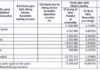

Notably, other income surged to VND 4,578.6 billion, compared to a loss of over VND 222 billion in the same period last year. As a result, net profit reached VND 5,401 billion (a decrease of VND 74 billion compared to the self-prepared report), while the company posted a loss of VND 1,386 billion in the previous year.

With the profit in the first half, Vietnam Airlines’ cumulative loss decreased to VND 35,907.6 billion, and negative equity stood at VND 11,633 billion.

According to Vietnam Airlines’ explanations, the consolidated business results for the first six months of 2024 showed a significant improvement compared to the same period last year, mainly due to profitable operations of the parent company and its subsidiaries. The company also recorded a substantial increase in other income due to debt forgiveness for its subsidiary, Pacific Airlines, as per the agreement for aircraft return.

Vietnam Airlines attributed the positive performance to the recovery of the transportation market and the company’s proactive implementation of a series of solutions, including flexible management of supply and transportation capacity, maximum cost reduction, and successful negotiation of service price reductions. These measures significantly improved production and business activities, especially in the first quarter of 2024, which is typically a peak season for the aviation industry. However, due to seasonal fluctuations, April and May are usually the lowest months for the domestic aviation market, resulting in less effective production and business outcomes compared to the first quarter.

As of the end of the second quarter, Vietnam Airlines’ total assets amounted to VND 57,732 billion, a slight decrease from VND 57,791 billion reported in the self-prepared financial statements.

Total liabilities stood at VND 69,364.4 billion, slightly higher than the self-prepared report’s figure of VND 69,324 billion. The company’s financial borrowings were over VND 23,355 billion, reflecting a reduction of approximately VND 3,500 billion compared to the beginning of the year.

In the audited semi-annual financial statements for 2024, KPMG, the auditing firm, highlighted that as of June 30, 2024, the company and its subsidiaries’ short-term debt exceeded short-term assets by VND 40,787 billion, with overdue payables amounting to VND 13,351 billion and negative equity of VND 11,633 billion.

Vietnam Airlines’ ability to continue operating will largely depend on obtaining extensions for debt repayments from commercial banks and credit institutions, as well as suppliers and lessors. It will also rely on the success of the restructuring plan currently under review and approval by the competent authorities.

KPMG highlighted that as of June 30, 2024, the company and its subsidiaries’ short-term debt exceeded short-term assets by VND 40,787 billion, with overdue payables of VND 13,351 billion and negative equity of VND 11,633 billion.

In the section on assumptions related to going concern, Vietnam Airlines stated that its Board of Directors and Executive Board regularly assess the impacts and implement countermeasures to address financial challenges to maintain continuity of operations.

Regarding operational management, the company has adjusted its aircraft fleet plan, flight schedules, and routes to align with market demand, peak seasons, and post-Covid-19 travel and tourism trends to optimize operating costs and maintain its domestic passenger market share.

In terms of working capital, Vietnam Airlines has been negotiating with commercial banks to obtain additional credit limits to support its production and business activities. As of June 30, 2024, the total credit limit signed with commercial banks was VND 29,800 billion. Additionally, the company has accessed a refinancing loan of VND 4,000 billion from banks according to Circular No. 04/2021/TT-NHNN dated April 5, 2021.

During this period, banks agreed to continue providing credit limits for short-term loans that the company had repaid on time and met the conditions and regulations. Vietnam Airlines is confident in maintaining the current credit limits in the following year and ensuring the repayment of maturing loan principals.

For long-term borrowings and finance leases, the company has successfully negotiated with some creditors to restructure the repayment schedule for maturing loans. Many partners have agreed to reduce prices (for aircraft leasing and maintenance) or extend and postpone payment schedules (for aircraft leasing, air traffic control services, and flight-related services).

Concerning the restructuring plan, Vietnam Airlines has completed its development and reported it to the relevant authorities. The plan is currently under review by the competent authorities, who are also addressing difficulties and considering approval. The plan encompasses three groups of synchronous solutions to overcome the current financial situation:

1. Improve air transport business performance by implementing comprehensive solutions to enhance adaptability, accelerate recovery, and efficiently utilize production capacity.

2. Restructure assets and divest capital from subsidiaries and associated companies to increase income and cash flow.

3. Prepare the necessary conditions to implement the plan to issue shares and increase owner’s equity after obtaining approval from the competent authorities.

Industrial Real Estate Group Profits Surge, One Major Player ‘Slumps’

In Q2 of 2024, and for the first half of the year overall, most industrial real estate businesses witnessed notable growth. However, the behemoth that is Kinh Bac stood out with a significant decline during this period.