In a recently released report by TPS Securities, the firm provided an optimistic outlook for the stock market amid easing exchange rates.

According to TPS, the stock market will benefit from the cooling exchange rates as it positively impacts export-oriented businesses, subsequently affecting the stock market.

Additionally, the reduced pressure on exchange rates provides a favorable environment for policymakers to promote public investment policies and maintain a relaxed monetary policy, which also positively influences the stock market.

Moreover, accelerating exports create stable incomes for workers, an essential factor in boosting the consumption industry, thereby affecting the stock market.

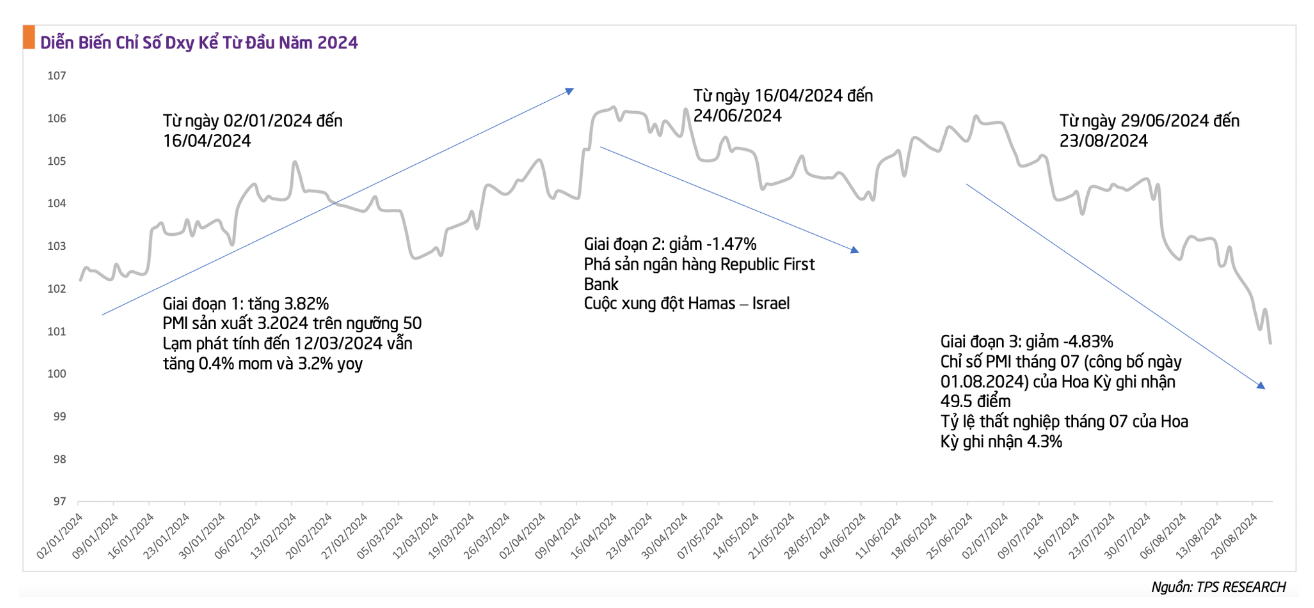

As per TPS Securities’ update as of August 26, 2024, the USD Index (DXY) had decreased by 1.4% year-to-date. The expectation of Fed interest rate cuts in the coming months drove this decrease, as indicated by the US’s PMI for August 2024, which was the lowest since early 2024, along with rising unemployment and decreasing inflation rates.

Following the Fed’s statement, investors anticipated further interest rate cuts by the Fed in upcoming meetings. This positively impacted Vietnam’s exchange rates in recent days, with rates at commercial banks dropping by 1.9% from their 2024 peak.

The cooling exchange rates have made it easier for policymakers to maintain relaxed monetary policies. However, gold prices remain high and are expected to continue rising, which may hinder the pace of exchange rate reduction.

According to a survey by the Fedwatch tool (CME group) as of August 26, about 39% of the market predicted that in the September 18 meeting, the Fed would lower the current interest rate of 5.25 – 5.5% to 4.75 – 5%. Approximately 61% of the market anticipated a rate of 5.0 – 5.25%.

From a technical analysis perspective, considering the daily chart, the market is approaching the 1,290 – 1,300-point threshold and testing this resistance zone. The possibility of a Fed rate cut in September boosts optimism that the index might surpass the 1,300-point mark again and aim for higher levels.

The New Wave of Stock Market Investors: Vietnamese Expats

VTV.vn – There is a significant number of Vietnamese individuals residing, studying, and working abroad who are actively investing in the Vietnamese stock market.