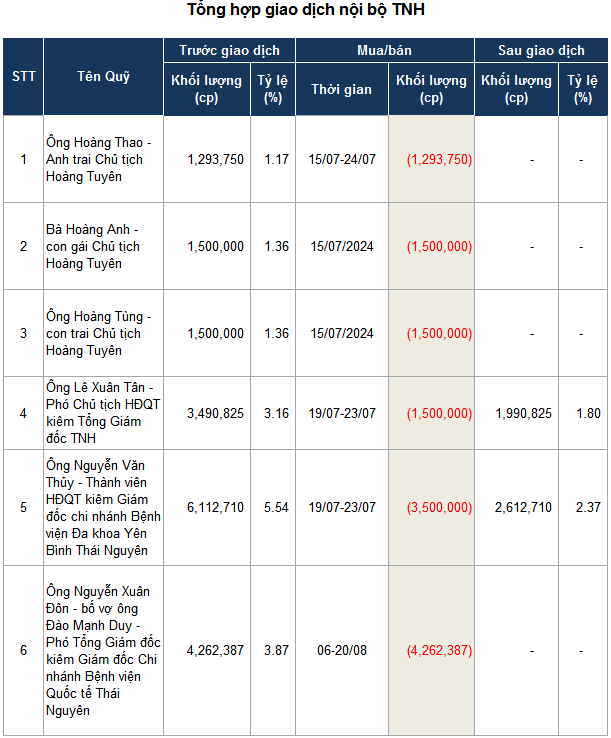

Specifically, Mr. Don sold all of his nearly 4.3 million TNH shares, or 3.87% of TNH’s capital, to address personal financial needs.

| TNH share price movement from the beginning of 2024 to the session on 09/04 |

During the period when Mr. Don reported the transaction, only 600,000 TNH shares were traded through matching, so it is highly likely that Mr. Don sold the aforementioned shares through order matching. Referring to the closing price of TNH on August 20 at VND 22,400 per share, down more than 21% from the peak (July 15 session), it is estimated that Mr. Don could have collected more than VND 95 billion after no longer being a shareholder of TNH.

Regarding the relationship with insiders, Mr. Dao Manh Duy – Deputy General Director and Director of Thai Nguyen International Hospital Branch, is the son-in-law of Mr. Nguyen Xuan Don. This Deputy General Director personally holds 55,200 TNH shares, equivalent to a holding rate of 0.05%.

Source: VietstockFinance

|

The wave of divestment by TNH insiders began in July when the Company welcomed a major foreign shareholder. In particular, the Chairman’s family Hoang Tuyen completely divested their holdings in the period from July 15-24.

Following the move of the Chairman’s family of TNH, in the period from July 19-23, the Vice Chairman of the Board of Directors and General Director Le Xuan Tan and Mr. Nguyen Van Thuy – Member of the Board of Directors of TNH also successfully sold 1.5 million shares and 3.5 million shares of TNH through matching, reducing their ownership to 1.8% and 2.37%, respectively.

On the other hand, the organization from Singapore, Blooming Earth Pte. Ltd., became a major shareholder of TNH after purchasing 412,000 TNH shares in the session on July 12. Since no matching transactions were recorded for TNH in this session, it is highly likely that Blooming Earth purchased the shares through order matching.

Subsequently, the foreign major shareholder continued to buy 4.3 million TNH shares on the floor in the session on July 15, increasing its ownership to 10 million shares, or 9.1% of the capital.

On July 15, TNH recorded a matching transaction with a volume equal to the volume purchased by Blooming Earth. The transaction value was nearly VND 129 billion, equivalent to nearly VND 30,000 per share. TNH closed at VND 28,450 per share in this session – the highest price since the beginning of 2024.

The above transaction to welcome a foreign major shareholder almost filled TNH’s foreign ownership room, reducing the remaining room from 5.27% to 1.12%, equivalent to 1.23 million shares.

| Business results for the first half of 2024 |

In terms of business performance, in the first half of 2024, TNH recorded over VND 222 billion in net revenue and nearly VND 54 billion in net profit, down 3% and 14%, respectively, compared to the same period last year.

TNH attributed the decrease in net profit to the increase in cost of goods sold while revenue decreased, causing gross profit to drop by 21%. During this period, the Company focused most of its resources on completing the Thai Nguyen Hospital TNH Viet Yen project, especially the recruitment costs to attract high-quality human resources and meet the requirements of the Ministry of Health for appraisal. In addition, from April 2024, the Company implemented a comprehensive adjustment of income levels according to job positions and work efficiency for employees to ensure alignment with the base salary after the State increased the basic salary from July 01, 2024.

Compared to the business plan with a revenue target of VND 540 billion and a net profit target of VND 155 billion, TNH has achieved 41% of the revenue target and 34% of the net profit target in the first six months.