A new wave of Vietnamese tea and coffee brands, including Phê La, Phúc Long, Katinat, Oola, and La Si Mi, are taking the market by storm, outshining once-popular foreign chains and captivating young consumers, despite prices ranging from 50,000 to 60,000 VND per cup.

The Rise of Vietnamese Bubble Tea Brands

Recent F&B market reports concur that the bubble tea market is becoming saturated. It’s evident that the long queues and hype surrounding certain foreign bubble tea brands are fading. However, this doesn’t signify a decline in the market but rather a shift in consumer trends.

Phê La is a pioneer in the trend of strong-flavored bubble tea made from specialty tea. The brand has dedicated spaces serving limited editions of pure tea and manually brewed coffee. (Photo: H.Linh)

Over the past year, the overly sweet and creamy flavors characteristic of foreign brands have fallen out of favor. A new trend is emerging, with consumers gravitating towards stronger-flavored tea that is less sweet and milky. The key appeal lies in the robust and slightly astringent taste of the tea base, which is skillfully prepared to bring out the unique aroma of each tea variety without being overly bitter. This trend has played into the hands of Phúc Long, renowned for its tea-based bubble tea.

Katinat has also experienced a resurgence, along with the emergence and rapid growth of new brands like Phê La, Oola, and La Si Mi. These newcomers share a common vision of promoting specialty teas from renowned Vietnamese tea-growing regions like Bảo Lộc and Thái Nguyên.

Although a late entrant, Phê La has successfully attracted customers with its bold statement, “We sell specialty Ô Long from Đà Lạt,” and its compelling brand story centered on a journey to discover the “original intense flavor” and a mission to “awaken the distinctive notes of Vietnamese agricultural specialties.”

Phê La has successfully established itself by exclusively offering tea from Đà Lạt. The trend towards stronger-flavored bubble tea can be traced back to Phê La’s entry into the market, especially after COVID-19. In the four years since its launch, Phê La has expanded to 31 stores (as of early September 2024). Many of their stores feature dedicated spaces serving limited editions of pure tea and manually brewed coffee. According to Vietdata’s report, Phê La generated nearly VND 300 billion in revenue and approximately VND 57 billion in profit in 2023.

Katinat has also made a strong comeback with its signature product—bubble tea made from strong-flavored tea brewed from Ô long tea buds grown in the highland region of Mộc Châu. Their menu boasts an array of distinctive tea-based drinks, such as Ô long tứ quý sữa, Trà B’lao sữa, and Trà ô long nướng sữa.

This Vietnamese bubble tea brand, which has been in the market for six years, was featured on the LED screen of the Nasdaq Tower in Times Square, New York, in November 2023. (Photo: MayCha)

Oola, a newcomer to Ho Chi Minh City, has also made a grand entrance with multiple stores in Districts 1 and 3, attracting many customers eager to try their specialty Ô Long bubble tea from Bảo Lộc. They, too, claim to be pioneers in developing strong-flavored Ô Long tea drinks in Vietnam.

Another brand making waves in the strong-flavored tea trend is La Si Mi, which uses fresh tea leaves from Lâm Đồng, particularly Ô long, to create distinctive and flavorful bubble tea. La Si Mi has rapidly expanded to 37 stores, with the majority in Ho Chi Minh City and key tourist destinations from Đà Nẵng to the South, along with four outlets in Hanoi.

MayCha, with its affordable prices catering to students and office workers, has also experienced significant growth, now boasting 80 non-franchised stores after six years in the market. At the Vietnam F&B Summit 2024 in Ho Chi Minh City, founder Phùng Anh Thế shared that one of their stores sold 3,000-4,000 cups of bubble tea per day. The MayCha chain, with its 80 stores, generates annual revenue of over VND 550 billion with a staff of 1,700 employees.

In November 2023, MayCha was featured on the LED screen of the Nasdaq Tower in Times Square, New York, as part of a GrabFood campaign to honor their restaurant partners in Southeast Asia.

The Fate of Once-Popular Bubble Tea Brands

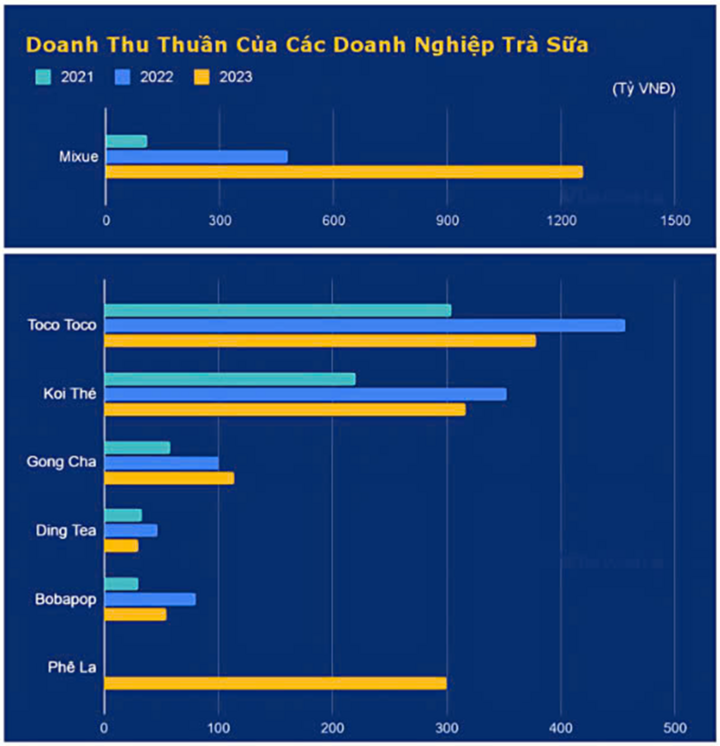

According to Vietdata’s market report on bubble tea chains, several well-known brands experienced a decline in performance in 2023 due to reduced consumer spending and heightened competition. Notable examples include Gong Cha, Toco Toco, Dingtea, Koi Thé, and Bobapop, all of which saw significant drops in revenue and profit compared to 2022.

Koi Thé, positioned in the premium segment, has also faced challenges, with a profit of only about VND 23 billion in 2023. (Photo: H. Linh)

Vietdata’s data reveals that Toco Toco, the first Vietnamese bubble tea brand, experienced a 17% decline in revenue in 2023, amounting to a loss of approximately VND 77.5 billion. Notably, the chain has incurred net losses for three consecutive years, with the highest loss of over VND 112 billion in 2023. The previous two years also resulted in losses of over VND 77 billion and VND 54 billion, respectively.

Toco Toco, positioned as “bubble tea made in Vietnam,” was launched in 2013 with a focus on using local agricultural produce. The brand quickly expanded to over 700 stores nationwide and ventured into international markets such as the US, Australia, and Japan. As part of their strategy, Toco Toco aimed to reach 1,500 stores by 2024, covering the entire country and expanding to the US, Japan, South Korea, Canada, and other markets.

Meanwhile, KOI Thé, a Taiwanese bubble tea brand, also faced challenges in 2023, with both revenue and profit declining compared to the previous year. Their revenue fell by over 10% to nearly VND 320 billion, and profit plunged by more than 50% to approximately VND 23 billion.

KOI Thé entered the Vietnamese market in 2015 and currently operates 47 stores without franchising. The brand experienced impressive growth in 2021 and 2022, with a 60% increase in revenue and a remarkable 730% surge in profit.

Ding Tea, another Taiwanese brand, saw a 35% drop in revenue in 2023 to only VND 30 billion, and profit plummeted by 80%, though it managed to avoid incurring losses. In 2022, Ding Tea had achieved a revenue growth of over 35% and a significant increase in profit to nearly 160%.

Ding Tea, a renowned Taiwanese brand, entered Vietnam in 2013 and now operates nearly 200 stores nationwide. The brand rarely offers promotions or engages in extensive advertising, relying mainly on word-of-mouth marketing.

Revenue of prominent bubble tea brands in the market during 2021-2023. (Source: Vietdata)

Bobapop, another Taiwanese brand, experienced a more than 30% decline in revenue in 2023, amounting to VND 55 billion. The chain has incurred losses for three consecutive years, with the highest loss of approximately VND 8.5 billion in 2021 and a loss of VND 1.2 billion in 2023.

Bobapop, which opened its first store in Ho Chi Minh City in early 2013, follows a take-away model and currently operates over 150 stores in Vietnam.

In contrast to these loss-making chains, Gong Cha achieved a 13% increase in revenue in 2023, totaling nearly VND 115 billion. Their profit also surged by almost 100%, enabling them to eliminate accumulated losses through adjustments in operations and cost management. Additionally, Gong Cha expanded into coffee sales in 2023.

Gong Cha, a well-known Taiwanese brand, entered the Vietnamese market in 2014 through franchising and currently operates 40 stores in the country as of July 2024.

Mixue, a late entrant from China, has experienced phenomenal growth, reaching 1,000 stores in less than five years since its launch in 2018. In 2023, Mixue’s revenue soared by over 160% to nearly VND 1,260 billion, and profit surged by more than 200% to over VND 200 billion.

Mixue’s main offerings are tea and ice cream, known for their affordable prices ranging from VND 25,000 to VND 35,000. As the bubble tea market reached saturation, the brand strategically shifted its focus to ice cream as the primary product, streamlined its tea menu, and targeted students and young consumers.

The Sip and the Buzz: How Phúc Long and Phê La Prolong the ‘Addiction’ to Milk Tea, Brewing a Storm for Specialty Tea in Vietnam

About a decade ago, it seemed like you couldn’t walk a few blocks without stumbling upon a new bubble tea shop, with foreign brands like Royal Tea and Dingtea leading the trend. Fast forward to the present, and it’s now equally common to spot shops advertising “strong-flavored tea” with every few steps. Interestingly, this “strong-flavored tea” trend, which may seem like a recent phenomenon, could have potentially started over 20 years ago when Phúc Long first opened its doors on Mạc Thị Bưởi Street, Ho Chi Minh City, back in 2005.