organized annual large-scale events like the Heineken Countdown music festival, Tiger Remix, the EDM festival, and Heineken Silver Music Party in major cities such as Hanoi, Ho Chi Minh City, and Nha Trang.

Heineken’s annual countdown party

From 2020 to 2023, Heineken’s brands consistently topped the rankings of the most prominent beer brands on social media, as surveyed by YouNet Media.

Carlsberg has also been working tirelessly to increase its brand recognition by investing more in marketing and sales activities. In 2023, the Carlsberg Group increased its investment in the Asian market as part of its SAIL’27 campaign, with a 14.3% increase in marketing expenses compared to the previous year, amounting to 9.0% of revenue.

This additional investment was primarily directed towards the Vietnamese and Chinese markets to strengthen the presence of Carlsberg’s beer brands. As a result, Carlsberg’s market share in Vietnam increased to 9.2% in 2023.

Sabeco, on the other hand, has organized various events to promote its brand alongside consumer promotions. Some notable events include the “Proud to be Vietnamese” music festival in 2018, The Chill Fest in 2022, the Vietnam Cultural Food Festival in 2023, the “Star of All Joys” contest in 2022 and 2023, The Chill Fest – Summer Adventure in 2023, and the Vung Tau Beer Festival in 2023.

Additionally, Sabeco has sponsored various sporting events, including the Vietnam Olympic Committee at Sea Games 30, the Diamond Sponsor of Sea Games 31 in 2022, and the leading and exclusive partner in the beer industry for the National Football Team from July 2022 to July 2025.

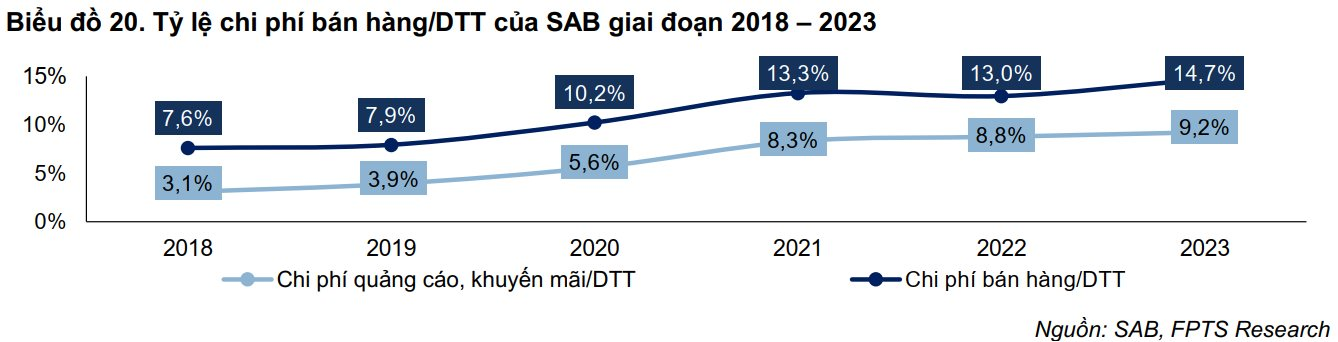

The ratio of Sabeco’s sales expenses to net revenue increased from 7.6% in 2018 to 14.7% in 2023. Within this, advertising and promotion expenses as a percentage of net revenue rose from 3.1% in 2018 to 9.2% in 2023.

However, FPTS noted that compared to Heineken Vietnam, Sabeco’s brand-building events were smaller in scale and less frequent. As a result, despite increased investment in sales and advertising, Sabeco’s market share continued to decline from 2018 onwards.

The E-Commerce War in Q2: Shopee and TikTok Shop Dominate with Over 93% Market Share, Leaving Lazada and Tiki with Crumbs

Shopee and TikTok Shop dominated the market in the second quarter of 2024, capturing a combined 93.4% of total transaction share. Shopee was the only platform to expand its market share in the past quarter, while the other three major players witnessed a contraction. Lazada and Tiki lagged behind, securing only 5.9% and 0.7% of the market, respectively.