Saigon Real Estate Joint Stock Corporation (Saigonres, code SGR – on HoSE) announced its reviewed consolidated financial statements for the first half of 2024 with many declining indicators.

Specifically, Saigonres’ net revenue reached over VND 60 billion, down 21% from the self-reported figure of over VND 76 billion and up 109% compared to the same period last year. Due to the decrease in revenue, the gross profit after deducting cost of goods sold was only over VND 25 billion, a decrease of VND 15 billion compared to the self-reported figure.

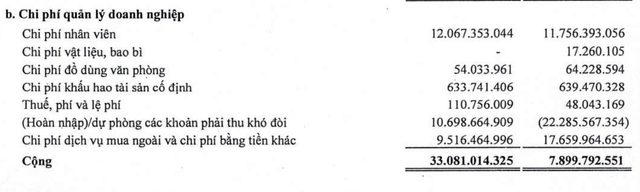

In addition, management expenses increased by 48% compared to the pre-reviewed figure, from VND 22 billion to VND 33 billion.

As a result, Saigonres unexpectedly turned from a profit of VND 2.3 billion in the self-reported figure to a loss of VND 23.3 billion after the review. Explaining this issue, Saigonres stated that it mainly adjusted for lower revenue from the transfer of real estate, and this revenue will be recognized in the next period when the conditions for recognition are met and, at the same time, provisions for expected credit losses must be established as recommended by the auditor.

Source: SGR

The increase in management expenses was mainly due to a provision of VND 10.7 billion in the period compared to a reversal of VND 22.3 billion in the same period last year. Notably, SGR unexpectedly made a provision of VND 10.8 billion related to short-term receivables from short-term lending to Ho Chi Minh City Electrical Appliance JSC, which is already overdue between 6 months and 1 year.

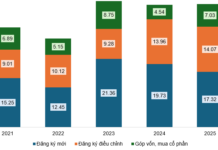

In 2024, Saigonres plans to achieve a revenue of VND 628 billion and a pre-tax profit of VND 190 billion, up 48.1% compared to the performance in 2023.

Thus, with a pre-tax profit of VND 22 billion loss in the first half of 2024, Saigonres is far from its yearly plan.

As of June 30, 2024, Saigonres’ total assets were VND 2,094 billion, lower than the self-reported figure of VND 2,107 billion.

Of this, short-term receivables were VND 936 billion, lower than the self-reported figure of VND 974 billion. Inventories were recorded at VND 520 billion (compared to VND 518 billion in the self-reported figure).

Long-term receivables were VND 199 billion (compared to VND 192 billion in the self-reported figure). Notably, the investment held to maturity increased from over VND 7 billion to VND 27 billion after the review.

In terms of capital sources, Saigonres’ total financial borrowings increased by 16% from the beginning of the year to VND 407.6 billion, almost unchanged from the self-reported figure. The main reason for the increase was the additional borrowing of more than VND 56.6 billion at BIDV – Truong Son Branch to supplement working capital.

In the latest development, with the parent company’s post-tax profit on the reviewed consolidated financial statements for the first half of 2024 being negative, SGR shares of Saigonres were put on HoSE’s list of securities that do not meet the conditions for margin trading.

“Vingroup’s Acquisition of VinWonders Nha Trang Proves Profitable with Nearly 2,000 Billion VND in Earnings: Every 2 VND in Revenue Generates Over 1 VND in Profit”

“In February 2024, Vingroup announced its acquisition of a 99% stake in VinWonders Nha Trang from its partners. The total cost of the transaction amounted to 10.319 trillion VND. This move showcases Vingroup’s strategic expansion and their commitment to developing captivating attractions within Vietnam.”

Travel to Multiple Destinations and Win Big This 2-9 Holiday

During the 4-day holiday period from September 2nd, Khanh Hoa province recorded an estimated 175,200 tourist arrivals, a 14.6% increase compared to the same period last year. The province’s tourism director, Ms. Nguyen Thi Le Thanh, shared that approximately 403,000 visitors were recorded at various attractions, marking a 15% rise from the previous year.

“Saigontel’s Profit Plunge: Unveiling the 28% Drop in Review”

After the review, Saigontel’s financial costs increased by VND 5 billion due to additional provision adjustments. Along with changes in some other indicators, the company’s post-inspection profit after tax decreased by 28%, to over VND 13 billion.