Since the early 2010s, Vietnam has witnessed an explosion of Asian-inspired culinary chains. Among these, Sumo BBQ, Gogi, and iSushi stood out, followed by direct competitors like ThaiExpress, Hotpot Story, and King BBQ. However, it was Khao Lao, a Lao cuisine chain, that recently stirred up controversy on social media.

Who owns the Khao Lao chain?

The most popular Asian-themed restaurant chains are currently owned by two main companies. While Sumo, Gogi, and iSushi belong to Golden Gate Corporation, names like King BBQ, ThaiExpress, Hotpot Story, and Khao Lao fall under Goldsun Food Joint Stock Company (Goldsun Food).

|

Goldsun Food’s Restaurant Chains

Source: GoldsunFood

|

Speaking of Goldsun Food, the company was established on October 17, 2019, initially under the name Golden Sun Food Co., Ltd. According to their official website, the company transitioned from Redsun ITI Joint Stock Company in 2020, with Pham Thi Kim Thoa (born in 1973) as its legal representative and General Director.

In January 2020, Goldsun Food became a joint-stock company, adopting the name Goldsun Food Joint Stock Company (GSF). At this point, its charter capital was 15 billion VND, with five founding shareholders. Mr. Pham Cao Vinh held the highest percentage of shares (47.6%, equivalent to 713,700 shares), closely followed by Le Vu Minh (nearly 46.2%, or 692,700 shares). The remaining shares were evenly distributed among three shareholders, Duong Thi Viet Huong, Nguyen Hoai Nam, and Hoang Duc Lam, each holding approximately 2.1% (31,200 shares).

In March 2020, the position of legal representative was transferred to Mr. Vinh, who also served as the company’s Chairman and General Director. In November 2021, the company’s charter capital increased to 30 billion VND.

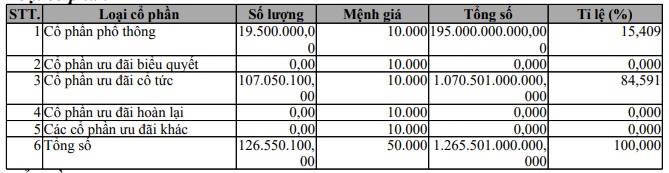

Goldsun Food underwent several changes in 2022. In February, Pham Do Kim Phuong assumed the role of General Director and legal representative. However, after just two months, both positions reverted to Mr. Vinh. By May 2022, the company’s charter capital had soared from 30 billion to 726 billion VND. Of this, 21.5% were common shares, amounting to 15.6 million units or 156 billion VND, while the remaining 78.5% were preferred shares, totaling 57 million units or 570 billion VND.

As of December 2023, Goldsun Food’s charter capital had risen further to over 1,230 billion VND. With the number of common shares remaining constant, their proportion decreased to just over 12.7%. In contrast, preferred shares now accounted for 87.3%, totaling more than 107 million units. In January 2024, the company’s charter capital witnessed a slight increase to 1,270 billion VND, with the addition of 3.9 million common shares.

|

Shareholding Structure of Goldsun Food as of January 2024

Source: Ministry of Planning and Investment

|

The company, which has issued nearly 1,000 billion VND in bonds, experienced delays in interest payments in the first half of 2024.

Prior to its transformation into Goldsun Food, Mr. Pham Cao Vinh was also a founding shareholder of Redsun ITI. Additionally, Mr. Vinh currently serves as Chairman and legal representative of Goldsun Packaging and Printing Joint Stock Company (Goldsun).

In May 2024, VNDIRECT Securities Corporation (HOSE: VND) announced its decision to acquire shares from Goldsun Food. Subsequently, the company entrusted its General Director, Nguyen Vu Long, with tasks related to the share transfer, including searching for and selecting potential partners, determining the timing and number of shares to be transferred (not exceeding 15% of Goldsun Food’s capital), and finalizing the transfer value.

|

Established in 2008, Redsun ITI had Pham Thi Kim Chi as its Chairman and General Director. As of January 2018, the company possessed a charter capital of 150 billion VND, with Chi holding 52.58% of the shares, Le Vu Minh owning 22.24%, and Pham Cao Vinh controlling 16.18%. By 2022, the company had increased its capital to 250 billion VND, and Le Vu Minh took on the role of General Director and legal representative. Redsun ITI currently owns the restaurant brands operated by Goldsun Food.

|

Interestingly, among the D-Bond products offered by VND, there are also those from Goldsun.

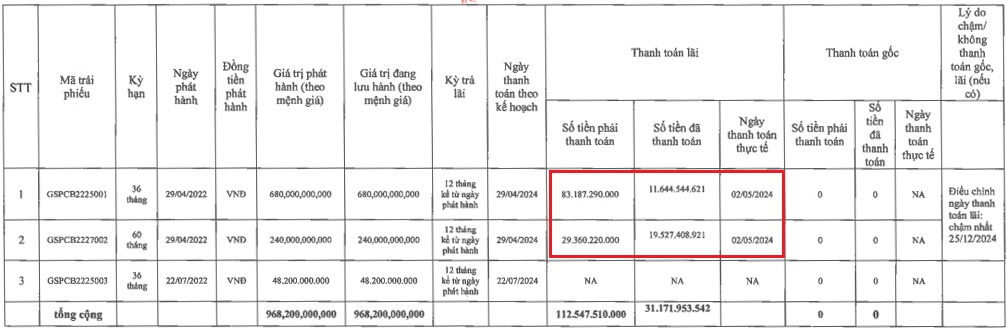

At present, Goldsun has three bond lots with codes GSPCB2225001, GSPCB2227002, and GSPCB2225003, each with a par value of 100,000 VND, totaling over 968 billion VND. Of these, VND offered two lots, GSPCB2225001 and GSPCB2227002, with total proceeds of 680 billion and 240 billion VND, respectively, amounting to 920 billion VND.

The two lots, issued on April 29, 2022, will mature on April 29, 2025 (36 months), and April 29, 2027 (60 months), respectively. The bonds feature a 12-month interest payment period, with a floating interest rate structure. The first static interest period offers an 11% annual rate, while subsequent periods apply a floating rate comprising the average savings interest rate of four state-owned banks plus a margin of 5% (but not less than 11% per annum).

On July 22, 2022, Goldsun issued an additional lot, GSPCB2225003, with a term of 36 months and 482,000 bonds, raising 48.2 billion VND. This lot carried an 11% issuance interest rate. The bond lots are secured by tens of millions of units in Goldsun and Goldsun Food, subject to varying terms and conditions.

According to semi-annual bond principal and interest payment updates for 2024, Goldsun is experiencing delays in interest payments for its two most substantial lots. Specifically, the company has paid only 11.6 billion VND out of over 83 billion VND in interest for the GSPCB2225001 lot, and over 19.5 billion VND out of nearly 29.4 billion VND in interest for the GSPCB2227002 lot. This delay is due to the company’s decision to adjust the interest payment date, with a tentative new date set for December 25, 2024.

|

Goldsun Faces Delays in Interest Payments for Its Two Highest-Value Bond Lots

Source: HNX

|

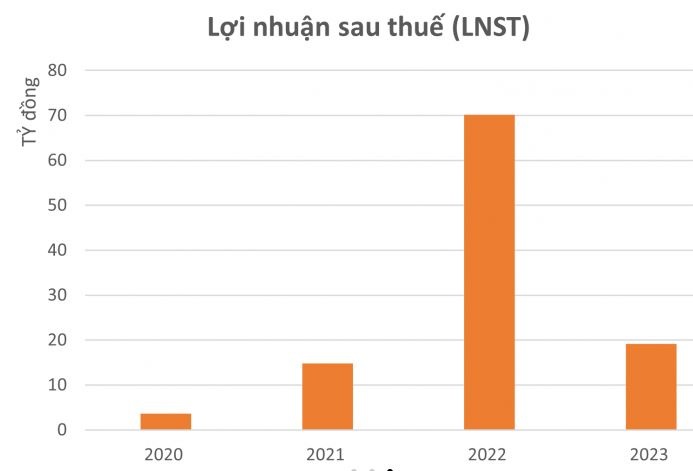

Turning to financial performance, according to disclosures from VND, Goldsun’s revenue in 2023 reached 2,029 billion VND, a 3% decrease from the previous year. The gross profit margin dropped from 13% in 2022 to 11% in 2023 due to a reduction in product selling prices. Net profit for 2023 stood at 19 billion VND, only a quarter of the previous year’s peak, primarily due to declining gross profit and rising interest expenses in a high-interest-rate environment.

Source: VND

|