After a strong rebound from its lows, the market’s upward momentum has noticeably stalled, with lackluster liquidity reflecting investors’ cautious sentiment ahead of the long holiday break. The VN-Index ended August at 1,284 points, just over 20 points shy of breaking into new peak territory.

VN-Index to Enter a New Uptrend After the Holiday

At the “Pulse of the Money Flow” workshop hosted by FIDT and FiinTrade, Mr. Nguyen Thanh Nguyen Vu, Founder of TVN & Partners, expressed optimism about the market’s prospects amid a stable macroeconomic environment, easing exchange rates, and expectations for continued improvement in Q3 GDP.

While the anticipation of a Fed rate cut has largely been priced in, investors are now focused on the magnitude of the cut. However, the Fed’s and central banks’ accommodative policies will ease pressure on exchange rates and give the State Bank of Vietnam more breathing room in managing interest rates in the remaining months of the year. Maintaining low-interest rates will create the most favorable conditions for the economy in general and the stock market in particular. These are the stories that will stimulate investment money flow back into the market.

So, when will the big money flow in? According to the expert, this strong market rise is entirely due to investors’ expectations, and businesses have not seen much change in their operations. Nevertheless, with the recovery being reinforced by large enterprises in each industry group with substantial market capitalization, and more stable internal and external macroeconomic factors, investment money flow will enter to create a balance after the bottom-fishing money flow. As a result, the expert believes that the market now has the right to expect a new uptrend after the September 2nd holiday.

Stock Market is the Best Investment Channel in the Short and Medium Term

Sharing a positive view, Mr. Doan Minh Tuan, Head of Research and Investment at FIDT, opined that the global context is stable with rapidly declining inflation risks amid rising unemployment rates.

With the scenario of reversing interest rate cuts, the Fed is expected to cut interest rates 4-5 times in the next 6 months, with rates falling by 1-1.3%. Following the Fed, central banks around the world reversed course and lowered interest rates. The global economy is about to enter a new phase of monetary easing in the period of late 2024-2025.

Against this backdrop, DXY fell sharply to 98-100, the lowest in more than two years. US stock indices also surged, hitting new highs. This indicates that global investment money flow is positively welcoming more dovish signals from the Fed.

Domestically, Vietnam’s economic growth is entering a recovery phase, with the FDI sector remaining a mid-term bright spot and production and trade leading the way in economic growth. Looking into Q4, deposit interest rates continue to hover at historical lows, and the corporate bond market has not recovered. FIDT experts believe that the macroeconomic context in Q4/2024-2025 will be very favorable for stocks and real estate, with equities being the best investment channel in the short and medium term.

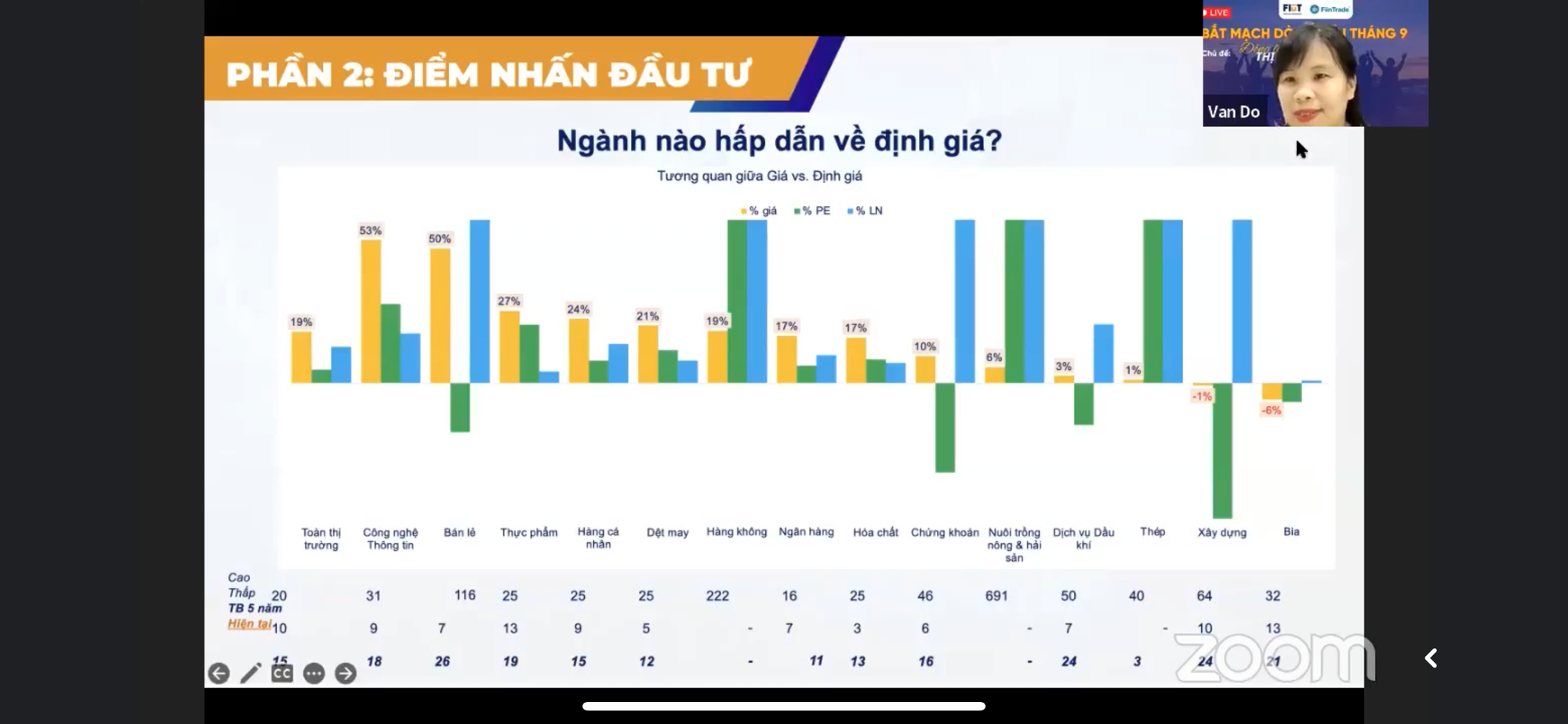

Discussing the 1,300 resistance level, which has caused the VN-Index to retreat several times, the expert argued that this level is merely a psychological barrier, and investment conditions remain favorable with interest rates staying at historic lows and the market’s valuation still being attractive at a P/E of 13.7 times, compared to a 5-year average of 14.8 times. Meanwhile, listed companies’ profits have been on a stable growth trend since Q2/2024.

Therefore, the VN-Index has the opportunity to be re-rated to a more balanced P/E in 2025 (15-16 times), reflecting the market’s true growth potential as the risks of a macroeconomic downturn have passed.

Which Sectors Show Promise?

With positive assessments of the market, Mr. Doan Minh Tuan believes that five sectors will demonstrate significant potential.

Firstly, real estate has many opportunities to break out due to the mid-term reversal in real estate trends, creating investment potential for enterprises with actual projects that can sell and absorb well in the next 6-9 months. Additionally, the industry will benefit from the completed real estate legal framework and the recovery of the real estate market. Investors should prioritize enterprises with plans to develop significant projects in the first half of 2025.

Secondly, banks will continue to benefit from sustained low-interest rates, assured and improved NIMs, and quick economic recovery, which will ensure controlled credit growth and non-performing loan risks.

Thirdly, livestock farming will also show potential due to persistently high domestic pork prices, ensuring sustainable profits in the second half of 2024. Moreover, the impending commercialization of the ASF vaccine and the readiness of vaccine exports in the latter half of Q4 will create opportunities for the livestock industry.

Fourthly, the textile industry is also expected to thrive in the coming months, benefiting from order shifts in the latter half of the year from Bangladesh and Myanmar. Revenue and profits are projected to peak in the latter half of 2024.

Fifthly, hydropower and renewable energy will benefit from La Nina, leading to improved revenue and profits.

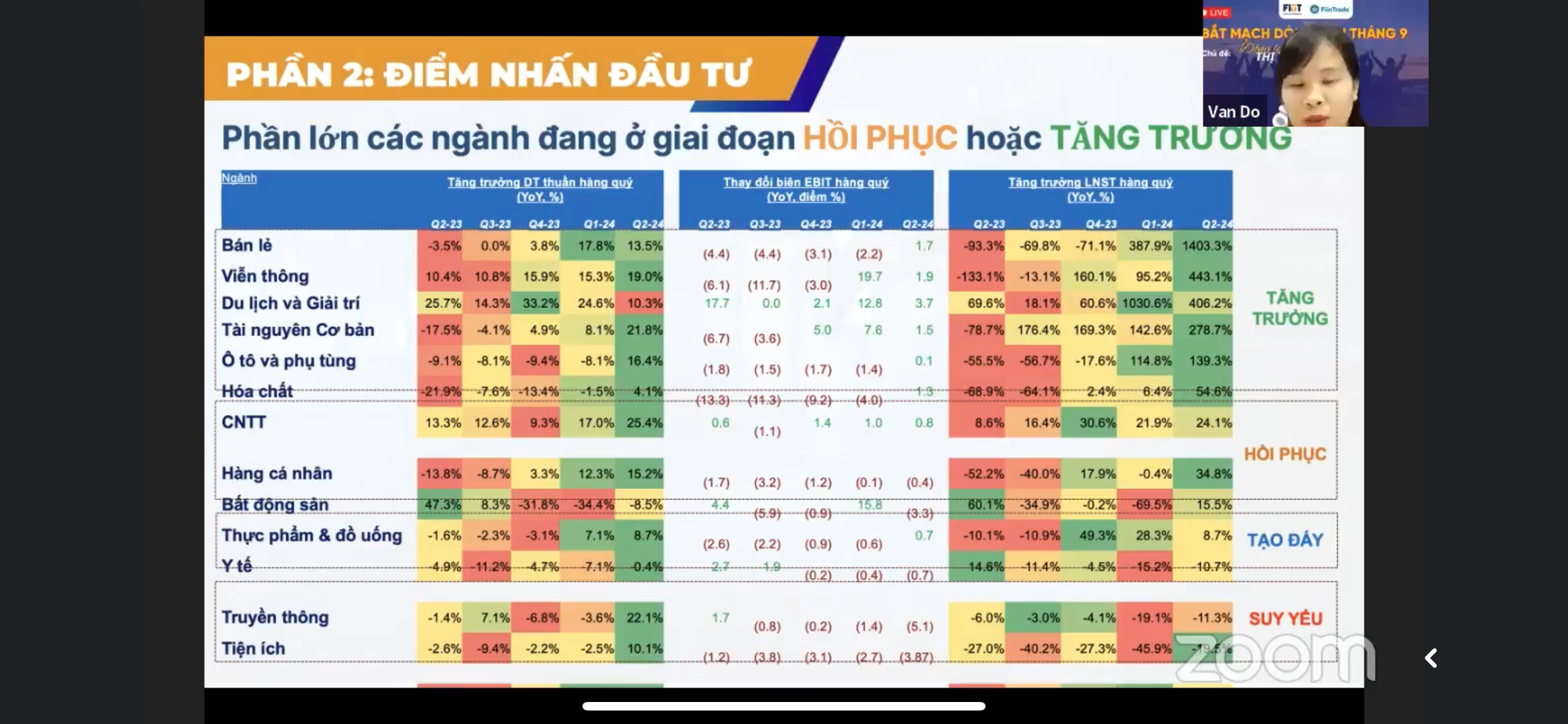

For her part, Ms. Do Hong Van, Head of FiinGroup’s Analysis Department, anticipates that stable domestic and global macroeconomic conditions and profit growth will be significant drivers for the market in the second half of the year.

While the momentum to surpass 1,300 remains, the FiinGroup expert believes that it is not enough for the market to break out strongly. This is because, excluding the banking group, the market’s valuation is no longer cheap, which will hinder the entry of large money flow. Moreover, the market lacks additional information with sufficient leading value to expect the VN-Index to make a strong breakthrough.

Investors should prioritize sectors that (1) are at the beginning of a profit recovery cycle or have strong growth prospects, (2) have attractive valuations or have been significantly discounted after the market adjustment, and (3) require cash flow improvement.

Based on these three factors, the FiinGroup expert believes that retail and exports will be the focus, with expectations for positive growth. Additionally, the securities group is expected to attract money flow after a period of stagnation.

What Stocks to Pick After the 2-9 Holiday?

The recent market volatility and corrections present a prime opportunity for savvy investors to snap up potential stocks for the year-end rally, according to securities firms. This post-holiday dip is a chance to get in on the ground floor and position yourself for success as the market bounces back.