On September 16, Digiworld Joint Stock Company (stock code: DGW) will finalize its list of shareholders to carry out a 2023 dividend payout. The total ratio stands at 35%, comprising a 5% cash dividend (equivalent to VND 500 per share) and a 30% stock dividend (equivalent to 30 new shares for every 100 shares owned). DGW is expected to commence cash dividend payments from September 25, 2024.

With over 167 million shares in circulation, DGW will disburse approximately VND 84 billion in cash dividends to its shareholders while issuing an additional 50 million shares, thus increasing its charter capital to nearly VND 2,200 billion.

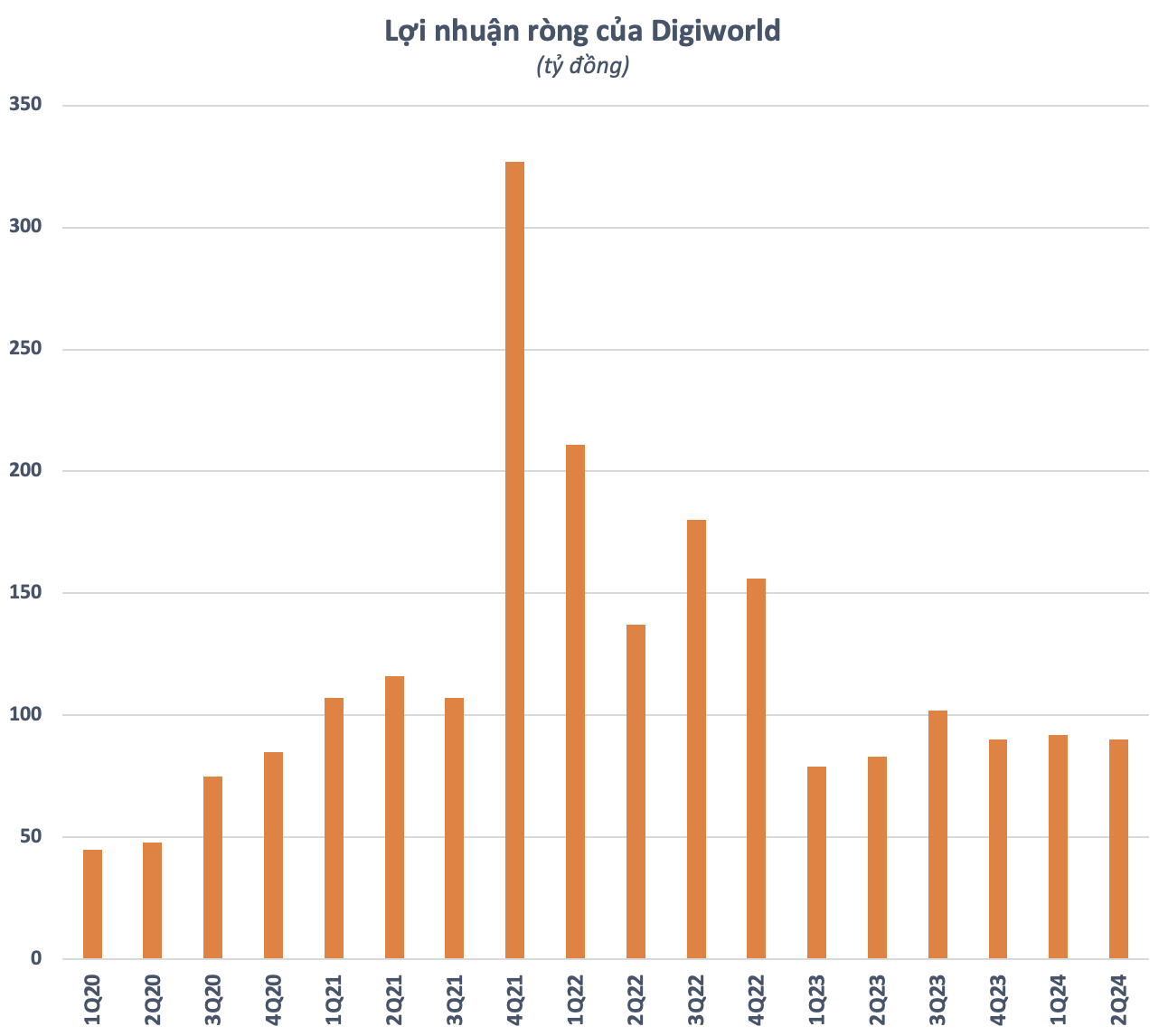

In terms of business performance, the company recorded a second-quarter revenue of VND 5,008 billion and a net profit of VND 89 billion in 2024, marking a 9% increase compared to the same period last year. For the first half of 2024, DGW’s revenue climbed 17% to VND 9,993 billion, while its net profit reached VND 182 billion, up 12% year-on-year, and accomplishing 37% of the full-year profit target.

According to a recent report by DSC Securities, the ICT sector is anticipated to witness a more evident recovery in 2024, particularly during the second half, attributable to: (1) the product replacement cycle, which typically occurs after 2.5-3 years (with the ICT segment’s record revenue taking place in Q4 2021), (2) the launch of new-generation tech products, and (3) the back-to-school season, which tends to stimulate demand for electronic devices.

One of Digiworld’s most notable M&A deals in the recent past was its acquisition of a 75% stake in Achison, a company specializing in providing industrial equipment and personal protective equipment (PPE). The industrial equipment and PPE sectors are currently considered highly promising, given Vietnam’s appeal as a preferred destination for FDI capital inflows.

DSC expresses optimism that with its strategy to expand its PPE portfolio, Achison can continue to capture a larger market share, thereby contributing more significantly to Digiworld’s revenue structure. Additionally, in the first quarter of 2024, Digiworld announced the acquisition of the Vietmoney chain, aiming to tap into the potential of secondhand products and stimulate customer spending.

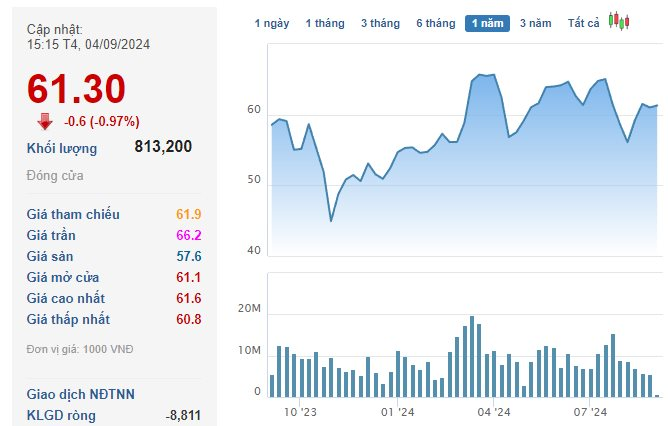

In the stock market, DGW shares closed at VND 61,300 per share on September 4.

When Will the Vietnamese IB Market Bounce Back?

The Vietnamese IB market was once likened to a land of opportunity, but it has become stagnant in recent years due to various reasons. However, according to Mr. Nguyen Van Quang, Head of Investment Banking at NH Vietnam Securities Company (NHSV), it remains a market with strong long-term potential and could bounce back to life if Vietnam’s stock market is successfully upgraded.

The Electric Car Distributor’s Plight: A Record Loss in Vietnam

“Wuling’s Mini EV is now in Vietnam, distributed by TMT Motor. However, the company has hit a rough patch in the first half of 2024, with losses amounting to nearly 100 billion VND. With short-term debts exceeding short-term assets by 120.7 billion VND, the auditing firm has expressed doubts about TMT Motor’s ability to continue operating.”