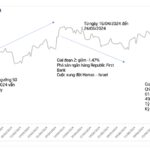

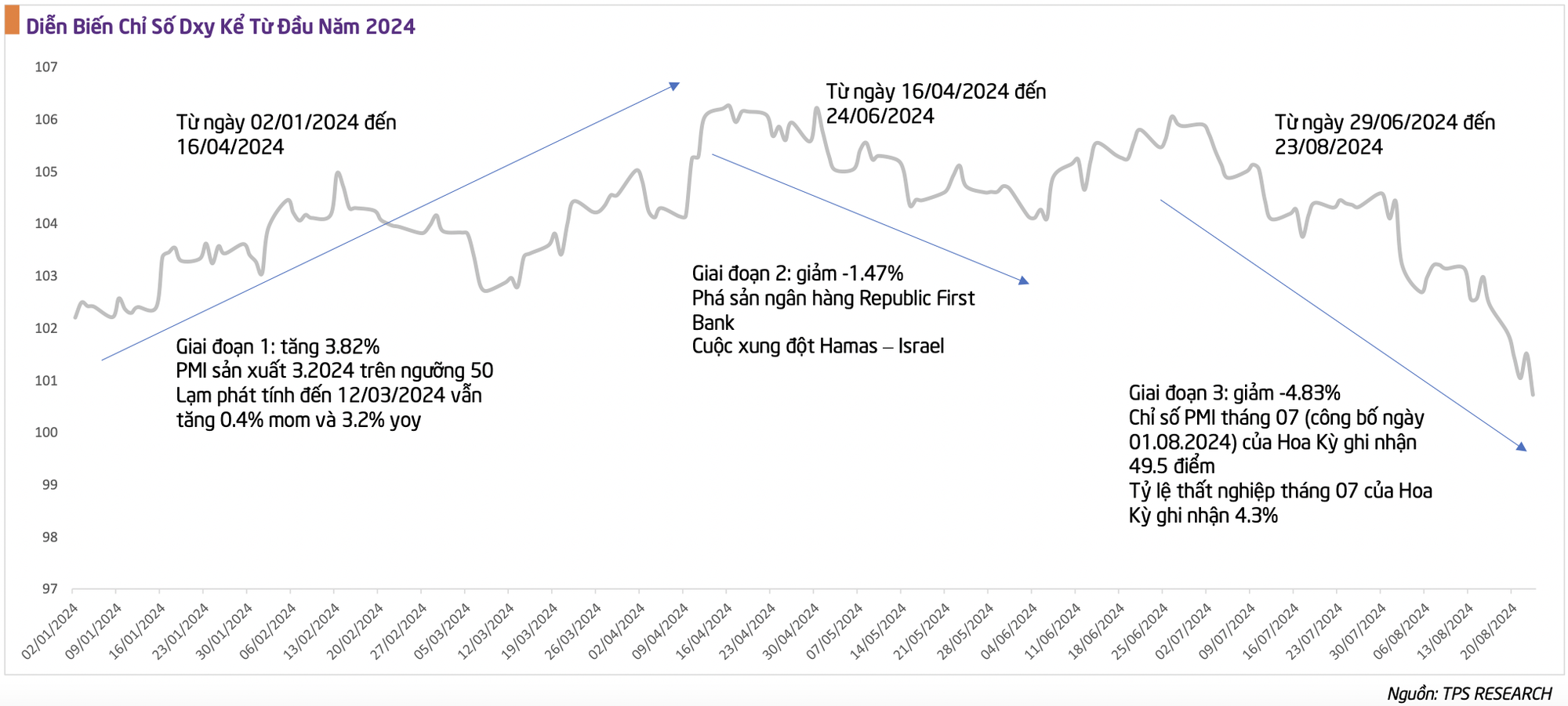

In a recent report, TPS Securities provided an update as of August 26, 2024, noting that the US Dollar Index (DXY) had declined by 1.4% year-to-date, marking its highest drop so far this year. This decrease can be attributed to expectations of an interest rate cut by the Fed in the coming months due to the US’s August 2024 PMI recording its lowest level since early 2024, along with rising unemployment and declining inflation rates.

Following the Fed’s statement, investors are increasingly anticipating an interest rate cut by the Fed in the upcoming meetings. This has had a positive impact on Vietnam’s exchange rate in recent days. The bank exchange rate has dropped by 1.9% from its 2024 peak.

The cooling-off in exchange rates has made it easier for policymakers to maintain a loose monetary policy. However, gold prices remain high and are expected to continue rising in the future, which could slow down the decline in exchange rates.

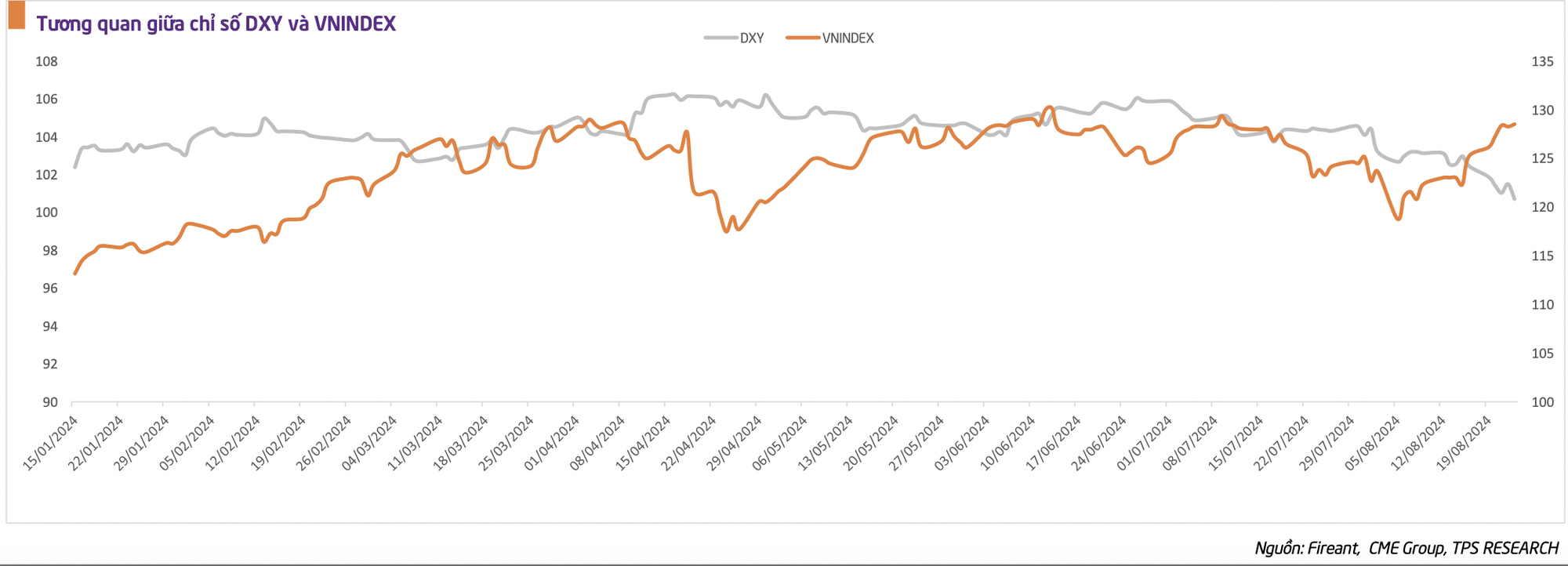

According to TPS, the easing of exchange rates has positively affected the stock market recently. From a macroeconomic perspective, the stock market will benefit as the cooling-off in exchange rates leads to reduced import costs, positively impacting exporting businesses and, subsequently, the stock market.

Additionally, the reduced pressure on exchange rates provides a favorable condition for policymakers to promote public investment policies and maintain loose monetary policies, which also positively affects the stock market.

Moreover, accelerating exports create stable incomes for workers, an essential factor in boosting the development of the consumer goods industry, which, in turn, impacts the stock market.

As per a survey by Fedwatch (CME Group) as of August 26, approximately 39% of the market predicted that in the September 18 meeting, the Fed would lower the current interest rate range of 5.25% – 5.5% to 4.75% – 5%. Meanwhile, about 61% of the market anticipated a reduction to 5.0% – 5.25%.

TPS Securities anticipates that the Fed will cut interest rates after September, influenced by factors such as the US PMI being below 50, declining US inflation, rising unemployment, and slowing consumption in the US market.

From a technical analysis perspective, considering the daily chart, the market is approaching the 1,290 – 1,300-point threshold and testing this resistance zone. The news of a potential Fed rate cut in September could boost market sentiment, enabling the index to surpass the 1,300-point mark once again and aim for higher levels.

However, in the short term, after a prolonged upward trend, some corrective movements are likely to occur. TPS expects the market to find support at two levels: 1,250 and 1,220 points. This corrective phase (if it occurs) serves as a breather, creating opportunities for investors to enter the market when positive news arises.

The Stock Market Benefits as Currency Exchange Rates Cool Off

The TPS team presents three compelling reasons why the stock market is set to benefit from a cooling exchange rate.