|

Stock Changes in VNM ETF for the Week of 26-30/08/2024

|

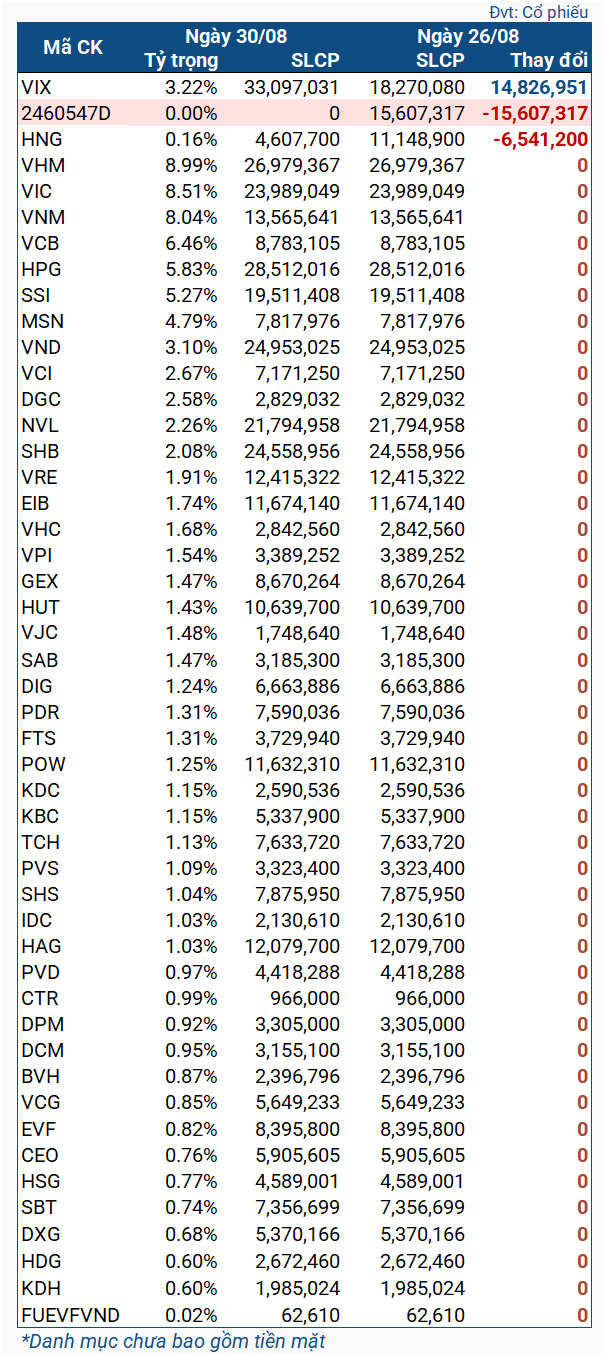

During this period, the VNM ETF offloaded a significant amount of HNG stocks, with a volume of over 6.5 million shares, making it the only stock to be sold net. This also marks the second consecutive week of net selling in this stock. Previously, in the period from 19-26/08, VNM ETF sold nearly 2.3 million HNG shares.

On the other hand, VIX was the only stock to witness an increase in its holdings as the Fund added more than 14.8 million shares. However, these shares were part of a share offering to existing shareholders to raise capital for VIX, with an exercise ratio of 100:95, meaning 1 share corresponds to 1 purchase right, and 100 rights are required to purchase 95 new shares. Along with the increase in shares, more than 15.6 million VIX share purchase rights also decreased.

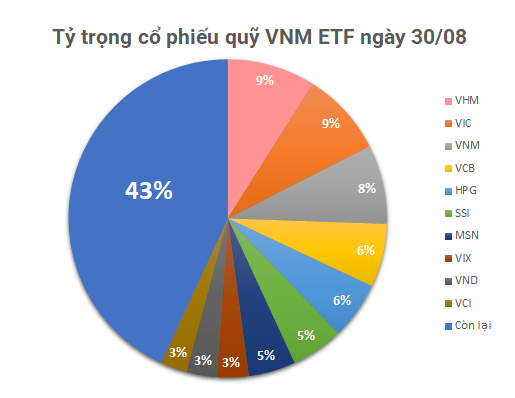

As of 30/08, the net asset value of VNM ETF stood at nearly $502 million, a slight increase from over $500 million on 26/08. The entire portfolio comprises Vietnamese stocks, with the top weights held by VHM (8.99%), VIC (8.51%), VNM (8.04%), VCB (6.46%), and HPG (5.83%). Additionally, with the inclusion of nearly 15 million shares, VIX also entered the top 10 stocks with the largest weights in the Fund, ranking 8th with a weight of 3.22%.