Meet Howard Marks – the billionaire investor and founder of Oaktree Capital Management, an investment firm managing over $190 billion in assets as of June 2024.

|

The abrupt dip in global stock prices in August, followed by a swift rebound, prompted legendary investor Howard Marks to share his perspective with the investment community. However, instead of delving into in-depth analyses, he chose to approach a seemingly simpler topic: mental discipline.

Howard Marks is one of the most renowned and influential investors in the financial realm. He is the co-founder and chairman of Oaktree Capital Management, a leading global investment firm, particularly known for its expertise in illiquid and distressed assets.

Marks stands out not only for his investment success but also for his writing prowess and knowledge dissemination. His letters to the investment community, often referred to as “memos,” have become invaluable resources closely followed by industry peers.

In his latest memo, Howard Marks dissects the psychological underpinnings of market behaviors during the volatile period in early August 2024.

He highlights three primary factors that led to the market turmoil: First, a rush away from carry-trade positions; second, US economic data, particularly signs of weakness in the labor market, sparking concerns about a potential recession in the world’s largest economy; and finally, the shocking news that Warren Buffett’s Berkshire Hathaway had sold a substantial amount of Apple stock.

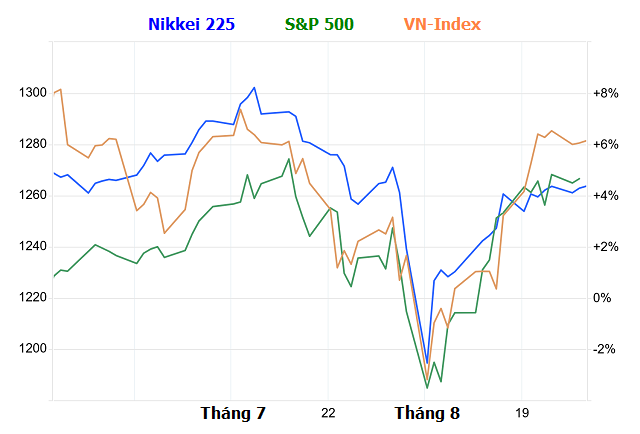

“This triple whammy of news” – as he puts it, sent a wave of pessimism through the markets, triggering a rush away from equities and causing the S&P 500 (US) to drop by 6.1% in just the first three trading days of August.

If the underlying reality didn’t change much, why did valuations (as reflected in stock prices) fluctuate so dramatically? Marks explains that the main culprit lies in the shifts of human psychology.

According to Marks, things in the real world tend to fluctuate between neutral states like ‘fairly good’ or ‘not too hot,’ but in investing, human perception oscillates between ‘extreme optimism’ and ‘deep despair.’ This, he argues, is the key driver of volatility, rather than any actual changes in economic value.

In prosperous times, investors tend to focus on positive information and overlook contrary signs, or they interpret everything with a positive bias. However, when psychology shifts, their behavior reverses abruptly and powerfully.

If stock prices were solely the result of a rational and objective weighing process, then negative information would cause prices to dip slightly and continue to decline gradually with further bad news. But in reality, when markets are exuberant, they tend to ignore negative information until the buildup of bad news reaches a breaking point. “That’s when the optimists surrender and the rush to the exits begins,” Marks notes.

An interesting insight from Marks is that “during crises, everything correlates.”

When there’s any trouble in the US stock market, European investors may see it as a sign of a serious problem and start selling off. Then, investors in Asia sense something amiss and join the selling spree overnight, US time. When US investors wake up the next morning and are spooked by the moves in Asian markets, it reinforces their pessimism, leading to further selling.

Like a game of Chinese whispers, the message gets distorted, but it encourages all players in the chain to act without solid grounds.

This contagion of psychology also played out in Vietnam’s stock market during the trading session on August 5, when the VN-Index plunged by 48.6 points. On that fiery Monday, few investors would have asserted that the sell orders were placed due to an analysis showing a significant decline in enterprise value overnight.

It only took a short while for the global stock markets to recover, and participants in the Vietnamese market regained their composure and started buying again. The VN-Index has now climbed back to the high-point region of the year.

|

Correlation in Crises

Stock markets with different fundamentals exhibited significant correlation during the July-August 2024 turmoil Source: tradingeconomics.com

|

According to Marks, stock markets are often influenced by the behavior of the most fickle investors – those easily swayed by stock price movements. They tend to buy out of fear of missing out during bullish periods and then panic-sell when prices suddenly drop.

Compared to the total number of shareholders in a company, only a small fraction actively trades during both market highs and lows. The enterprise value fluctuates with each transaction, but it doesn’t mean the entire business is being handed over. Only a small group of emotional investors drive the extreme volatility in a company’s stock price with their transactions.

The worst mistake an investor can make is to let themselves be influenced by the irrational actions of others.

The Flow of Capital: Is the Biggest Headache Over?

The Vietnamese stock market endured a tumultuous week, reeling from significant disruptions in global asset markets. The 3.92% plunge on August 5th marked the most substantial fluctuation in 2024, second only to the 4.7% drop on April 15th. Interestingly, the catalysts for these dramatic shifts did not stem from intrinsic factors.