On September 3, 2024, HDBank, or the Ho Chi Minh City Development Joint Stock Commercial Bank (HOSE: HDB), was recognized as the ‘Leading Partner Bank in Vietnam’ by the Asian Development Bank (ADB) through its Trade and Supply Chain Finance Program (TSCFP). This recognition was based on HDBank’s superior performance in promoting trade finance and supporting sustainable development for Vietnamese enterprises.

HDBank has demonstrated its exceptional capabilities by being one of the partner banks with the highest financing limits granted by ADB in Vietnam. In August 20204, ADB increased HDBank’s trade finance limit from 145 million USD to 200 million USD for guarantee, trade finance, and revolving credit loan activities. This achievement showcases ADB’s high regard for HDBank’s risk management, transparency, and efficiency during their collaboration, providing new momentum for the bank to further extend its support to import-export businesses and value chains.

As part of its strategic cooperation with ADB, HDBank focuses not only on trade finance but also on initiatives related to Environment, Social, and Governance (ESG) factors. With ADB’s support and the partnership of other development finance institutions, HDBank has accomplished significant milestones in critical technical projects, enhancing its capacity for sustainable development:

- Green and Sustainable Credit: HDBank is participating in a technical advisory project to develop a green/sustainable credit portfolio with funding from ADB.

- Inclusive Economic Development for People with Disabilities: HDBank is the only bank in Vietnam involved in the second phase of this ADB-led project.

Additionally, HDBank successfully concluded the ADB Climate Tagging Project in July 2024, which improved the classification of trade finance transactions with a positive climate impact.

As of Q2 2024, HDBank’s total assets reached VND 624,443 billion, reflecting a 3.7% growth rate compared to the beginning of the year. Customer loan balances increased significantly by 12.5%, reaching VND 386,186 billion, while customer deposits grew by 4.3%, amounting to VND 386,573 billion. In the first half of 2024, HDBank achieved a pre-tax profit of VND 8,165 billion, representing a remarkable 48.9% increase compared to the same period last year, along with enhanced capital safety and operational efficiency.

In 2024, HDBank became the first bank in Vietnam to publish a sustainability report, committing to becoming a net-zero emission bank by 2050.

“With the strong support from ADB and other international partners, HDBank is committed to further advancing its green and sustainable development strategy, especially in areas such as renewable energy and efficient resource management,” said Mr. Tran Hoai Nam, HDBank’s Deputy CEO. “We aim to continue contributing positively to the promotion of a green economy in Vietnam, enhancing the competitiveness of businesses, and creating sustainable value for the community.”

The Ultimate Guide to HDBank’s Interest Rates: Maximize Your Savings with Online Deposits

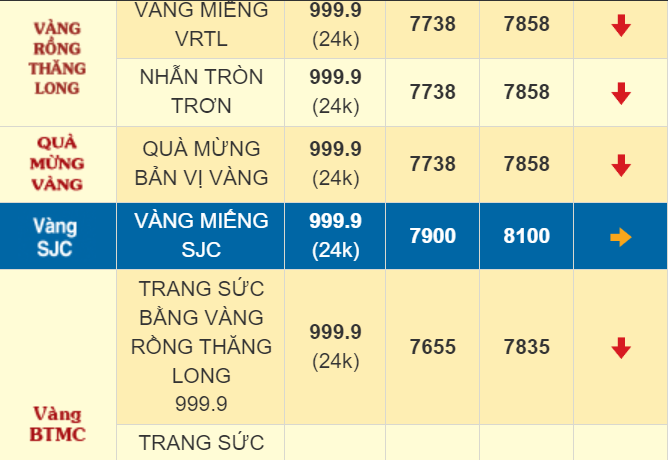

In early September, HDBank offered an attractive interest rate bracket for individual customers, ranging from 0.5% to 8.1% per annum. The peak interest rate for regular savings accounts was set at 6.1% per annum, while deposits of 500 billion VND and above were eligible for an impressive maximum rate of 8.1% per annum.

The Green Evolution: Unveiling Sacombank’s ESG Strategy

Sacombank’s leadership has shared their vision for the bank’s future. Alongside their short-term goal of completing the restructuring plan and regaining their position as a top player in the market by 2025, they have their sights set on long-term sustainable development following the ESG model.

The Retail Giant: Generating $170 Million in Annual Tax Revenue

Masan Group is proud to be one of the largest taxpayers in the provinces where its factories operate, but its contribution to the community goes beyond that. The company provides employment opportunities for thousands of people, improving their livelihoods and positively impacting their lives. Additionally, Masan Group is committed to community development, allocating a portion of its profits to initiatives that make a lasting difference in the areas it serves.