The Vietnamese stock market remained range-bound ahead of the 1,300-point threshold, with the VN-Index fluctuating within a narrow range. The main contributors to the index’s performance in the week leading up to the holiday break were the gains seen in the banking sector. Additionally, the rise in other blue-chip stocks, coupled with the relatively modest declines in other groups, helped keep the VN-Index buoyant. The VN-Index closed August 2024 at 1,283.87 points, largely unchanged from the previous week’s trading.

Looking ahead to the week after the holiday break, experts offered a relatively cautious outlook for the VN-Index. Most analysts predicted the possibility of a short-term correction, but they viewed this as a “healthy” adjustment for the market.

VN-Index trades sideways around 1,260-1,280; investors still have opportunities to profit in the stock market

Mr. Ngo Minh Duc, Founder of LCTV Investment and Finance Company

According to the Founder of LCTV, the VN-Index closed out August with a lackluster performance, characterized by back-and-forth movements and a largely range-bound trend. As we move into September, investors may anticipate the Fed’s decision to cut interest rates for the first time in over 2.5 years, a shift from their previous policy of high-interest rates aimed at curbing inflation.

However, as this development has already been partly priced in by the market, it may not cause significant fluctuations. Mr. Duc predicts that the sideways trend around the 1,260-1,280 range is likely to persist, and the probability of breaking above 1,320 is relatively low.

The Fed’s rate cut is seen as a positive development for the Vietnamese economy. Specifically, it will help narrow the interest rate differential between the VND and the US dollar, thereby reducing pressure from foreign outflows and exchange rate tensions. This will provide the State Bank of Vietnam with additional room to maintain its accommodative monetary policy to support the economy, as both exchange rate and inflation pressures, which have been sources of concern in recent quarters, are now showing signs of easing.

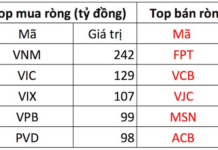

With regards to the Vietnamese stock market, the expert anticipates that foreign investors will return to net buying after having net sold nearly $2.8 billion since the beginning of the year, which should help improve the sentiment among domestic individual investors.

On market liquidity, Mr. Duc noted that the matched order value in recent sessions has shown signs of weakening, partly due to investor caution as the VN-Index approached the resistance zone of 1,280-1,300, which it failed to breach on three occasions earlier this year. The market is awaiting a potential catalyst, be it a significant shift in the index level or crucial news that could alter the current trend, such as the release of August macroeconomic data in early September and the announcement of FTSE’s review results on market upgrade.

Additionally, the current price levels of non-financial stocks are not particularly attractive, and the net selling trend by foreign investors, along with an increase in share issuances, are primary factors contributing to the cautious sentiment and low liquidity.

“The recent uptrend (1,188-1,285) was a recovery in the form of an ‘Arch’ pattern, largely driven by large-cap stocks in the VN30 index such as BID, MSN, BVH, and VHM, while mid-cap and small-cap stocks even witnessed declines. As such, the breadth and extent of the advance were not significant. Investors should not rush to the conclusion that they have missed out on opportunities,” said the LCTV expert.

Investors are advised to remain calm and selectively choose sectors with strong growth potential in the second half of 2024 for their portfolio allocation. The market has already differentiated, and not all sectors are on an upward trajectory, hence stock selection is crucial. The focus should be on companies with strong profit growth prospects, and if Vietnam’s stock market is upgraded, identifying sectors that will attract foreign capital is essential.

Regarding earnings expectations for the third and fourth quarters, the LCTV expert anticipates improved performance from the banking sector. The State Bank of Vietnam’s recent adjustment to the credit growth target for banks that have achieved over 80% of their credit growth target will provide a boost to efficient banks, offering further growth potential.

A “healthy” correction may be on the horizon

Mr. To Quoc Bao – Head of Market Strategy at PSI Securities Company

According to the PSI expert, with positive economic recovery data globally, many economists and investors anticipate that the Fed may cut interest rates more aggressively than market expectations in the FOMC meeting on September 18, and there could be two rate cuts in 2024.

When the Fed initiates rate cuts, Vietnam will experience reduced pressure on the USD/VND exchange rate, easing inflationary pressures from imports, and subsequently lowering the risk of a return to tight monetary policies. This development is expected to positively influence the sentiment of investors in the Vietnamese stock market.

Domestically, Vietnam’s GDP grew by 6.42% in the first half of the year, meeting the government’s 6-6.5% growth target for 2024. Import recovery has been picking up pace in recent months. System-wide credit growth in the first half reached approximately 6.0%. Overall, the Vietnamese economy is on a path of positive recovery, providing a solid foundation for the local market.

Notably, exchange rate pressures have eased since the second quarter of 2024, which could encourage foreign investors to return to the Vietnamese stock market. Additionally, market-wide profits are expected to rebound and show more evident growth in the second half of 2024, potentially leading to a direct improvement in the valuation of listed companies.

In the current context of the Vietnamese stock market, the VN-Index is likely to face corrective pressures and volatility in the first few sessions immediately after the 2/9 holiday break. This is considered a “healthy” adjustment for the market. Prior to the break, the Vietnamese stock market had a positive month, with the VN-Index recovering by more than 100 points from its lows. This was a relatively swift rebound, accompanied by an average gain of over 10% in many stocks. Therefore, the market may need technical corrections to consolidate and test the strength of demand at higher price levels.

On the other hand, the business results of listed companies in the second half of 2024 are expected to recover and show more evident growth compared to the first six months. Sectors anticipated to maintain their growth momentum and exhibit exceptional profit growth include Banking, Securities, Real Estate, and Retail.

For the financial sector, particularly banking stocks, Mr. Bao expects credit growth to accelerate in the second half, and a slight improvement in NIMs for banks, leading to increased net interest income and sustaining the current growth trajectory.

Additionally, the retail sector may witness positive momentum due to domestic economic stimulus policies driving a recovery in consumer demand.

In contrast, for real estate businesses, the second half of the year is typically a peak period for real estate transfers and revenue recognition. Therefore, this period will likely see a significant improvement in the performance of companies in this sector. Furthermore, supportive policies aimed at addressing challenges in the real estate market are gradually having a positive impact, but only financially robust companies with a solid land bank and complete legal procedures will reap the benefits.

Some sectors related to import-export activities are also expected to show positive signals, as Vietnam’s total import-export value has grown rapidly, increasing by 17.2%, which is a very positive sign for Vietnamese enterprises in the import-export value chain.

The Ultimate Guide to LPBank’s Interest Rates: Maximize Your Savings with the Best Online 18-Month Deposit Rates in September 2024

“This September, LPBank is offering an attractive interest rate of up to 5.6% p.a. on online deposits for personal customers. This competitive rate is applicable for fixed-term deposits ranging from 18 to 60 months, providing customers with a great opportunity to grow their savings.”