Buy QNS with a target price of VND 57,000/share

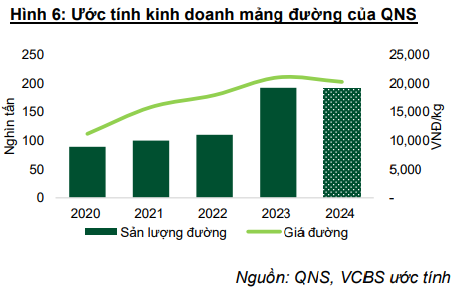

VCBS believes that, in terms of sugar production, to make up for the shortfall in refined sugar imports, QNS will focus on (1) expanding its raw material region and increasing its sugarcane cultivation area from 29 to 32 hectares, and (2) developing technology to enhance sugar recovery efficiency from sugarcane. Currently, QNS’s efficiency stands at 8.8 tons of sugarcane per ton of sugar, which is competitive with Thailand’s average of 9.4 tons. As a result, QNS’s sugarcane production is expected to increase by 20,000 tons this year, compensating for the 25,000-ton decline in the first half. Thus, VCBS forecasts a slight decrease in total production for 2024, estimating it to reach approximately 220,000 tons (a 2.2% decrease compared to the same period last year).

Vietnamese sugar prices are expected to remain stable around current levels due to the following factors:

On the global market, sugar prices are showing signs of recovery due to (1) Thailand’s sugar production being impacted by unfavorable weather conditions and extreme heat, (2) widespread forest fires in Brazil affecting the country’s 2024-2025 crop season, with expected production to decrease from 42.7 million MT to 42 million MT, and (3) India’s plans to restrict sugar exports to ensure domestic supply and ethanol production.

In Vietnam, (1) anti-dumping measures, import taxes, and quotas on sugar imports from Thailand and ASEAN countries have been implemented, and (2) efforts to combat smuggling, including enhanced border security and negotiations between the Vietnam Sugar Association and Thailand, are underway.

Regarding the soy milk business, as household income gradually recovers and VAT reduction policies are implemented for consumer products, the dairy industry is still experiencing negative growth, but the decline is narrowing. QNS’s consumption volume is expected to continue its mild growth as the company (1) maintains its product price reduction strategy to enhance competitiveness, (2) develops new product lines under the Veyo brand, targeting high-income urban areas this June, and (3) further expands sales channels, especially MT channels in supermarket chains, convenience stores, and e-commerce platforms.

The gross profit margin for the dairy segment is expected to recover from the fourth quarter onwards as the company starts a new round of raw material price negotiations this September. Currently, soybean prices are fluctuating around $980-$1,000/Bu, significantly lower than the $1,200/Bu recorded in March this year. Thus, VCBS anticipates that the decrease in raw material prices could offset the decline in product selling prices, supporting the profit margin of the dairy segment from 2025 onwards.

In the electricity segment, QNS sells almost all of its electricity to EVN at a price of 7.03 cents/KW. Electricity production will depend on sugarcane crushing capacity. For the remaining segments, consumption volume for mineral water, confectionery, and beer grew by 4%, 9%, and 9%, respectively, in the first half of 2024, but they account for a relatively small proportion of the revenue structure.

According to QNS, for the project “Investment in expansion and upgrading of the sugar processing system from sugarcane to 25,000 TMN and electricity to 135 MW,” the company is in the process of obtaining an environmental impact assessment from a consulting firm, preparing to sign a contract with a design consulting firm, and including the project in the power development plan. This project is expected to become operational by November 2026, with an estimated investment of VND 2,000 billion, including VND 1,200 billion for sugarcane mill upgrades and VND 800 billion for the installation of a 40 MW generator. As for the ethanol plant, QNS has not proceeded beyond the stage of receiving documents from a European consulting firm. QNS has maintained a relatively high dividend payout ratio, typically ranging from 30% to 40% per annum. The company’s dividend yield is quite attractive, fluctuating between 5.7% and 8.7% in the last three years.

Based on the FCFF discounting method and the P/E comparison method, with a 50/50 weightage, VCBS recommends buying QNS with a target price of VND 57,000/share.

Read more here

Buy NAB with a target price of VND 19,286/share

VPBank Research assesses that, in the last five years, Nam A Commercial Joint Stock Bank (HOSE: NAB) has recorded a CAGR of 23% in total assets and 29% in equity, significantly outpacing the 10-year average of 17%. In 2025, NAB plans to increase its charter capital to over VND 15 trillion. VPBank Research believes that the optimal way for NAB to achieve this plan is by paying dividends in shares with a minimum ratio of 10% – equivalent to nearly VND 1,373 billion. This analysis unit considers this payout feasible due to NAB’s retained earnings in 2024 and 2025, projected at VND 3,325 billion and VND 5,444 billion, respectively, which would be sufficient for NAB to pay dividends and conduct business activities, allowing NAB to potentially pay out up to 25%.

During this period, pre-tax profit grew at a 5-year CAGR of 35%. In the first half of 2024, pre-tax profit reached VND 2,216 billion, a 45% increase compared to the same period last year, completing 55% of the business plan.

However, NII accounts for an average of 88% of TOI. The ratio of Non-II/TOI in the period when Banca developed well was only 14%. As of the first half of 2024, the ratio of Non-II/TOI was 8.4%. While NAB aims to increase the ratio of non-interest income to total income to 16%-17% by 2025, it lacks a clear strategy to achieve this.

NIM has shown marked improvement during the same period, with signs of increasing CASA and stable COF thanks to its focus on corporate clients. However, CASA remains lower than the industry average, even though corporate clients are their primary focus. CIR has been higher than the industry average, although it has actively decreased over the last five years.

In the first half of 2024, net interest income reached VND 3,925 billion, a 27% increase compared to the same period last year, mainly driven by Q2-2024, which saw a 28.6% increase compared to the previous quarter. This improvement was due to a significant 33% reduction in deposit interest expenses compared to the same period last year, leading to a decrease in funding costs (4.9% in Q2-2024 compared to 8.7% at the end of 2023), which supported a 40-basis point increase in NIM to 3.7% in Q2-2024. However, loan interest income declined by 7% due to price competition, so VPBank Research expects NAB to maintain NIM above 3.5% despite a 15% increase in NIM in the first half of 2024, outperforming 7 out of 27 banks.

Fee income decreased by 19%, mainly due to a more than 90% drop in asset custody fees and insurance fees compared to the same period last year. Income from debt handling increased 4.3 times compared to the same period, in line with the positive trend in the market.

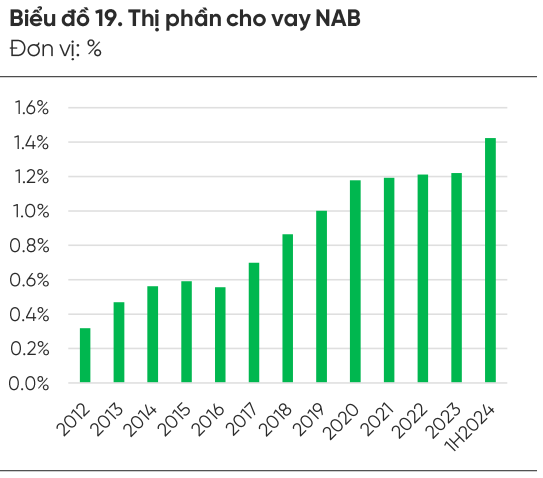

Credit growth (TTTD) over the past five years has been at a CAGR of 22%/year, along with a market share increase to over 1% for the first time since 2019, reaching a new peak in the first half of 2024. TTTD reached 10.5% compared to the beginning of the year, with a positive growth of 7% in Q2, significantly higher than the industry average of 6%.

During this growth period, NAB focused on expanding its individual customer base to gain more opportunities to increase market share, similar to the successful strategies employed by private banks like VPB and VIB. Despite being a small-scale bank, NAB has demonstrated more effort than similarly-sized banks that have lost market share, such as ABB, OCB, and SSB. Currently, its most significant competitor in the same scale is BVB, another rapidly growing bank.

The proportion of medium and long-term loans has grown healthily and contributed to easing the pressure on controlling the SMLR ratio below 30% (at 20.95% as of 30/09/2023).

Source: VPBank Research

|

NAB’s loan portfolio by customer group is mainly focused on corporate clients (81.25%) and has remained relatively stable. Overall, NAB still heavily relies on this customer segment, despite introducing new products and policies for individual customers. However, it is challenging for NAB to compete with other retail banks like VPB or VIB in terms of brand image, product offerings, or funding costs.

Equity/Total Assets increased from 5.2% in 2019 to 7.4% in the first half of 2024. LDR has also been on the rise and exceeded 100% in the first half of 2024. On the other hand, Equity/Non-performing Loans and LLR have continuously declined, indicating that higher leverage compromises liquidity risk for growth.

Based on NAB’s latest business results and a cautious assessment of its business prospects in the coming years, VPBank Research projects NAB’s business results for 2024 to rebound in a more supportive business environment, aligning with NAB’s business plan.

Read more here

AST is positive with a target price of VND 64,500/share

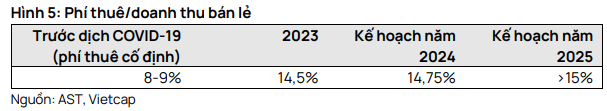

Vietcap Securities believes that the revenue-sharing policy of the Vietnam Airports Corporation (ACV) will affect the profit margin of Taseco Air Services Joint Stock Company (HOSE: AST) but will improve the company’s competitive advantage in bidding for new contracts. Since 2023, this policy has gradually replaced fixed rental fees, currently applying to 95% of AST’s stores, according to information at the 2024 Annual General Meeting of Shareholders. The new fee structure includes both fixed rental costs and revenue sharing, increasing the rental fee/retail revenue ratio to over 15%, compared to 8-9% before the COVID-19 pandemic. Details of the calculation method have not been disclosed. While AST acknowledges that the new policy reduces profit margins, it also provides an advantage in terms of scale, making it easier for the company to compete in bidding processes or opening new stores as smaller retailers may struggle with the costs, and it becomes impractical for a retailer to operate only one or two stores.

Along with leveraging the benefits of ACV’s revenue-sharing policy, Vietcap currently forecasts that AST will open 54 new stores in the 2024-2028 period, 10 more than its previous estimate. On the other hand, in the first half of 2024, international passenger volume increased significantly by 40% over the same period last year, reaching 20.3 million, with international and Chinese passenger volume reaching 104% and 76%, respectively, compared to pre-COVID levels. Based on these positive results, Vietcap forecasts that international passenger volume for the full year of 2024 will reach 45 million. Conversely, the securities company has adjusted its domestic passenger volume forecast downward to 74 million due to lower-than-expected results in the first half of 2024, an 18% decrease attributed to aircraft repairs and weaker-than-expected consumer sentiment.

Given the expectation of higher rental costs for AST due to ACV’s revenue-sharing policy, Vietcap maintains a positive outlook on AST with a target price of VND 64,500/share.

Read more here

Double Delight as Exchange Rates Cool Off

The Vietnamese currency market has witnessed a positive trend recently, with the VND/USD exchange rate cooling off. The USD has dropped below the 25,000 VND mark. On August 29, 2024, the State Bank of Vietnam (SBV) set the daily reference exchange rate at 24,221 VND per USD, an increase of 9 VND from the previous session, but a decrease of 29 VND from the previous week. The SBV’s trading arm maintained the buying rate for USD at 23,400 VND while increasing the selling rate to 25,382 VND per USD.

The Heiress and Senior Executive of Phat Dat Want to Sell Millions of PDR Shares

PDR stock is currently down 14% since the beginning of 2024. A concerning decline, but a potential opportunity for savvy investors to enter a promising market. With a strategic approach, this stock could offer a unique entry point and a chance to diversify. A well-timed investment could see a significant rebound, offering a profitable future for those willing to take a calculated risk.