Illustrative image

The State Bank of Vietnam (SBV) has recently announced adjustments to credit growth targets for banks. Accordingly, from August 28, 2024, banks with a credit growth rate of 80% of the target announced by the SBV at the beginning of 2024 will be allowed to proactively adjust their credit balances based on the ranking of the credit institution.

“The addition of this limit is the initiative of the SBV, and credit institutions do not need to make a request,” emphasized the SBV.

Previously, from the beginning of 2024, the SBV had assigned the entire credit growth target to credit institutions, corresponding to a general growth rate of about 15%. This method of allocating credit limits differs from previous years, when the SBV allocated them in multiple batches and required banks to submit requests for limit increases.

According to the SBV’s leadership, this change conveys a message to banks that capital injection into the economy this year must be more robust, aggressive, and responsible.

“If in previous years we considered them as allocations or distributions, now it is a mechanism to encourage banks to strive to achieve the target. Because last year, while some banks fully utilized their credit limits, many others did not even come close, and some even had negative credit growth. For those banks with low or negative growth rates, it could be due to their hesitancy to lend. Therefore, this change in mechanism aims to motivate these banks to strive to achieve the assigned credit target,” said Deputy Governor Dao Minh Tu at a press conference at the beginning of 2024.

However, as of August 26, 2024, the credit growth of the entire system was only 6.63% compared to the end of 2023, much lower than the targeted orientation at the beginning of the year. The credit growth rates of credit institutions were uneven, with some even experiencing negative growth.

With the banking sector’s plan to achieve a 15% credit growth rate for the whole of 2024, the system will need to inject more than VND 2 quadrillion into the economy this year. In the first eight months, the injected capital did not even reach VND 900 trillion.

Therefore, the system will need to inject the remaining capital of over VND 1.1 quadrillion in the last five months, averaging VND 227 trillion per month, to achieve the set growth target – a growth rate twice as high as the average of the first eight months. This poses a significant challenge for the banking system.

Banks that will receive increased credit limits

The SBV’s move to relax credit limits is considered timely to facilitate banks that are close to their limits to proactively expand their loan balances and achieve the system-wide credit growth target of about 15%.

Recently published data shows that many banks have achieved much higher loan growth rates than the industry average in the first half of the year, such as LPBank (15.2%), ACB (12.8%), HDBank (12.5%), Techcombank (11.6%), MB (10.3%), and VPBank (10.2%). In contrast, some banks have lower growth rates than the general level, such as Agribank (2.6%), BIDV (5.9%), TPBank (4.0%), VIB (4.7%), and SHB (5.2%).

In a recently published report, VPBank Securities assessed that this policy would motivate banks to compete more aggressively for credit limits and market share. Consequently, interest rate policies would become more favorable for borrowers but could be traded off with a slight decrease in net interest income.

According to VPBank Securities, banks that have achieved over 80% of the assigned target (such as ACB, HDBank, LPBank, and Techcombank) will have their credit limits increased to 18-18.7%. If banks can utilize 90% of the credit limit assigned at the beginning of the year, and the SBV does not increase the policy rate, with a GDP growth of 6%, the credit growth of the entire industry may reach 14.83%.

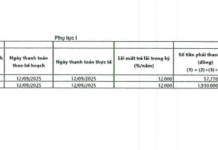

In related news, Mr. Pham Nhu Anh, CEO of MB, said that as of August 28, the bank’s credit growth rate reached 10.44%, equivalent to 65.7% of the growth target assigned by the SBV at the beginning of the year. According to the SBV’s document adjusting credit growth targets, MB is expected to increase its credit balance by VND 14 trillion.

ACB’s management also shared with the media that the bank has received an increased credit limit in the latest adjustment.

On the other hand, banks with slow credit growth rates are likely to have their limits reduced.

Speaking at a recent regular press conference, Deputy Governor Dao Minh Tu stated that the credit limits of banks that are unable to lend will be transferred to other banks.

“We will take strict action against banks with low credit growth rates, especially since the SBV has allocated full credit limits to commercial banks from the beginning of the year,” said Mr. Tu at the conference.

According to Mr. Tu, the SBV “will transfer the credit limits of banks with low credit growth to proactively create favorable conditions for banks with potential for credit development in the coming time.”

“The Big Four Banks: September’s Best Deposit Rates”

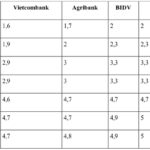

The interest rates offered by Agribank, BIDV, VietinBank, and Vietcombank currently hover around the 1.6-4.8% annual mark. Among the Big 4 banks, Vietcombank consistently offers the lowest interest rates to its customers.

The Surprising Lending Speed of Ho Chi Minh City Banks

“Hanoi’s bank credit growth has yet to reach its expected breakthrough as businesses continue to face challenges. Despite this, there remains an air of cautious optimism within the city’s financial sector. With a resilient economy and a dynamic business landscape, the potential for a surge in credit growth is ever-present, and banks are poised to play a pivotal role in facilitating this anticipated upswing.”