At around 10 a.m. last Friday, in pouring rain, three customers were queuing at the first branch of 7-Eleven in Tokyo.

One was buying a croissant and coffee; another, a bottle of Yakult, a salmon rice ball, and a pack of limited-edition grape-flavored chewing gum; the third was purchasing cat food. A batch of fried chicken appeared from the back of the store, brought out by a female staff member wearing the world-famous green, red, and orange uniform.

“I probably spend more money at 7-Eleven than any other store; they’re always there, they’re a part of life, and the food is getting better and better,” said the coffee and croissant buyer.

Asked about reports that 7-Eleven could soon be sold to a Canadian company for $50 billion, they continued: “I heard they might be sold, but I don’t think it could happen, could it?”

The answer is maybe, especially if the buyer is a foreign entity. Canadian convenience store giant Alimentation Couche-Tard, best known for its Circle K brand, has approached Seven & i Holdings, the parent company of 7-Eleven, with a takeover offer.

But no formal proposal has yet been put to Seven & i’s shareholders. Nonetheless, many bankers, investors, lawyers, and government officials have described it as the most significant and transformative M&A deal Japan has ever seen.

“I think Couche-Tard’s offer will accelerate and expose everything,” said the manager of one of the world’s largest investment funds and a current Seven & i shareholder.

“The game has started, and it’s highly likely that Japan will become the world’s M&A center for the next 10 years.”

Couche-Tard’s interest reflects that of Western investors in Japan generally. They have pursued the company for two decades but have been thwarted by a combination of factors. These include Japanese companies’ instinctive resistance to takeovers, the historical absence of management pressure to put shareholders’ interests first, and the availability of other defensive mechanisms.

Their target has been softened by two different activist investors—a relatively new phenomenon in Japan—who have conducted noisy campaigns urging management to rationalize the conglomerate to improve profits.

This approach has been facilitated by shareholder-friendly M&A guidelines issued by the Ministry of Economy, Trade, and Industry (Meti) last year, which almost oblige Japanese companies to consider bona fide takeover approaches rather than simply dismissing them.

But even in this new environment, a question remains unanswered: is the government prepared to accept a non-Japanese owner of Seven & i? Not to mention, there is also no precedent to convince the domestic population that a foreigner could never run such a Japanese company better.

Convenience stores (konbini in Japanese) are the pinnacle of what Japan does best. They sell fresh bento, affordable Cabernet Sauvignon wine, gelato, shirts, funeral attire, cosmetics, metal dinosaur models, and concert tickets. Customers can pay tax bills there or conduct banking transactions.

They have strived to become indispensable—and won. Behind the scenes, this operation is supported by automation, robotics, finely tuned supply chains, and efficient distribution logistics.

“I think foreigners can buy Japanese companies,” said the cat food buyer. “But I don’t believe a foreigner could run a typical Japanese company like this.”

NATIONAL TREASURE

7-Eleven convenience stores first opened in Dallas, Texas, in 1927.

Executives at the parent company, Southland Corporation, were known as the “7-7-7” group for their ability to work from 7 a.m. to 7 p.m., seven days a week. Ito-Yokado, the predecessor company of Seven & i, signed a licensing agreement with Southland to develop the concept in Japan in 1973. After the US parent company filed for bankruptcy, it seized the opportunity to take full control of the conglomerate in 1991—a time when American anxiety about Japan’s technological, managerial, and financial prowess was nearing its peak.

Since then, konbini has evolved into Japan’s most potent consumer, retail seduction, and innovation channel. For many Japanese, konbini is an indispensable part of life. They flock to what has been dubbed a “national treasure” daily to buy food, send parcels, and pay bills.

After years of consolidation, the country now has three significant competitors: 7-Eleven, Family Mart, and Lawson, together controlling over 50,000 stores in the domestic market.

Nearly half of these are run by Seven & i, attracting 22 million customers each day. The group also has convenience operations abroad, notably in the US, where in 2020, the company agreed to pay $21 billion in cash to buy Speedway, a chain of gas stations owned by oil refiner Marathon Petroleum. But like many other Japanese companies, domestic dominance and operational prowess have not translated into shareholder profits.

In many ways, long-term investors see Seven & i as representing both the best and the worst of Japan. Behind the core convenience store business lies a hinterland of supermarkets, restaurants, and other often unrelated operations that have produced mixed profits and long seemed ripe for pruning.

An activist campaign by Dan Loeb’s Third Point hedge fund helped oust chairman and CEO Toshifumi Suzuki—once dubbed the “king of konbini”—in 2016. Ryuichi Isaka then took over as CEO.

In the past few years, Isaka has overhauled the company’s board, appointed a progressive international chairman, and sold off some non-core assets while promising to accelerate international expansion.

But some investors say these efforts are not enough. Alicia Ogawa, a board member at Nippon Active Value Fund and an expert on Japanese governance reform, points out that many new non-executive directors are not truly independent, coming from suppliers or companies with deep relationships with Seven & i.

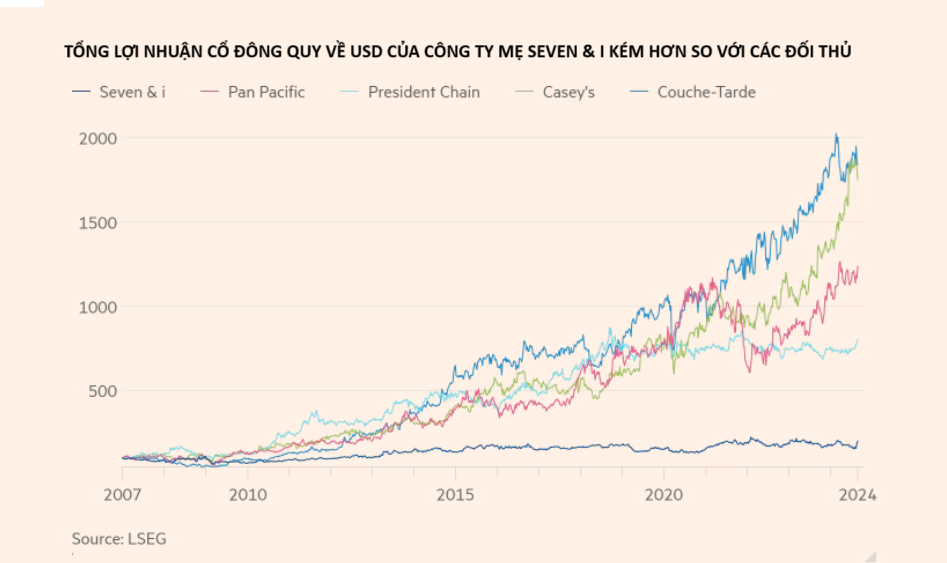

Even accounting for the surge since Couche-Tard’s bid was announced, the company’s share price has underperformed the Topix, Japan’s benchmark index, this year and over the past five years. Benjamin Herrick, an investor in Seven & i at Artisan Partners, points out that since Isaka’s appointment, the company “has deployed $25 billion on acquisitions, but its market capitalization is little changed in yen terms and even lower in dollars.”

“Total shareholder returns over that period are –1%,” Herrick added. “Over the same period, total shareholder returns for Couche-Tard are 191% after deploying $12 billion of capital.”

That performance gap has created a gulf in both market capitalization and valuation between Couche-Tard and Seven & i. That, along with the changed M&A guidelines and the company’s need to show itself more receptive to shareholder priorities, has opened a rare opportunity for the Canadian group.

“What Couche-Tard is doing is taking advantage of the conglomerate discount that Seven & i has suffered from for a long time,” said Shunsuke Kuriyama, an analyst at Jefferies in Tokyo.

“Buying the whole company is probably cheaper than just buying the international business, especially with the potential to divest other assets.”

IS IT FEASIBLE

It has been almost a decade since Japan introduced its first corporate governance and stewardship codes.

In that time, there have been clear signs of progress—and a degree of disappointment that the reforms have not made as much difference as initially hoped.

But the announcement of Couche-Tard’s deal has shaken Japan’s financial sector. In more than 30 interviews with bankers, lawyers, fund managers, and government officials, most described the offer as a turning point, a catalyst, or a test of Japan’s readiness to accept a version of shareholder capitalism it has long avoided.

monica-writing-entry-btn-root { ._monica-theme-d2f2b383 { –theme-text-primary: 262626; –theme-text-secondary: 404040; –theme-text-tertiary: 595959; –theme-text-quaternary: 8C8C8C; –theme-text-disable: BDBDBD; –theme-text-white-primary: FFFFFF; –theme-text-white-secondary: FFFFFF; –theme-text-link: 1E6FFF; –theme-text-link-active: 1E6FFF; –theme-text-brand: 6841EA; –theme-icon-primary: 222226; –theme-icon-secondary: 3D3D43; –theme-icon-tertiary: 55555D; –theme-icon-quaternary: 868692; –theme-icon-disable: D9D9DD; –theme-icon-white-primary: FFFFFF; –theme-icon-white-secondary: FFFFFF; –theme-icon-brand: 6841EA; –theme-btn-fill-primary: 6841EA; –theme-btn-fill-primary-hover: 9373FF; –theme-btn-fill-primary-active: 522BD6; –theme-btn-fill-secondary: ECECEE; –theme-btn-fill-secondary-hover: F5F5F5; –theme-btn-fill-secondary-active: D9D9DD; –theme-btn-fill-tertiary: F0EBFF; –theme-btn-fill-tertiary-hover: DFD5FE; –theme-btn-fill-tertiary-active: B8A3FB; –theme-btn-border-primary: 4F59661F; –theme-btn-border-secondary: 4F596614; –theme-fill-tsp-components-primary: 4F59661F; –theme-fill-tsp-components-secondary: 4F596614; –theme-fill-tsp-components-tertiary: 4F59660A; –theme-fill-btn-primary: ECECEE; –theme-fill-btn-secondary: F5F5F5; –theme-fill-white: FFFFFF; –theme-fill-tsp-blue: 185CEB14; –theme-fill-tsp-brand: 6841EA14; –theme-fill-tsp-brand-primary: 6841EABF; –theme-fill-tsp-brand-secondary: 6841EA73; –theme-fill-tsp-brand-tertiary: 6841EA3D; –theme-fill-tsp-gray: 4F596652; –theme-fill-black-none: 252528; –theme-label-tsp-brand-primary: 6841EA1F; –theme-label-tsp-brand-secondary: 6841EA14; –theme-border-light: 4F596614; –theme-border-primary: 4F59661F; –theme-border-quaternary: 4F596633; –theme-border-active: 6841EA; –theme-border-white: FFFFFF0A; –theme-tab-fill: 4F596614; –theme-tab-fill-active: 222226; –theme-tooltips-fill: 000000D9; –theme-bg-white: FFFFFF; –theme-bg-gray-primary: F5F5F5; –theme-bg-gray-secondary: FAFAFA; –theme-bg-mask: 00000073; –theme-bg-menu-white: FFFFFF; –theme-bg-menu-gray: F5F5F5; –theme-bg-tsp-gray-primary: F5F5F5E6; –theme-bg-tsp-white-primary: FFFFFF; –theme-bg-gray-nav: ececee; –theme-bg-tsp-white-secondary: FFFFFF73; –theme-function-info: 3BBFFF; –theme-function-success: 00AA5B; –theme-function-warning: FFAB00; –theme-function-error: EA3639; –theme-function-error-border: FFA4A3; –theme-function-warning-light: FDFAE9; –theme-function-warning-border: FFE266; –theme-shadow-s1: rgba(0, 0, 0, 0.04); –theme-shadow-s2: rgba(0, 0, 0, 0.08); –theme-shadow-s3: rgba(0, 0, 0, 0.24); –theme-box-shadow-s1: 0px 1px 20px 0px var(–theme-shadow-s1); –theme-box-shadow-s2: 0px 8px 24px 0px var(–theme-shadow-s2), 0px 0px 1px 0px var(–theme-shadow-s2); –theme-box-shadow-s3: 0px 12px 40px -4px var(–theme-shadow-s3), 0px 0px 2px 0px var(–theme-shadow-s2); } ._monica-theme-d2f2b383._monica-dark { –theme-text-primary: F3F3F3; –theme-text-secondary: DBDBDB; –theme-text-tertiary: AAAAAA; –theme-text-quaternary: 7A7A7A; –theme-text-disable: 4C4C4C; –theme-text-white-primary: E9EAED; –theme-text-white-secondary: E9EAED; –theme-text-link: 5E8CFF; –theme-text-link-active: 3767EB; –theme-text-brand: 7F58FD; –theme-icon-primary: F3F3F4; –theme-icon-secondary: BFBFC4; –theme-icon-tertiary: A7A7AE; –theme-icon-quaternary: 77777E; –theme-icon-disable: 4A4A4F; –theme-icon-white-primary: F3F3F4; –theme-icon-white-secondary: F3F3F4; –theme-icon-brand: 7F58FD; –theme-btn-fill-primary: 7F58FD; –theme-btn-fill-primary-hover: 8363E9; –theme-btn-fill-primary-active: 5E40BF; –theme-btn-fill-secondary: 56565F3D; –theme-btn-fill-secondary-hover: 56565F52; –theme-btn-fill-secondary-active: 56565F52; –theme-btn-fill-tertiary: 3C2B73; –theme-btn-fill-tertiary-hover: 332560; –theme-btn-fill-tertiary-active: 271F42; –theme-btn-border-primary: A2B1D733; –theme-btn-border-secondary: A2B1D71F; –theme-fill-tsp-components-primary: 56565F52; –theme-fill-tsp-components-secondary: 56565F33; –theme-fill-tsp-components-tertiary: 5

Unlocking the Potential: Exploring Opportunities to Enhance Vietnam-Japan Cross-Border Payments

The State Bank of Vietnam’s (SBV) working delegation, led by Deputy Governor Pham Tien Dung, conducted a comprehensive survey and market potential assessment in Tokyo, Japan. The aim was to identify opportunities to enhance efficient bilateral cross-border payment cooperation between Vietnam and Japan.

Unlocking the Potential of Vietnam’s IB Market: A Challenge Worth Taking

“The Vietnamese IB market holds immense potential, but unlocking this power is a challenging journey. This is according to Tran Nhat Huy, Director of Investment Banking at Shinhan Securities Vietnam (SSV). He shared that while the market holds great promise, there is a long way to go to truly awaken its inner strength.”