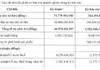

With a payout ratio of 20%/cp (1 cp receives VND 2,000) and 63.25 million cp in circulation, VGR is estimated to spend VND 126.5 billion on the first round of 2024 dividend payments to shareholders. The expected payment date is October 3, 2024.

The 2024 Annual General Meeting of VGR approved a dividend of no less than 20% of charter capital for 2024. With this interim dividend, the Company will have achieved the minimum dividend approved by shareholders.

Source: VietstockFinance

|

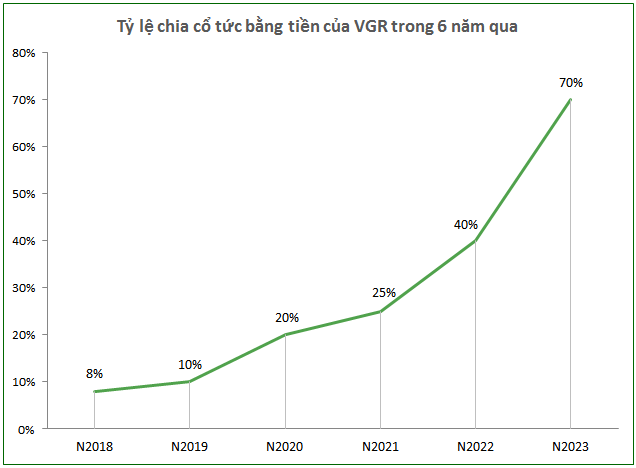

Looking back at VGR‘s dividend history (2018-2023), the Company has a tradition of paying cash dividends with a gradually increasing ratio, with the highest dividend of 70% in 2023.

On December 28, 2014, VGR was established by two large shareholders, Joint Stock Company Container Vietnam (HOSE: VSC) and Petroleum Transport Joint Stock Company VIPCO, with an initial charter capital of VND 450 billion.

In 2016, to expand its business operations, VGR increased its charter capital from VND 450 billion to VND 575 billion by selling 12.5 million cp (equivalent to VND 125 billion) to strategic shareholder Evergreen Marine Corp (Taiwan) Ltd.

Source: VGR

|

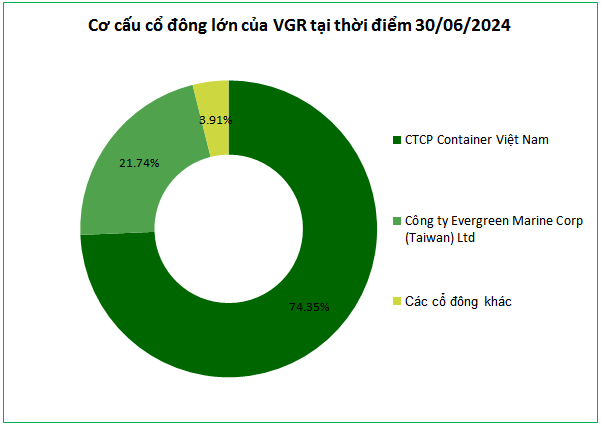

As of June 30, 2024, VGR has two major shareholders, with Container Joint Stock Company being the parent company of VGR with a 74.35% ownership stake, expected to receive over VND 94 billion. The remaining large shareholder, Evergreen Marine, holds 21.74% capital and is expected to receive VND 27.5 billion in dividends from VGR.

VIP Greenport is located in the lower reaches of the Cam River, in the Dinh Vu – Cat Hai economic zone, Hai Phong, with a favorable geographical location for transportation connections and access to the sea. VIP Greenport is currently operating with 02 berths with a total length of 400m, 05 cargo handling equipment on the bridge with a lifting capacity from 45 tons to over 100 tons, and an average productivity of 28 moves/ hour/ equipment.

| VGR’s Business Results for the First Half of 2024 |

In terms of business results, in the first half of 2024, VGR achieved nearly VND 527 billion in net revenue, up 30% over the same period last year. Moreover, the cost of goods sold increased slower than net revenue (up 19% over the same period) and selling expenses decreased by 10% over the same period, helping net profit increase by 71% to over VND 187 billion.

VGR stated that due to a nearly 20% increase in cargo volume through the Port compared to the same period, higher freight rates, and many machines and equipment that have been fully depreciated, resulting in reduced expenses and increased profits in the first half of this year.

Compared to the plan to achieve a pre-tax profit of VND 240 billion for the whole of 2024, the Company has achieved 88% of its target. However, it should be noted that VGR‘s 2024 plan represents a 22% decrease compared to the 2023 results. In the previous year, VGR recorded a pre-tax profit of over VND 307 billion.

The Haunting of Real Estate Stocks: Unraveling the Continuous Mishaps

In recent times, DIG shareholders and investors have been through a rollercoaster. From the tragic passing of the company’s chairman to the ongoing inspections and the subsequent stock volatility, it’s been a challenging period. As the company navigates these trials, one can’t help but wonder what the future holds for this business and those invested in it.