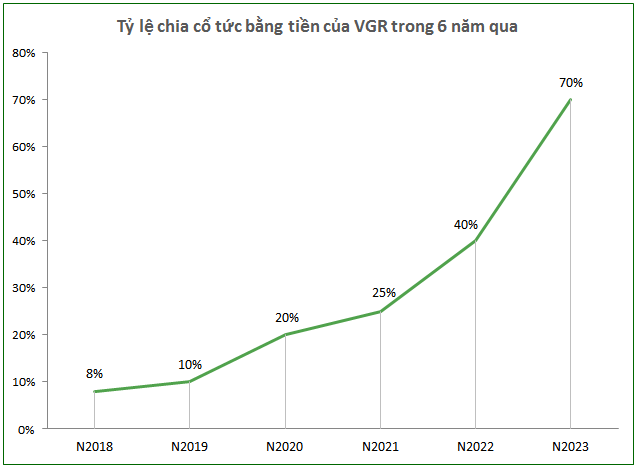

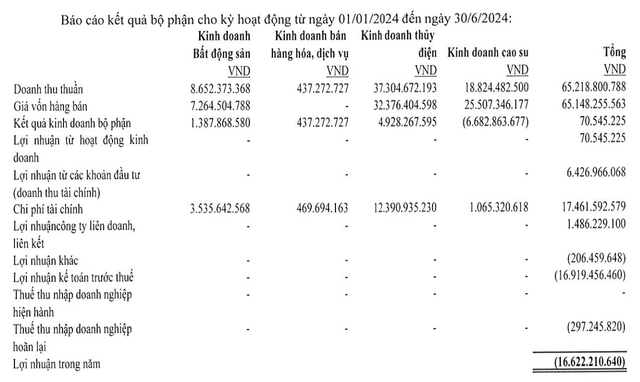

Vietnam-based company QCG has released its reviewed semi-annual financial statements for 2024, reporting a 65 billion VND revenue, a 69% decrease from the previous year. The company’s main sources of income were its hydropower and rubber divisions, contributing 37 billion VND and 19 billion VND, respectively. In contrast, the real estate division only generated 8.6 billion VND in revenue.

After deducting the cost of goods sold, the company’s gross profit stood at 70 million VND, a significant decline from the previous year’s 22 billion VND. Net losses after taxes totaled nearly 17 billion VND, with a net loss of over 15 billion VND.

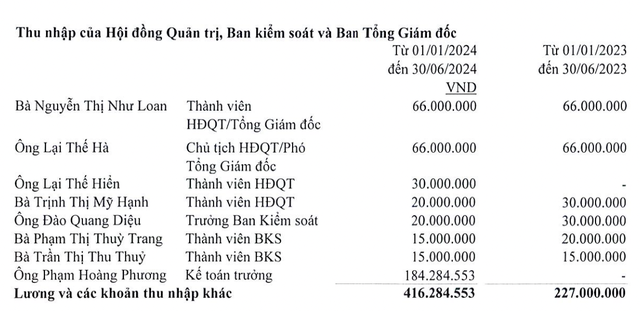

Despite the challenging business conditions, the total income of the eight members of the Board of Directors, Supervisory Board, and Board of Management doubled to 416.3 million VND in the first six months of 2024.

Ms. Nguyen Thi Nhu Loan, CEO and Member of the Board of Directors, and Mr. Lai The Ha, Chairman of the Board of Directors and Vice CEO, both earned 66 million VND for the six-month period (equivalent to 11 million VND per month). Other members received incomes ranging from 15 to 30 million VND for the same period (equivalent to 2.5 to 5 million VND per month). Notably, Mr. Pham Hoang Phuong, the Chief Accountant, earned 184.3 million VND in the first six months.

While the incomes have increased, they remain relatively low compared to industry standards. For instance, the CEO and Board Member of Novaland, Mr. Ng Teck Yow, earns a monthly income of 423 million VND. The CEO of Dat Xanh earns 340 million VND per month, and the CEO of Phat Dat, Mr. Bui Quang Anh Vu, receives 470 million VND per month.

The company’s leaders have also been providing financial support from their personal funds. As of June 30, the company owed Ms. Loan 2 billion VND, her daughter 700 million VND, Mr. Ha 24 billion VND, and his daughter 4.7 billion VND. The company frequently borrows money from these individuals and has repaid hundreds of billions of VND to them.

The audit also highlighted an issue with the financial statements regarding a court ruling. On April 11, 2024, the Ho Chi Minh City People’s Court issued a first-instance verdict ordering the company to return the full amount of 2,882.8 billion VND received from Sunny Land to fulfill its obligations to Ms. Truong My Lan. If the company repays the amount in full, it will regain ownership of the related real estate and associated documents. On April 23, 2024, QCG filed an appeal agreeing to repay only 1,441 billion VND.

QCG’s stock has seen unusual trading activity, with the share price reaching a peak of 18,800 VND in late April and then experiencing floor sessions, currently trading at 6,200 VND per share (a 67% decrease from its peak). The market capitalization has also decreased by 3,466 billion VND, now standing at 1,706 billion VND.