Vietnam’s stock market experienced volatility in the first session after the holiday break, with the index closing 8.07 points lower at 1,275. Trading volume remained low, with a value of over VND 15,700 billion on HOSE. Foreign investors were net sellers, offloading nearly VND 794 billion across all markets.

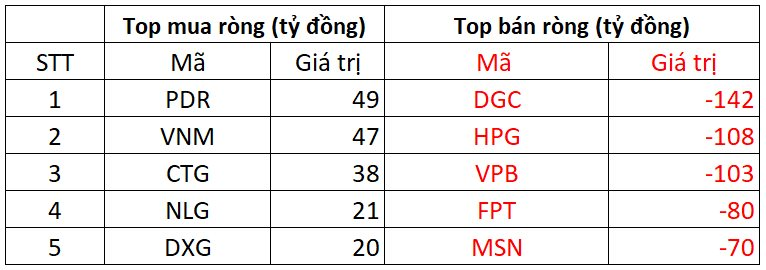

On HOSE, foreign investors sold a net of VND 775 billion.

In terms of purchases, PDR was the most bought stock by foreign investors on HOSE, with a value of over VND 49 billion. This was followed by VNM and CTG, which were accumulated at VND 47 billion and VND 38 billion, respectively. NLG and DXG were also bought for VND 21 billion and VND 20 billion, respectively.

On the other hand, DGC faced the strongest selling pressure from foreign investors, offloading nearly VND 142 billion. HPG and VPB also witnessed net selling of VND 108 billion and VND 103 billion, respectively.

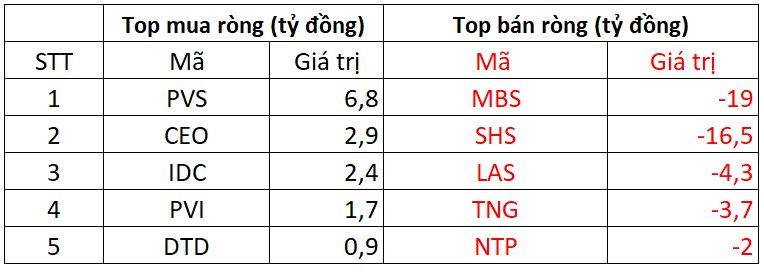

On HNX, foreign investors sold a net of VND 29 billion

In terms of purchases on HNX, PVS was the most bought stock by foreign investors, with a net value of VND 7 billion. CEO followed closely with a net purchase of VND 3 billion. Foreign investors also spent a few billion dong each to accumulate IDC, PVI, and DTD.

On the selling side, MBS faced the highest net selling pressure from foreign investors, with a value of nearly VND 19 billion. SHS, LAS, and TNG also witnessed net selling of a few billion dong each.

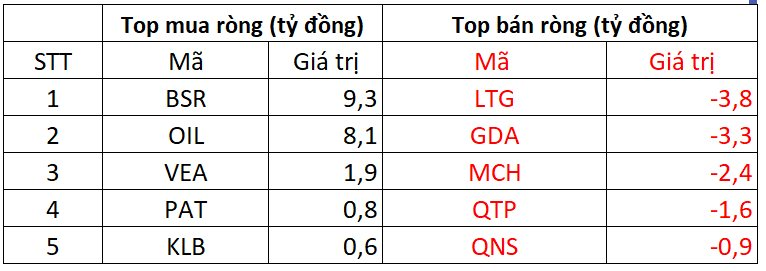

On UPCOM, foreign investors bought a net of VND 10 billion

Conversely, LTG faced net selling pressure from foreign investors, with a net sell-off of VND 4 billion. Foreign investors also net sold GDA, MCH, and other stocks…

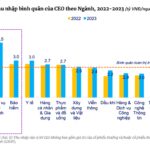

Unveiling the “Massive” Income of Chairpersons and CEOs in the Banking and Real Estate Sectors

The average income of a CEO in the real estate, securities, and insurance industries is an impressive 2.5 billion VND per year. This figure showcases the potential earnings of those at the top of these lucrative sectors. It is a testament to the rewards that come with leadership and expertise in these fields.

The Stock Market Investors’ “Shock” Post-Holiday

The sharp decline in the morning session of September 4th can be attributed to a spillover effect from the US stock market and the broader global market downturn.