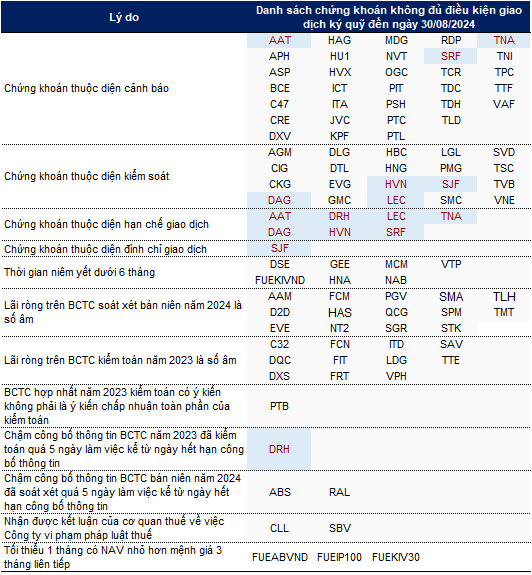

The supplementary list comprises securities of FECON Mineral Joint Stock Company (HOSE: FCM), Hacisco Joint Stock Company (HOSE: HAS), Power Generation Corporation 3 – Joint Stock Company (HOSE: PGV), Quoc Cuong Gia Lai Joint Stock Company (HOSE: QCG), Saigon Real Estate Corporation (HOSE: SGR), and TMT Motor Joint Stock Company (HOSE: TMT).

Thus, with these six new additions, the number of securities subjected to margin cuts on HOSE increased from 89 to 95 as of August 30. Most of the securities on this list were included due to warning, control, or restricted trading statuses; net losses in the reviewed semi-annual financial statements for 2024; net losses in the audited financial statements for 2023; or a listing duration of less than six months.

A small number of securities were also included due to trading suspension (SJF); delayed disclosure of audited financial statements for 2023 (DRH) and reviewed semi-annual financial statements for 2024 (ABS, RAL) by more than five working days from the information disclosure deadline; consolidated audited financial statements for 2023 with non-compliant audit opinions (PTB); tax violation conclusions (CLL, SBV); and public investment funds with a minimum of one month of NAV/ccq smaller than the par value for three consecutive months (FUEABVND, FUEIP100, FUEKIV30).

Notably, eight securities fell into the list due to a combination of two reasons, including AAT, SRF, TNA, DAG, HVN, SJF, LEC, and DRH.

Source: HOSE, Author’s Synthesis

|

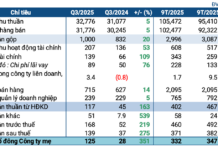

“Revenue Down, Management Costs Up: Saigonres Swings to Loss Post-Review”

Saigonres witnessed a significant shift in its financial standing, moving from a reported profit of 2.3 billion VND to a staggering loss of 23.3 billion VND after a thorough review. This drastic change can be attributed to reduced revenue and soaring business management expenses, highlighting the challenges faced by the company.