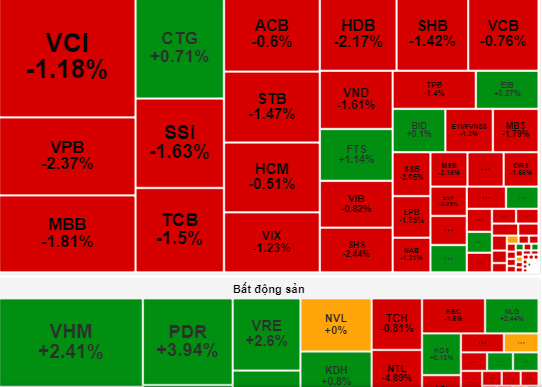

VN-Index closed at 1,275 points, down 8 points (-0.63%) at the end of the September 4 session.

After the September 2 holiday, Vietnamese stocks fell immediately upon entering the trading session on September 4, largely due to the impact of a global stock market rout amid recession fears, leading some domestic investors to reduce their stock holdings.

However, the downward momentum was curbed around the 1,270-point level, and a recovery effort was made towards the end of the afternoon session when bottom-fishing demand flowed into some stocks in the real estate, oil and gas, and banking sectors. As a result, many investors expect this trend to continue in the upcoming sessions.

At the close, the VN-Index fell 8 points (-0.63%) to close at 1,275. Matched volume on the HoSE rose to 588 million shares.

According to BETA Securities Company, with the emergence of correction phases and strong net selling pressure from foreign investors, investors need to be cautious but not panic. Short-term fluctuations can cause concern, but they also present opportunities to restructure investment portfolios and seek out potential stocks.

“The emergence of bottom-fishing cash flow is a positive signal. This shows that many investors are still willing to disburse when stock prices fall. To adapt, stock investors should focus on stocks with strong financial foundations and long-term growth prospects, while maintaining a necessary amount of cash to be flexible in seizing opportunities when the market corrects,” BETA Securities recommended.

Dragon Vietnam Securities Company assessed that the VN-Index is being supported to hold the 1,275-point region. This signal could help the market recover in the near term and retest supply in the 1,280-1,285 region before giving more specific signals. Therefore, investors need to slow down and observe supply and demand dynamics to assess the market’s status; temporarily consider the recovery rhythm to take short-term profits or restructure the stock portfolio towards minimizing risks.