On September 5, the Board of Directors of Imexpharm Pharmaceutical Joint Stock Company (HOSE: IMP) approved the list of shareholders to receive shares issued to increase charter capital from equity sources. The ex-rights date is September 17, 2024.

On September 5, the Board of Directors of Imexpharm Pharmaceutical Joint Stock Company (HOSE: IMP) approved the list of shareholders to receive shares issued to increase charter capital from equity sources. The ex-rights date is September 17, 2024.

With a performance ratio of 100%, corresponding to 1 new share received for every 1 share held, Imexpharm Pharmaceutical plans to issue more than 77 million new shares. The issuance is expected to be completed in Q3-4/2024.

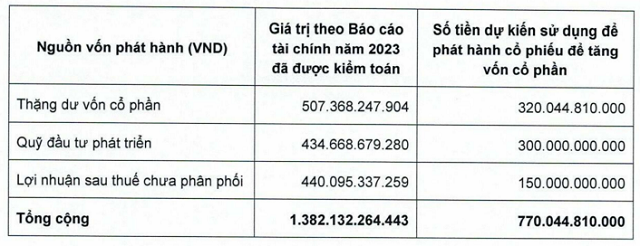

The issuance capital comes from surplus capital, investment funds, and audited post-tax profits as of December 31, 2023, valued at over VND 1,382 billion.

Source: IMP

|

If the issuance is successful, IMP will double its capital to over VND 1,540 billion, corresponding to more than 154 million shares.

Regarding the capital increase, this pharmaceutical company also recently paid a 2023 dividend of 20% (including 10% in cash and 10% in shares) in July.

Listed since 2006, IMP has consistently paid annual dividends to shareholders with rates ranging from 5-22% in cash/shares.

After the news of Imexpharm’s plan to double its capital at the end of April, IMP share price has been on a strong upward trend, reaching a new peak in the morning session of September 6, trading around VND 93,800/share, up 85% compared to the beginning of the year, with an average liquidity of over 55,000 shares/session.

IMP Share Price Movement since the Beginning of 2024

In terms of business performance, Imexpharm’s Q2/2024 revenue increased by 18% over the same period last year, reaching VND 517 billion; while after-tax profit decreased by 17% to VND 66 billion.

The company attributed the increase in cost of goods sold to its proactive adjustment of inventory in response to the stagnant OTC market, as well as depreciation of the IMP4 factory as planned and rising active ingredient prices. These factors were partially offset by effective control of selling and management expenses, which decreased by 6% over the same period last year to VND 213 billion.

This is the third consecutive quarter that Imexpharm has reported a profit decline. For the first 6 months of the year, the company achieved more than VND 1,000 billion in net revenue, up 10% over the same period last year; after-tax profit decreased by 19%. Compared to the plan approved at the 2024 AGM, the company has achieved 43% of the revenue target and 38% of the pre-tax profit target.

Imexpharm Takes a Step Back as it Adjusts Product Costs