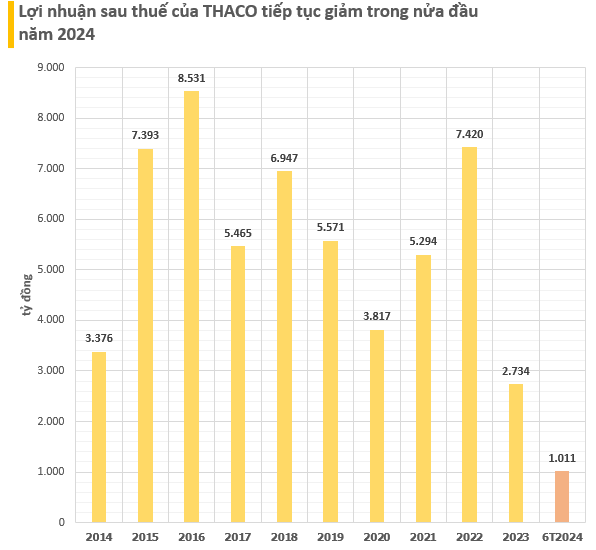

Truong Hai Auto Corporation (THACO) has released its financial report for the first half of 2024, revealing a net profit of 1,011 billion VND, a 6% decrease compared to the same period last year. As of June 30, equity capital stood at 54,260 billion VND, an increase of 8.3% from a year earlier and 3.6% higher than at the end of 2023.

THACO’s financial report reveals a net profit decrease for the first half of 2024.

The debt-to-equity ratio rose to 2.45, indicating approximately 133,000 billion VND in debt. Additionally, the bond debt-to-equity ratio increased to 0.26, reflecting bond debt of around 14,100 billion VND.

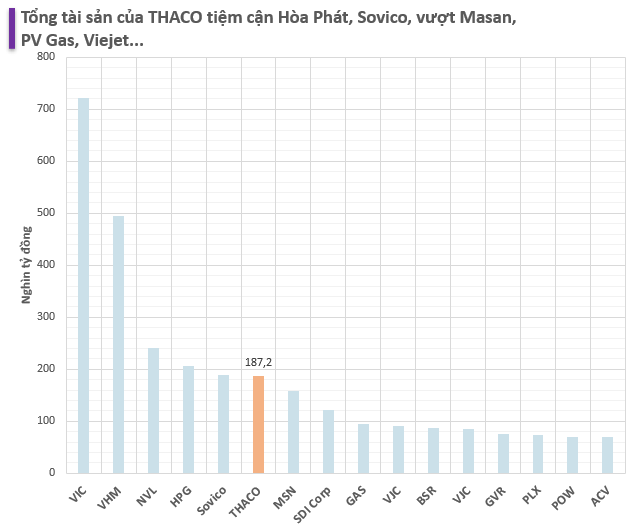

As a result, THACO’s total assets amount to over 187,200 billion VND (approximately 7.4 billion USD). This figure rivals that of Hoa Phat (206,000 billion VND) and Sovico Group (188,200 billion VND), surpassing giants such as VinFast, Masan Group, PV Gas, and BSR.

THACO’s total assets surpass those of VinFast, Masan Group, and others.

Earlier this year, during a tax assessment meeting for the first quarter in Quang Nam province, the Quang Nam Tax Department expressed concern about Truong Hai, owned by billionaire Tran Ba Duong.

According to the department, Truong Hai Group is a significant contributor, accounting for over 60% of Quang Nam’s domestic revenue. However, the first three months of 2024 showed a significant decline. In January, Thaco paid 1,663.5 billion VND in taxes, followed by 609 billion VND in February and 465.5 billion VND in March.

“This is a matter of great concern. If this situation persists, it will significantly impact the province’s total revenue”, noted the Quang Nam Tax Department.

It is worth noting that Thaco aims to contribute 24,500 billion VND in taxes for 2024. This year marks the second year of Thaco’s restructuring from an automobile manufacturing and assembly group investing in various industries to a parent group that solely manages capital and investments. Thaco now comprises six member groups operating in different fields with large-scale production and business activities.

Thaco Auto targets the sale of 95,400 vehicles of various types this year, including 76,200 passenger cars and 19,200 trucks and buses, capturing 38% of the domestic market share. They also plan to export more than 1,600 vehicles, with a consolidated revenue of 68,400 billion VND. The total investment for this group is over 2,100 billion VND.

Thaco Industries aims for a consolidated revenue of 13,000 billion VND in 2024, including an export revenue of 250 million USD. Their total investment is 2,100 billion VND.

Thaco Agri plans for a consolidated revenue of 6,600 billion VND, with an export revenue of 190 million USD. Their total investment stands at 5,800 billion VND.

Thadico (Dai Quang Minh) expects a total investment of 3,085 billion VND for 2024.

Thiso forecasts a consolidated revenue of 5,880 billion VND for the year, with a total investment of 9,469 billion VND.

Thilogi aims for a total consolidated revenue of 3,800 billion VND in 2024 (with 40% coming from external business activities) and nearly 1,000 billion VND in total investment.

The Rise of a Real Estate Giant: Unveiling the Mystery Behind the Soaring Success and the Enigmatic 100,000 Billion Dong Portfolio.

The real estate company boasts an impressive profit of over 4,400 billion VND in the first half of the year, ending a long streak of consecutive years of losses.