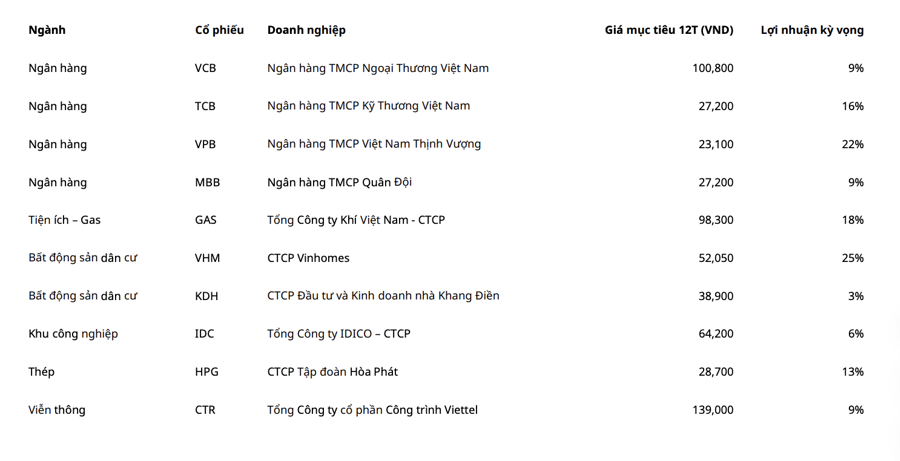

Mirae Asset has released its September stock recommendations, which include four banks with strong growth potential, along with real estate, building materials, and telecommunications stocks. Among these, one real estate stock stands out with an impressive projected price increase of up to 25%.

ASSET QUALITY REMAINS STABLE FOR MANY BANKS

For VCB: Mirae Asset assesses that the bank’s asset quality remained relatively stable in Q2. The non-performing loan (NPL) ratio decreased slightly by 2 basis points from Q1 to 1.2%, while the gross NPL ratio decreased more significantly by 22 basis points to 1.56%. The NPL coverage ratio improved marginally by 12.3 percentage points from Q1 to 212.1%. Although most asset quality indicators showed a relatively weak decline in 1H2024, they remain superior compared to the industry average, indicating a stable outlook.

Despite adjusting downward VCB’s growth projection for 2024, the outlook remains relatively optimistic. With a more positive macroeconomic outlook for the second half of 2024, international trade activities are expected to gradually recover, supporting VCB’s non-interest income growth.

Regarding TCB: Asset quality indicators showed a slight decline this period, with the NPL ratio increasing by 10 basis points quarterly to 1.23%, and the NPL coverage ratio decreasing by 5 percentage points to 101.1%. On a positive note, the ratio of Group 2 loans decreased from 1.1% at the end of Q1 to 0.8% at the end of Q2/2024, partially alleviating the pressure of increasing NPLs in the next period.

While TCB’s credit structure still entails concentration risks, the bank is making efforts to minimize this concentration. The proportion of corporate bond credit continued its downward trend in Q2/2024, reaching 6.5%, while real estate-related loans decreased by 1.5 percentage points quarterly to 64.5%. Additionally, the structure of real estate business loans also decreased by 70 percentage points quarterly to 34%.

Furthermore, liquidity indicators are maintained at high levels, demonstrating the bank’s strong resilience in less favorable conditions.

In the case of VPB: There was a quarterly decline in the asset quality of the balance sheet, but overall, there has been an improvement. The NPL ratio increased to 5.08%, a rise of 24 basis points from Q1, but a decrease of 144 basis points from the same period last year. The NPL coverage ratio ended the quarter at 48.1%, a decrease of 5.4% from Q1, yet an improvement of 5.1 percentage points from the previous year. The extended NPL ratio decreased by 23 basis points from Q1 and by 181 basis points from the same period last year to 12.9%.

Positive aspects noted in VPB’s Q2 performance include a significant decrease in the proportion of substandard bonds to 17.8% from 27.4% in Q1/2024 (a reduction of 53.8% in value), and the completion of VAMC’s special bond handling.

As for MBB: NPLs decreased positively, with the NPL ratio for the group reaching 1.64% in Q2/2024, and the parent bank achieving 1.43%. Credit costs reached 1.2%, and the bad debt provision ratio reached 102%. CAR reached 11.1%.

At the conference on August 5, MBB’s Chairman, Mr. Luu Trung Thai, stated that the debt of Trung Nam Group had decreased by VND 2,000 billion this year, and that the solar power projects financed by MBB were performing well and were not classified as NPLs. Nova Group’s debt has also decreased by VND 1,500 billion since 2023. MB provided loans for three of Nova Group’s projects: Novaland Phan Thiet, Aqua City Dong Nai, and Nova Ho Tram in Vung Tau. These projects are in the sales phase and are being closely monitored by MB.

A REAL ESTATE STOCK WITH A 25% PROJECTED PRICE INCREASE

In the non-financial group, for GAS, Mirae Asset adjusted the 2024 revenue upward by 7.4% while decreasing the net profit after tax by 2.7% compared to the previous projection, based on the assumption of a 16% increase in LPG sales volume due to positive progress in international business activities; a downward adjustment in dry gas consumption volume to 6.4 billion m3 from 7 billion m3 amid a 17% decline in onshore gas production in 7M2024 compared to the same period last year, as well as EVN’s reduced gas-fired power generation; and an increase in LNG contribution to 0.34 billion m3 from 0.14 billion m3 in the previous forecast.

In the real estate sector, VHM is the stock with the highest projected price increase of up to 25%. On August 7, 2024, VHM announced plans to repurchase up to 370 million treasury shares, equivalent to 8.5% of charter capital/outstanding shares. The company emphasized that this move aims to protect the interests of both the company and its shareholders, given that the share price is currently much lower than the company’s actual value. The share repurchase process is expected to commence in mid-September 2024.

Based on the stock’s trading range over the past 30 days, VHM is estimated to spend between VND 12,700 and 14,800 billion on this repurchase. In its mid-year 2024 report, VHM currently holds VND 17,200 billion in cash and short-term investments.

In a recent discussion with the Investor Relations (IR) team, the company affirmed that the share repurchase would be financed by available cash and operating cash flow, thanks to revenue from wholesale sales at the Vu Yen project this year and large-lot transaction sales expected to be completed in the second half of 2024 (estimated value of VND 40,000 billion).

Additionally, VHM anticipates additional revenue from the new sales launch of the Co Loa project in the latter half of the year.

For KDH: Consolidated revenue is projected to reach VND 3,822 billion, an increase of 83%, and net profit after tax is expected to reach VND 1,322 billion, an increase of 82.7% over the same period last year. Most of the revenue and income (90%–95%) will come from the handover of Privia. As of now, the company has sold 100% of the pre-sales of Privia. KDH is expected to hand over at least 90% of the total apartments of Privia in Q4/2024.

Mirae Asset also predicts that IDC will experience a surge in 2024, with outstanding results in the industrial park segment due to the handover of signed contracts totaling more than 170ha from the previous year (of which only 76ha was recorded in the 2023 fiscal year).

Turning to HPG, as we enter the second half of 2024, Mirae Asset has adjusted its outlook downward due to the challenges the company is facing in the current business environment.

Price is no longer a growth driver. High inventory levels at dealerships, weak demand during the rainy season, and increased competition from exports continue to put pressure on selling prices. In the short term, these factors are unlikely to improve, making it difficult for domestic steel enterprises to maintain their pricing policies.

For CTR, the construction segment is projected to grow by approximately 25% during 2024–2028, driven by increased infrastructure investment in 5G. Revenue from the operation and exploitation segment is expected to increase by about 17% annually due to existing contracts and new contracts related to the operation and exploitation of the BTS system in both domestic and foreign markets. The growth rate of the IT solutions segment is estimated at 4.0% annually during 2024–2028.

The Art of Optimizing: Crafting a Captivating Headline

The Fed Adjusts Credit Limits: Who Benefits the Banks?

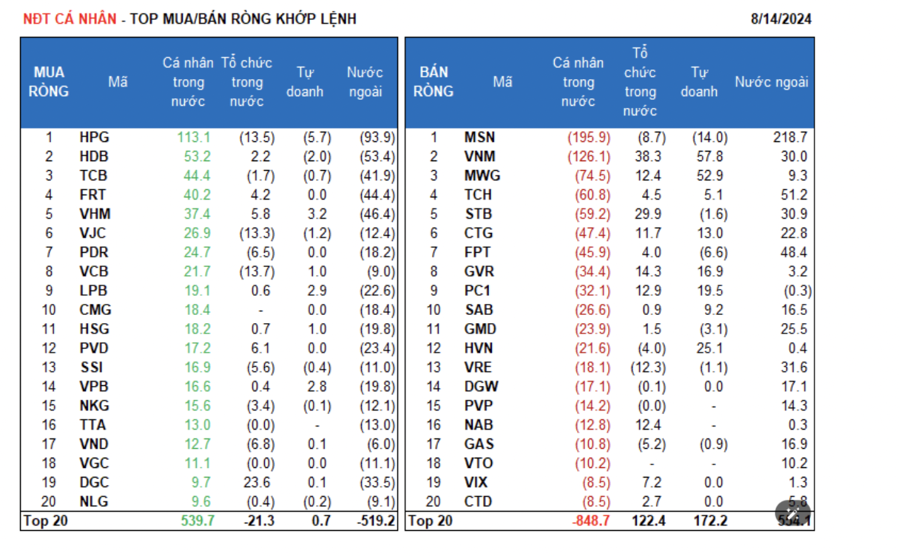

In the first half of the year, several banks achieved remarkable loan growth rates, outperforming the industry average. LPBank took the lead with an impressive 15.2% growth, followed by ACB at 12.8%, HDBank at 12.5%, Techcombank at 11.6%, MB at 10.3%, and VPBank at 10.2%. These figures showcase the resilience and dynamism of Vietnam’s banking sector, even amidst global economic uncertainties.

“Breathable Exchange Rates: Stock Markets Overcoming the Fear”

The US dollar weakened significantly in August, falling below the 25,000 VND mark at one point. Forecasts for the exchange rate trend from now until the end of the year look positive. As a result, the stock market has shaken off its fears of exchange rate volatility, and expectations are high for it to surpass the previous peak of 1,300 points soon after the 2nd of September holiday.