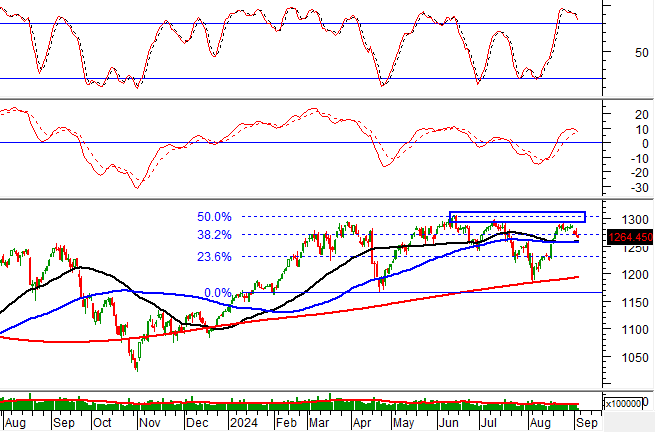

Technical Signals for the VN-Index

During the trading session on the morning of September 6, 2024, the VN-Index witnessed a decline, accompanied by a significant drop in trading volume. This indicates a lack of optimism among investors.

At present, the VN-Index is retesting the Fibonacci Projection 38.2% threshold (corresponding to the 1,265-1,285 point region) while the Stochastic Oscillator indicator signals a sell-off in the overbought zone. Should the indicator fall below this level, the risk of a downward adjustment will heighten in the upcoming sessions.

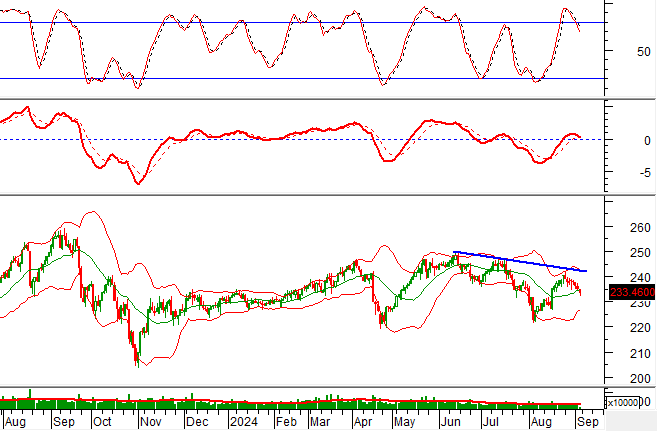

Technical Signals for the HNX-Index

On September 6, 2024, the HNX-Index extended its losing streak to eight consecutive sessions, with a slight increase in trading volume, reflecting investors’ pessimistic sentiment.

Additionally, the HNX-Index dipped below the Middle Bollinger Band, while the MACD indicator signaled a resumption of selling. This suggests that the short-term adjustment scenario is becoming a reality.

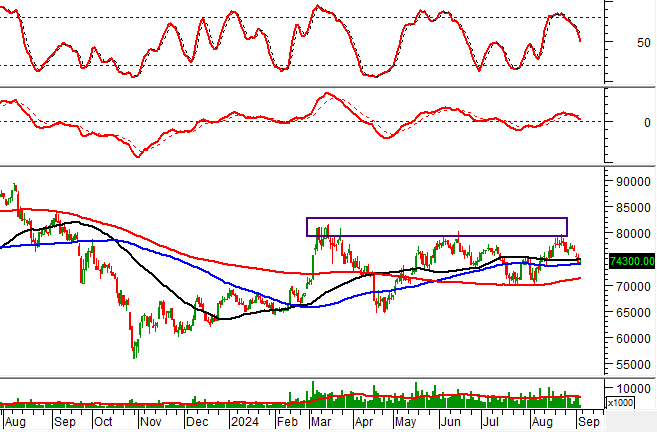

MSN – Masan Group Joint Stock Company

On the morning of September 6, 2024, MSN exhibited a slight increase in price, forming a Doji candlestick pattern. This improvement in trading volume reflects investors’ indecision.

Moreover, the stock price is retesting the group of SMA 50 and SMA 100 day moving averages. The Stochastic Oscillator indicator continues to trend downward after previously signaling a sell-off. Should the stock price fall below this region, the risk of a short-term adjustment will escalate in the forthcoming sessions.

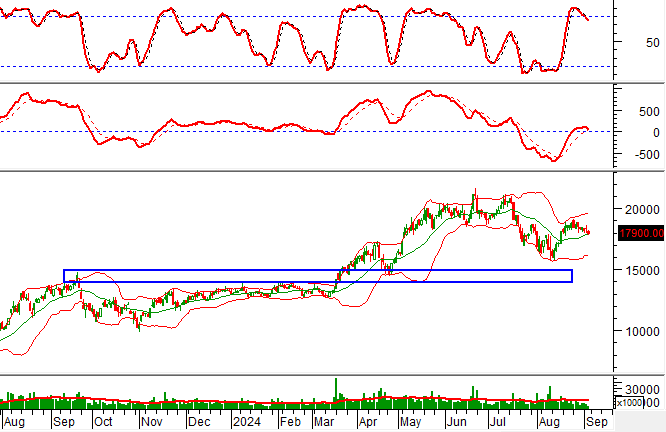

TCH – Hoang Huy Finance Services Investment Joint Stock Company

On September 6, 2024, TCH experienced a price decline, accompanied by a significant increase in trading volume, indicating a lack of optimism among investors.

Additionally, the stock price is testing the Middle Bollinger Band, while the MACD indicator is gradually narrowing the gap with the signal line. If a sell signal reappears in the upcoming sessions, the short-term outlook will turn more pessimistic.

Vietstock Consulting Analysis Team