As we return from the September 2nd National Day holiday, many investors are curious about the trajectory of the Vietnamese stock market. Additionally, with the Fed’s interest rate cut now clearly signaled, what impact will this have on Vietnam’s equities?

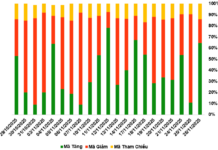

According to historical data, To Quoc Bao, Head of Market Strategy at PSI Securities Corporation, shared that the VN-Index has a relatively high probability of declining in the first trading week (5 sessions) following the September 2nd holiday.

Specifically, over the past 24 years, the VN-Index has only increased during the 5 trading sessions after the National Day holiday eight times, while it has decreased sixteen times. In the last 5 years, the market index has only increased once, in 2021, according to 5-session post-holiday data.

Given the current context of the Vietnamese stock market, the PSI expert predicts that the VN-Index is likely to face corrective pressure and experience volatility in the very first sessions following this September 2nd holiday. However, this is only a healthy adjustment phase for the market.

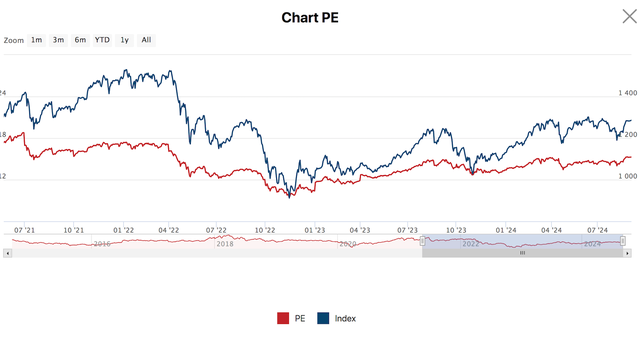

Prior to this, the Vietnamese stock market had a positive month as the VN-Index rebounded strongly, gaining about 100 points since its bottom (session on August 5th). With the relatively rapid recovery, many stocks also recorded an average increase of more than 10%. Therefore, the market will need technical adjustments to accumulate and test the buying power at a higher base price of the index.

Regarding the Fed’s move, it can be said that the expected interest rate cut by the Fed in the upcoming September FOMC meeting has been anticipated by many experts and investors alike.

As the Fed’s actions align with the expectations of stock market investors, the Vietnamese and global stock markets are unlikely to experience significant volatility in the short term, as these expectations have already been reflected in recent price movements.

However, in the long run, lowering interest rates will reduce exchange rate pressure on the VND, stabilizing the foreign exchange market and thus significantly reducing the risk of tightening monetary policy again. This also has a positive impact on the psychology of investors in the Vietnamese stock market. Moreover, lower interest rates can encourage investment in the stock market, attracting foreign investment back into Vietnam’s equities.

On another positive note, Vietnam’s stock market recently received good news from FTSE Russell, which announced that the annual 2024 market classification review will be published after the US market close on October 8th. Accordingly, the Vietnamese stock market is likely to be reclassified from a frontier market to a secondary emerging market. This will be well-received news for investors and the Vietnamese market.

VN-Index’s volatility presents an opportunity for investors to enter the market

For investors who missed the opportunity during the recent strong recovery, Mr. Bao stated that this is a good time to evaluate, identify potential stocks, and plan their investment strategies for the upcoming opportunities. The market has gone through a relatively long bullish phase without a proper break.

In the current context, short-term selling pressure is gradually increasing, and short-term speculative money tends to take profit partially. As a result, the Vietnamese stock market is likely to experience healthy volatility in the sessions ahead. “This presents an excellent opportunity for investors to deploy new purchases and restructure their existing portfolios in preparation for a new market cycle,” emphasized the PSI expert.

What Stocks to Pick After the 2-9 Holiday?

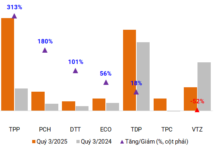

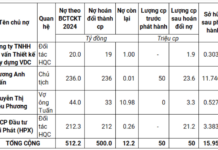

The recent market volatility and corrections present a prime opportunity for savvy investors to snap up potential stocks for the year-end rally, according to securities firms. This post-holiday dip is a chance to get in on the ground floor and position yourself for success as the market bounces back.