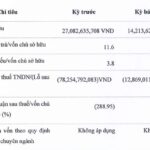

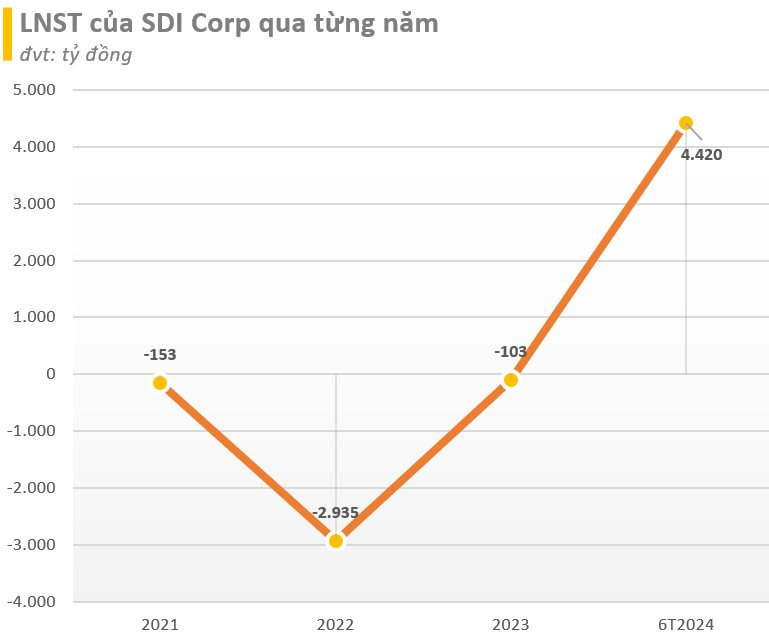

Saigon Investment and Development Joint Stock Company (SDI Corp) has just announced its semi-annual financial targets for 2024, with a net profit of over VND 4,400 billion, while in the same period last year, it suffered a loss of over VND 5,400 billion. The after-tax profit margin (ROE) reached 82.54%.

Prior to this, the company had reported losses for three consecutive years.

As of June 30, SDI Corp’s equity reached VND 5,356 billion. The debt-to-equity ratio stood at 21.66 times, equivalent to over VND 116,000 billion in payables. This includes nearly VND 6,600 billion in bond debt.

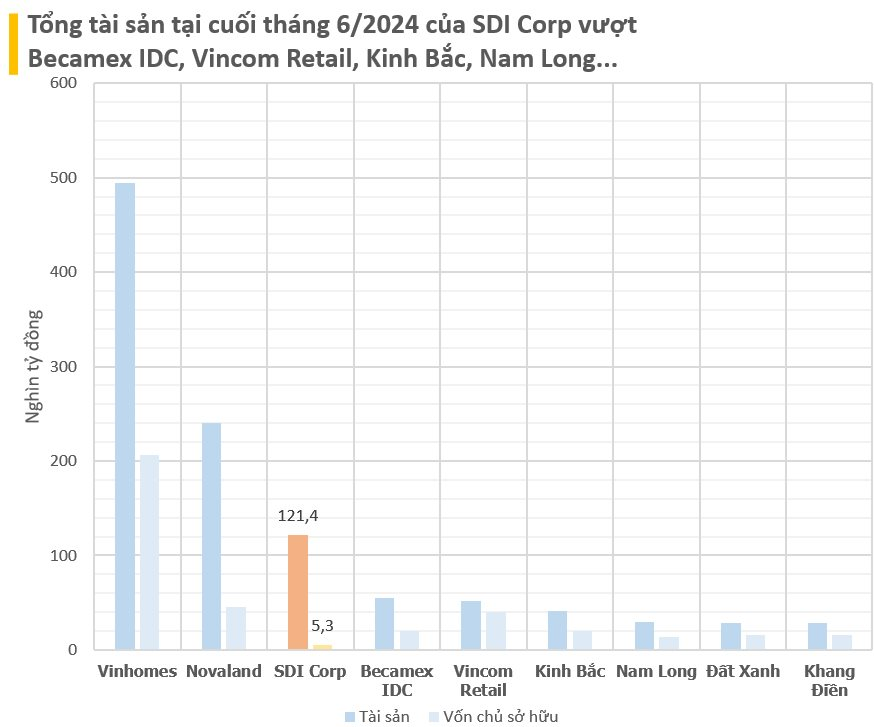

Thus, SDI Corp’s total assets amount to nearly VND 121,400 billion. Currently, on the stock exchange, only two companies have larger assets than this enterprise: Vinhomes and Novaland. SDI Corp’s assets surpass those of numerous giants such as Becamex IDC, Vincom Retail, Hung Thinh, and Khang Dien.

Currently, SDI Corp has one lot of bonds in circulation, totaling VND 6,570 billion. This lot was issued in 2021 with an announced interest rate of 10% per annum.

SDI Corp is headquartered at A3, Road 5, 10ha Residential Area, Ward 3, An Phu Ward, Thu Duc City, Ho Chi Minh City. Its main business activities include real estate trading and leasing of land-use rights, whether owned, leased, or rented.

The company is known as the investor of the mega-project Saigon Binh An Urban Area (commercial name The Global City), spanning over 117ha. It is located on the Long Thanh-Dau Giay highway, intersecting with Do Xuan Hop Street in Thu Duc City. According to the project’s website, The Global City comprises 1,800 shophouses and 10,000 high-rise apartments, a 92ha golf course with 18 holes, and a 400-room hotel.

The project encountered planning issues, with some components not complying with regulations, which caused delays for several years. Despite being allocated land in 2001, it was not until March 2021 that the project commenced construction, with expected completion by December 2025.

The Sun’s Energy Harvest: Unveiling a Profitable Venture with Over $220 Million in Gains, Adjusting Bond Yields

As per the latest financial report submitted to the Hanoi Stock Exchange (HNX), Trungnam Solar Power Joint Stock Company has reported favorable results for the first half of 2024.

Vietnam Airlines Releases Reviewed Consolidated Financial Report for H1 2024

Vietnam Airlines (Vietnam Airlines, code: HVN) has released its reviewed consolidated financial statements for the first six months of 2024, reporting impressive figures. The airline’s revenue reached VND 52,562 billion, a nearly 20% increase compared to the same period last year. After deducting the cost of goods sold, gross profit stood at VND 6,704 billion, more than double the figure from the previous year.

Mattress King Clears Bond Debt but Continues to Bleed Red

The first half of 2024 saw Vua Nem continue to make losses, however, these were significantly reduced compared to the same period last year. On a positive note, the enterprise is now free of bond debt.