Illustration

Deposit Interest Rates for Over-the-Counter Customers in September

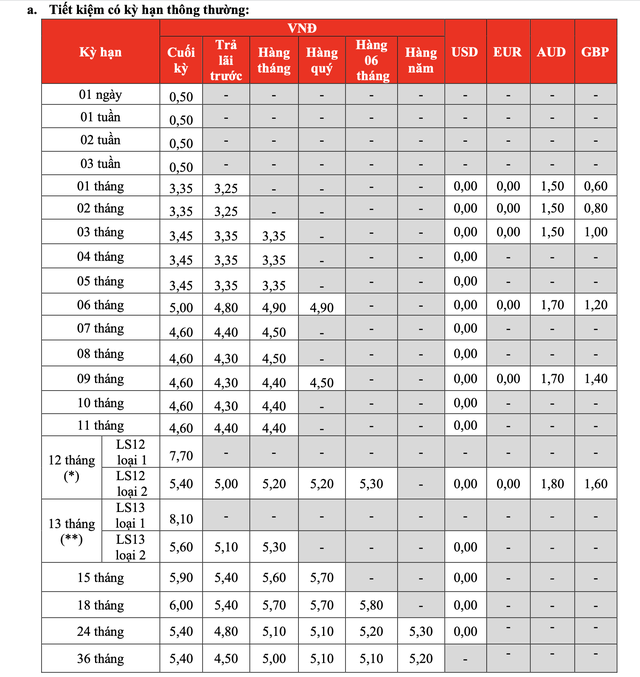

According to the latest survey, HDBank is offering deposit interest rates ranging from 0.5% to 8.1% per annum.

Specifically, the interest rate for a term of less than one month is 0.5% per annum; the interest rate for a term of 1-2 months is listed at 3.35% per annum, the interest rate for a term of 3-5 months is 3.45% per annum; the term of 6 months is 5% per annum; the term of 7-11 months has an interest rate of 4.6% per annum.

For a 12-month term, the interest rate for deposits of 500 billion VND or more is 7.7% per annum, while the interest rate for deposits of less than 500 billion VND is 5.4% per annum. Similarly, for a 13-month term, the interest rate for deposits of 500 billion VND or more remains at 8.1% per annum, and for deposits of less than 500 billion VND, it is 5.6% per annum.

The interest rates for 15 and 18-month terms are listed at 5.9% and 6.0% per annum, respectively. The interest rate for terms of 24 – 36 months is 5.4% per annum.

In addition to the end-of-term interest payment, HDBank also offers various other interest payment options with the following interest rates: Advance interest payment: 3.25% – 5.4% per annum; Monthly interest payment: 3.35% – 5.7% per annum; Quarterly interest payment: 4.5% – 5.7% per annum; Semi-annual interest payment: 5.1% – 5.8% per annum; Annual interest payment: 5.2% – 5.3% per annum.

HDBank’s Over-the-Counter Deposit Interest Rate Table for September 2024

Source: HDBank

HDBank Online Savings Interest Rates for September 2024

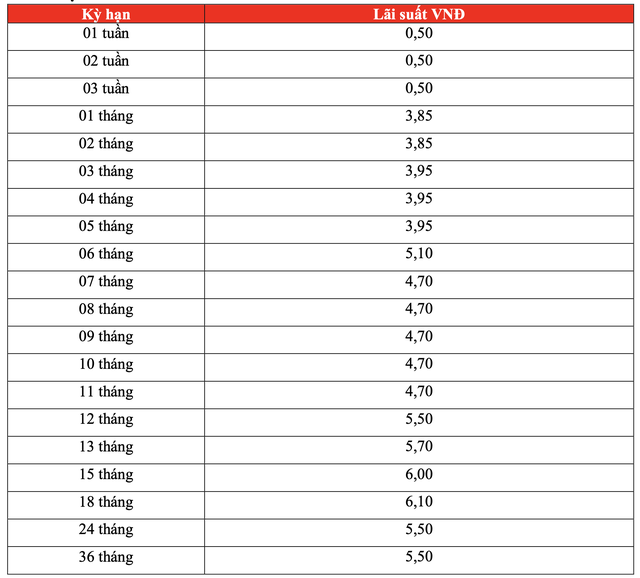

In early September, HDBank’s online deposit interest rates ranged from 0.5% to 6.1% per annum.

Specifically, the interest rate for terms of less than one month is 0.5% per annum; the interest rate for terms of 1-2 months is 3.85% per annum; the interest rate for terms of 3-5 months is 3.95% per annum; the interest rate for a 6-month term is 5.1% per annum; the interest rate for a term of 7 – 11 months is 4.7% per annum; the interest rate for a 12-month term is 5.5% per annum; the interest rate for a 13-month term is 5.7% per annum; the interest rate for a 15-month term is 6.0% per annum; the interest rate for an 18-month term is 6.1% per annum; the interest rate for 24 and 36-month terms is the same at 5.5% per annum.

With a maximum interest rate of up to 6.1% per annum for an 18-month term, HDBank is one of the banks with the highest deposit interest rates in the system today.

HDBank’s Online Deposit Interest Rate Table for September 2024

Source: HDBank

The Bank Boosts Savings Rates After a Three-Month Standstill

As of August, 16 banks have hiked their savings rates, including industry heavyweights Agribank, Eximbank, and HDBank. This move is a strategic response to the evolving market dynamics, with the banks aiming to attract more deposits and cater to the diverse financial needs of their customers.

The New ACB Interest Rates for August 2024: Maximize Your Savings with the Highest Online Deposit Interest Rates for 12 Months; Average Lending Rates for New Loans Stand at 6.87%/year.

Introducing ACB’s exclusive online savings account, offering an industry-leading interest rate for personal depositors. With a minimum commitment of 12 months, you can enjoy a competitive 6.87% annual interest rate on your savings. This exceptional rate applies to new loans, providing a smart financial strategy for those seeking lucrative returns.