The LICOGI13-invested 49.5MW Quang Tri Solar Power Plant Project.

Licogi 13 Joint Stock Company (Licogi 13; HNX: LIG) has just announced its semi-annual 2024 financial statement to the Hanoi Stock Exchange (HNX).

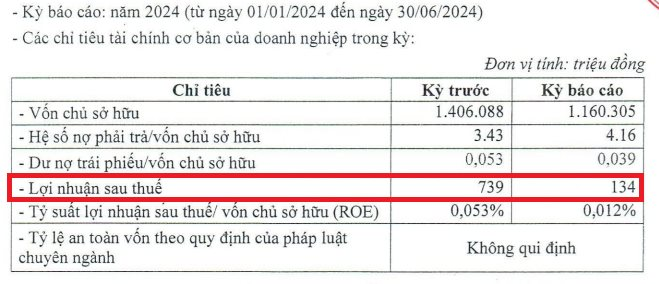

Accordingly, in the first six months, the company reported a profit of 134 million VND, down 81.9% over the same period in 2023.

The after-tax profit margin (ROE) was 0.012%, compared to 0.053% in the same period last year.

Previously, in the 2022 and 2023 financial years, Licogi 13 reported after-tax profits of 9 billion VND (ROE 0.69%) and 2.6 billion VND (ROE 0.19%), respectively.

In terms of financial health, as of June 30, 2024, Licogi 13’s equity was 1,160 billion VND, down 17.5% over the same period last year. The debt-to-equity ratio was 4.16 times, corresponding to the company’s debt balance of 4,827 billion VND. Of which, bond debt was 45 billion VND.

Thus, Licogi 13’s total assets currently stand at over 5,987 billion VND. Of this, debt accounts for 81%.

Notably, in the first six months of this year, Licogi 13 recorded a decline in business results, reporting an after-tax profit of 134 million VND, equivalent to less than 1 million VND per day.

LICOGI13, led by CEO Pham Xuan Thang, reported an after-tax profit of 134 million VND in the first six months of this year.

According to data from HNX, Licogi 13 is currently circulating only one batch of bonds, LIGH2123001, worth 75 billion VND, issued on December 31, 2021, with a term of 33 months, maturing on September 30 this year.

Since the beginning of 2024, the company has repurchased this bond issue in four tranches ahead of schedule, and the current outstanding balance of this bond issue is 25 billion VND.

Licogi 13 Joint Stock Company was established in June 2005, mainly operating in the fields of real estate business, construction of railway and road works, civil engineering works, and public works; electricity production, transmission, and distribution. Its headquarter is located at Licogi 13 Building, Khuat Duy Tien Street, Nhan Chinh Ward, Thanh Xuan District, Hanoi.

The enterprise has a charter capital of nearly 951 billion VND. Its legal representative is Mr. Pham Xuan Thang, General Director.

In the stock market, at the end of the session on September 4, LIG shares were priced at 3,400 VND/share, up 3.03% compared to the previous session, with a matched volume of more than 317,000 units.

The Continuous Prosecution of Leaders: How Does VEAM Operate Now?

As of the end of June 2024, VEAM’s total asset value reached an impressive VND 30,040 billion, reflecting a 10% increase since the beginning of the year. Notably, cash and cash equivalents accounted for just 1.2% of this figure, equating to VND 370 billion.