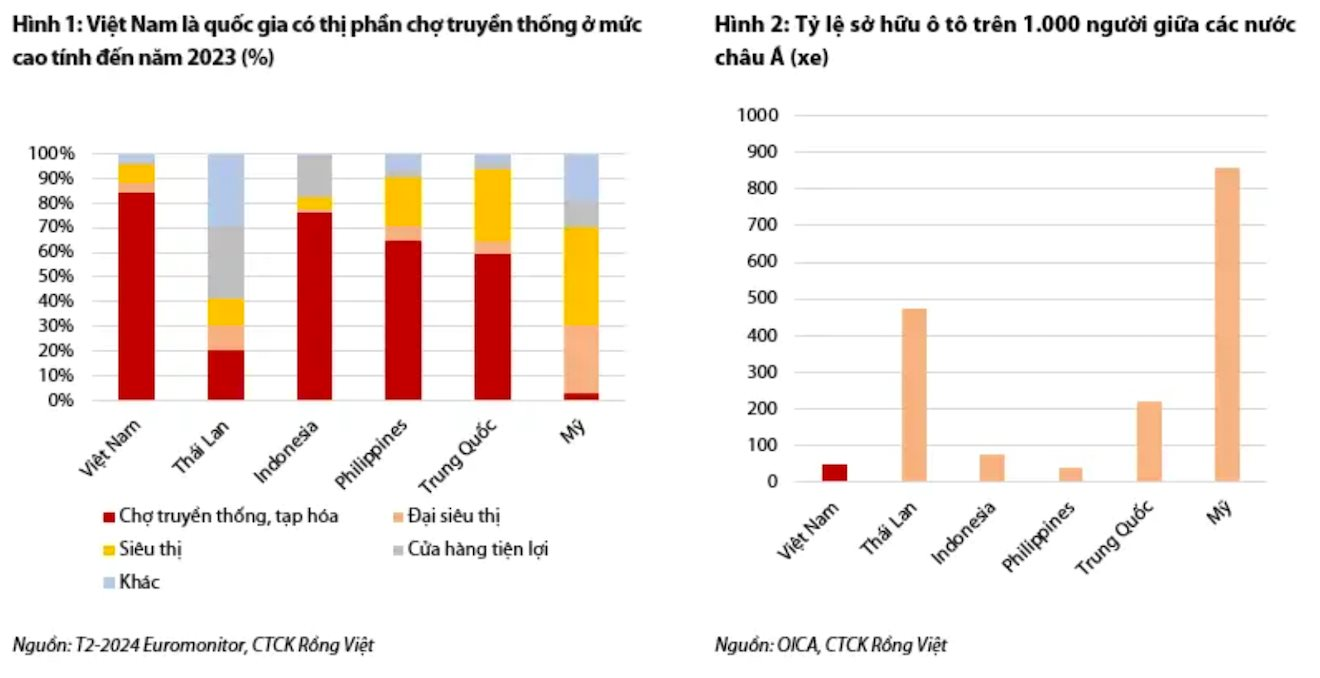

In its latest retail industry update, Rong Viet Securities (VDSC) noted that Vietnam’s transportation infrastructure is not yet conducive to a robust car market in the medium term. Instead, the predominant “motorcycle culture” will persist, favoring the proliferation of traditional markets, mom-and-pop stores, and mini-supermarkets like Bach Hoa Xanh and Winmart.

The hypermarket/shopping mall model is more prevalent in countries with well-developed transportation infrastructure and a car culture. In such nations, consumers primarily travel by car on unobstructed highways, easily finding parking and fulfilling all their shopping needs in one integrated location.

This reality also informs the expansion strategies of major retail chains in different countries. In car-centric cultures like the US, Thailand, and China, hypermarkets, and shopping malls (over 500 sq m) can afford to have fewer stores strategically located around highways.

In contrast, Vietnam’s pervasive motorcycle culture makes it more convenient for consumers to patronize traditional markets, small shops, and mini-supermarkets scattered along their routes.

Additionally, VDSC points out the challenges of finding suitable real estate for large-format retailers like hypermarkets and shopping malls in urban areas like Hanoi and Ho Chi Minh City due to limited land availability. Meanwhile, the unique shopping behaviors and strong traditional preferences of consumers in smaller provinces pose significant obstacles for these retailers.

With the motorcycle culture firmly in place, the two leading retailers, Bach Hoa Xanh and Winmart, have opted to establish mini-supermarkets (under 500 sq m) in far greater numbers to penetrate the market.

Mini-supermarkets shine amid swift shifts in consumer behavior

According to VDSC, both the traditional market & mom-and-pop store model and the mini-supermarket model exemplified by Bach Hoa Xanh and Winmart are well-positioned to maintain their market leadership in Vietnam.

However, mini-supermarkets have a particular advantage with the burgeoning young, affluent, and office-going population (Gen Y and Z), gradually supplanting the previous generation (Gen X). This demographic shift provides a solid basis for mini-supermarkets to gain market share rapidly in the coming years, starting from a modest base of ~7-8%.

Nonetheless, traditional markets retain their strengths in offering lower prices, a diverse range of products, fresh produce, and being long-standing consumer habits. Consequently, VDSC predicts that traditional markets will continue to dominate the market with a substantial 60-65% share in the medium term, albeit a decline from the current 85%.

“In summary, both Bach Hoa Xanh and Winmart are well-positioned to achieve high growth in the next 3-5 years, particularly after the successful restructuring strategies implemented by both chains,” the report emphasized.

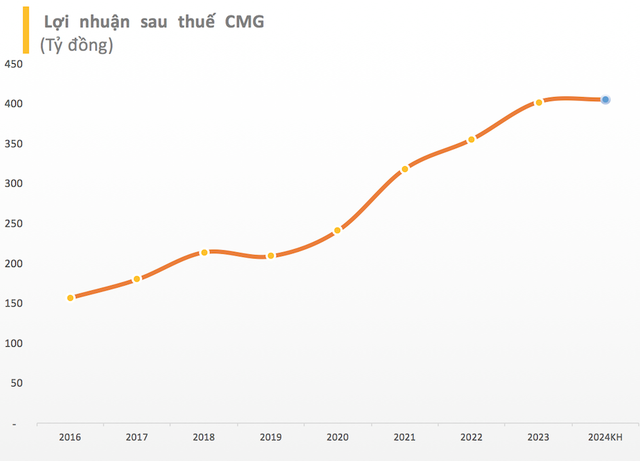

Improved financial performance

Indeed, Bach Hoa Xanh and Winmart have been posting impressive revenue and profit figures lately.

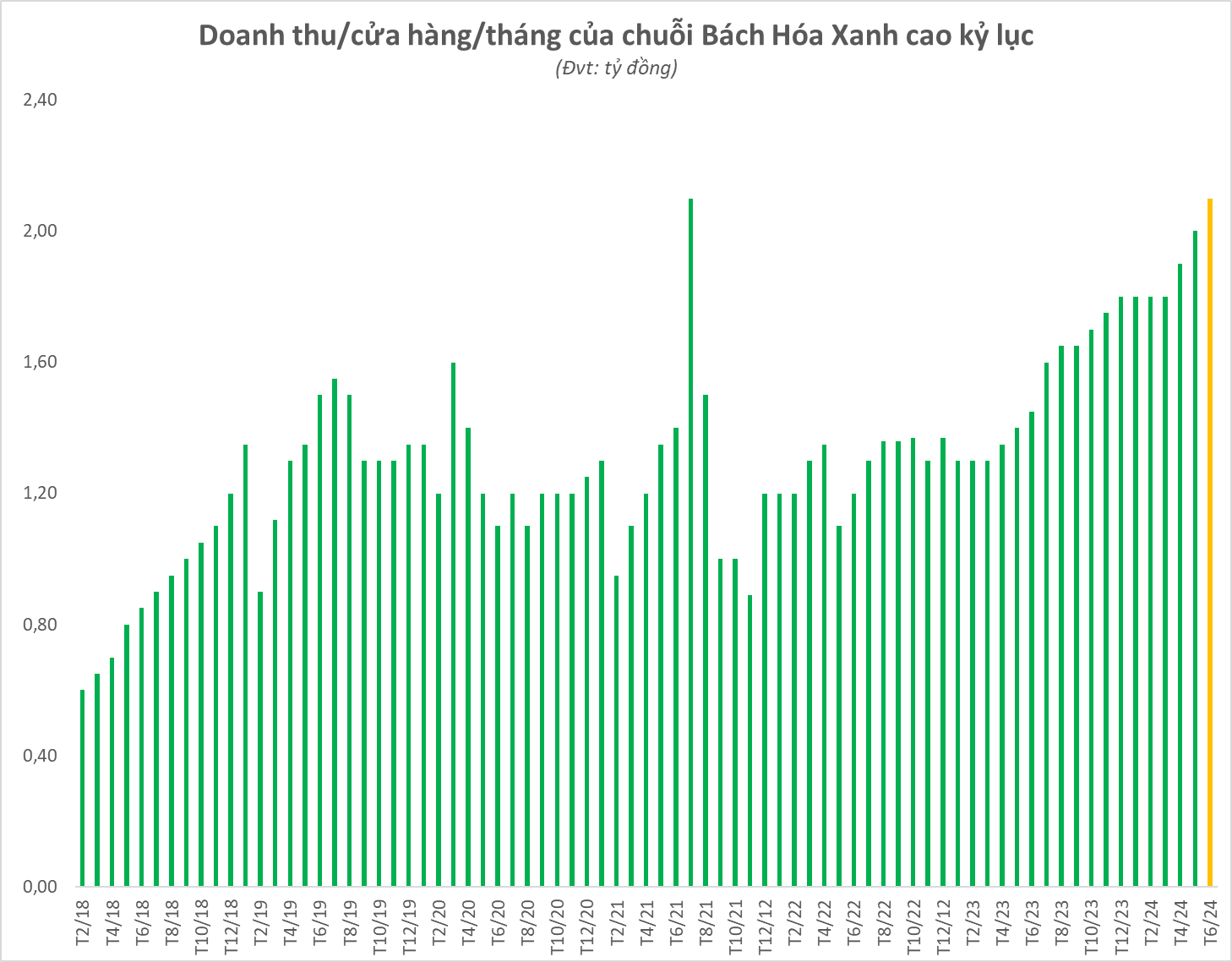

Bach Hoa Xanh stands out with its revenue for the first half of 2024 reaching VND 19,400 billion, a 42% increase over the same period last year and the highest ever since its inception. Notably, in Q2 2024, Bach Hoa Xanh’s revenue amounted to approximately VND 10,300 billion. Consequently, the supermarket chain turned a profit for the first time in Q2, earning nearly VND 7 billion.

Remarkably, the average revenue per Bach Hoa Xanh store hit a record high of VND 2.1 billion per store per month, except for July 2021, when revenue surged due to the COVID-19 pandemic.

As of the end of Q2 2024, Bach Hoa Xanh operated 1,701 stores, an increase of three stores compared to the beginning of the year. While the number of new openings is not significant, it is positive news as Bach Hoa Xanh’s scale has largely stagnated over the past two years.

Meanwhile, the WinMart chain turned profitable in June 2024, following a comprehensive reorganization of its stores and the continuous implementation of efficiency-enhancing measures. In Q2 2024, WinCommerce (the operator of WinMart/WinMart+/WiN stores) recorded a 9.2% year-over-year revenue growth, reaching VND 7,844 billion across its network.

As of June 2024, WCM managed 3,673 sales points, opening 40 new stores since December 2023. WCM aims to accelerate its store opening pace in the second half of 2024 to reach its target of 4,000 stores nationwide by the end of this year.

Masan has set a revenue target of VND 60,000 billion for the WinMart system by 2028, with a profit margin of around 3-5%, based on approximately 8,000 stores/supermarkets. This translates to an average growth rate of 15% over five years, compared to 2023 revenue of about VND 30,000 billion.

Revolutionizing Rail: A Holiday Boon for Vietnam’s Railways

On the afternoon of September 3, the Danang City Tourism Department announced that the number of visitors arriving by train had reached approximately 10,600, a significant increase of over 42% compared to the same period last year. Notably, there was a substantial rise in the number of passengers traveling by train from neighboring localities.