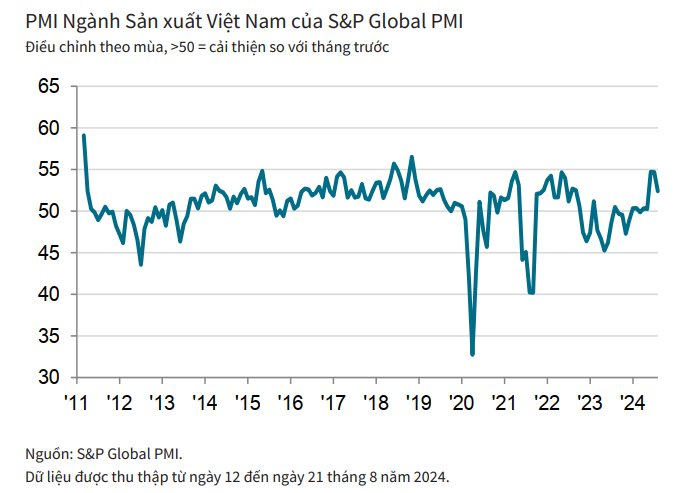

Vietnam’s manufacturing sector posted a PMI score of 52.4 in August, a slight dip from July’s 54.7, which was the highest since November 2018. Despite the month-on-month decline, S&P Global’s report assesses that business conditions still showed robust improvement midway through Q3.

This improvement in the health of the manufacturing sector was evident in the continued high levels of output and new orders. Specifically, new export orders increased for the fifth consecutive month.

The report states that improved customer demand drove up new orders, prompting companies to ramp up production accordingly. In some cases, relatively stable pricing helped companies secure new orders. Additionally, improved international demand also contributed to the growth in order volumes during the month.

This relative stability in pricing is also reflected in the input cost and output price data. Although both continued to rise, the rate of increase slowed considerably from July, with the weakest increase in four months.

While some manufacturers reported higher raw material prices, the rate of inflation eased amid competitive pressures. Meanwhile, some instances of falling oil prices also contributed to lower transportation costs.

The sharp rise in new orders and easing cost pressures led manufacturers to substantially increase their purchasing activity in August. Moreover, the rate of increase was faster than in the previous four months, the quickest since May 2022.

As the input goods are typically used directly in production, this suggests that stocks of purchases continued to decrease. Additionally, stocks of finished goods also declined as completed products were shipped to customers to fulfill orders.

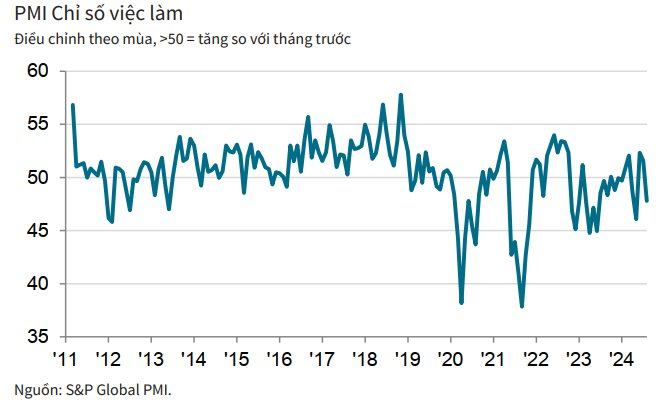

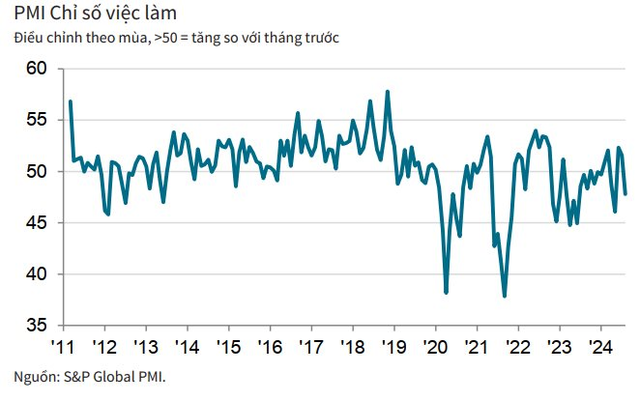

In contrast to the growth in purchasing activity, manufacturers reduced employment for the first time in three months, with some instances of voluntary departures and the non-renewal of temporary contracts.

Andrew Harker, Economics Director at S&P Global Market Intelligence, noted that the reduction in staffing levels made it more challenging to complete projects, leading to a rise in backlogs.

The decrease in the workforce, coupled with rising new orders, resulted in a further increase in backlogs of work in August. This marked the third consecutive month of rising backlogs, with the rate of increase unchanged from July.

“We would hope to see employment start to rise again in the coming months,” said Andrew Harker.

Suppliers’ delivery times shortened for the third month in a row, although the degree of improvement was marginal, with some reports of delays in international shipping.

Regarding business sentiment, manufacturers remained optimistic about future output, anticipating improved customer demand and expecting new orders to increase. However, business confidence eased for the second month, albeit at the weakest pace since January.

Commenting on Vietnam’s manufacturing sector in August, Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“As expected, Vietnam’s manufacturing production and new orders grew at slower rates than the exceptional highs seen in June and July. Such rates of increase are always difficult to maintain, and the fact that growth remained strong means there are few reasons to be concerned on this front.”

The positive aspect, he added, was related to inflation, as both input costs and output price inflation softened considerably in August. This, in fact, was a contributing factor to the sustained rise in new orders.

“Overall, the manufacturing sector is on a good growth path so far in the second half of the year, with plenty to play for in the coming months,” concluded the Economics Director at S&P Global Market Intelligence.

PMI Remains Positive in Vietnam: International Experts Foresee a Promising Growth Spurt for the Country’s Manufacturing Sector

According to S&P Global, Vietnam’s manufacturing sector maintained its solid growth trajectory in July, following an impressive performance in June. The surge in new orders prompted producers to ramp up their production levels, with the rate of expansion accelerating to near-record highs. Meanwhile, input costs and output charges continued to rise significantly, although inflation eased slightly compared to the previous month.

June 2024 PMI: Orders Surge to Highest Level Since March 2011

The S&P Global Vietnam Manufacturing Purchasing Managers’ Index (PMI) surged to 54.7 in June, up from 50.3 in May. This remarkable rise not only indicates a third consecutive month of improving health in the manufacturing sector but also points towards a significant strengthening of business conditions.