“Hanoi’s Real Estate Credit Growth: A Balancing Act for Banks”

According to Mr. Lenh, Hanoi’s real estate credit growth reached an impressive milestone, surpassing 1 quadrillion VND by the end of July 2024. This amount accounts for 27.6% of the total credit outstanding, reflecting a 5.5% increase compared to the previous year’s figures. Notably, the growth rate of real estate credit outpaced the overall credit growth in the region, which stood at 3.9% for the first seven months.

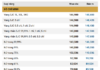

Housing credit, encompassing social, commercial, and other types of housing, held the lion’s share of the real estate credit portfolio, making up approximately 57% of the total.

The outstanding balance for social housing loans witnessed a significant surge, climbing to 2,543 trillion VND, a remarkable 78% increase from the end of the previous year. This substantial growth can be attributed to the proactive disbursements made by credit institutions during the first seven months, including 170 billion VND from the 120,000 billion VND package allocated for a worker housing project in Thu Duc City.

Real estate credit for production and business activities, including loans for developing industrial park infrastructure and for constructing offices, skyscrapers, restaurants, and hotels in tourist areas, all demonstrated robust growth rates.

Specifically, the outstanding balance for industrial park infrastructure development loans reached 48,392 billion VND, marking a 18.4% increase compared to the end of 2023. Similarly, the outstanding balance for office and skyscraper construction loans exhibited a notable 14% year-over-year increase, reaching 24,041 billion VND.

Mr. Lenh attributed the positive results in real estate credit activities to the upward trajectory of the market. However, given that real estate credit primarily consists of medium and long-term loans, the efficient and sustainable growth and development of the market hold significant implications for the credit operations of commercial banks. Therefore, strict adherence to credit regulations, coupled with a keen focus on the proper utilization of borrowed funds and the operational efficiency of enterprises, will not only ensure safe and effective credit growth but also propel the real estate market forward.

Credit institutions are advised to pay close attention to rational and efficient capital exploitation and utilization, aligning their strategies with the positive shifts in the market. These shifts encompass the development of real estate for production and business activities, the expansion of export processing zones and industrial parks, the growth of tourism services, and the establishment of housing, particularly social housing. By staying attuned to the evolving policies, mechanisms, and sustainable development strategies for the market, credit institutions can effectively leverage these positive changes.

The Capital Recovers Large Areas of Underutilized Space on the Ground Floor of Relocation Apartment Buildings

The ground floor commercial spaces in the resettlement apartment building lie vacant and in disarray, a stark contrast to the deteriorating state of the residential areas. It is a waste of valuable resources, as the funds are not available to renovate and repair the building.

Revolutionizing Rail: A Holiday Boon for Vietnam’s Railways

On the afternoon of September 3, the Danang City Tourism Department announced that the number of visitors arriving by train had reached approximately 10,600, a significant increase of over 42% compared to the same period last year. Notably, there was a substantial rise in the number of passengers traveling by train from neighboring localities.

The Future of Vietnam’s Urban Landscape: Are 13 Centrally-Governed Cities and Two Special Metropolitan Areas on the Horizon by 2028?

Vietnam will have two special administrative-economic units among its future 13 municipalities under the central government.