ABBank has just announced its new savings interest rates, effective today, September 4. The bank has significantly reduced its savings interest rates for select tenures.

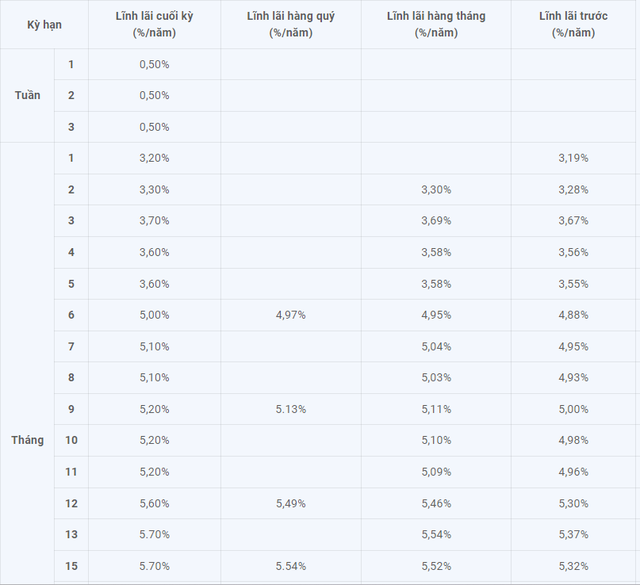

Specifically, the interest rate for the 3-month tenure has decreased by 0.3% per year to 3.7% per year. The interest rates for the 7-8 month tenure have also been lowered by 0.1% per year, now standing at 5.1% per year.

For the 12-month tenure, the interest rate has been reduced by 0.4% per year to 5.6% per year. Compared to July, the bank has decreased its interest rate by 0.6% per year, from a market-leading high of 6.2% per year to the current 5.6% per year.

ABBank has maintained the interest rates for other tenures. The 1-2 month tenure offers rates of 3.2%-3.3% per year, while the 4-5 month tenure stands at 3.6% per year. The 6-month tenure has an interest rate of 5% per year, and the 9-11 month tenure remains at 5.2% per year.

The highest interest rate is offered for the 13-60 month tenures, at 5.7% per year.

ABBank’s latest online savings interest rate table.

Following two consecutive interest rate reductions, ABBank’s deposit rates have decreased by 0.3-0.6% per year over the past two months.

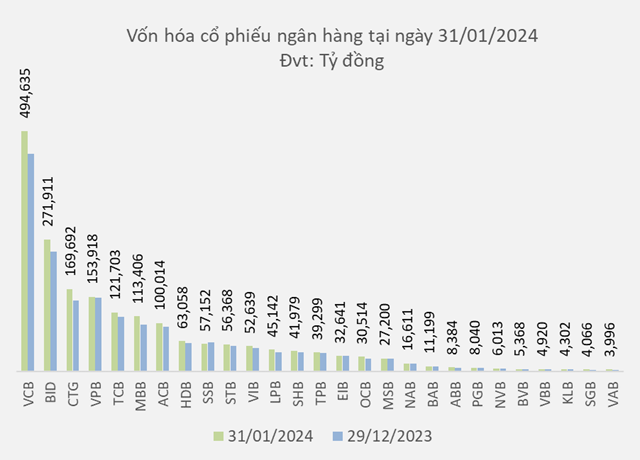

With these adjustments, ABBank is no longer among the banks offering savings interest rates of 6% per year or higher for regular deposits. Currently, the banks offering rates of 6-6.1% per year for long-term tenures include OceanBank, NCB, SHB, BVBank, BaoViet Bank, HDBank, Saigonbank, and Cake by VPBank.

Latest Sacombank Interest Rates for August 2024: Online Deposits for 24 Months Offer Competitive Rates, with New Loans Averaging at 7.58%/year

Introducing Sacombank’s exclusive online offer for personal depositors! Maximize your savings with our market-leading interest rates when you deposit with us for 24 months or more. Borrow with confidence, as our competitive average lending rate for new loans stands at 7.58% per annum.