In recent years, Phu Tho province has focused on accelerating the implementation of construction projects and initiatives to boost socio-economic development and improve the investment environment. However, while some projects are on track, many others, like the Huu Nghi Cement Factory in Thuy Van Industrial Park, Viet Tri city, are lagging.

The dilapidated state of Huu Nghi Cement Factory after its bankruptcy declaration.

According to sources, the construction of the Huu Nghi Cement Factory commenced in September 2001, and it officially commenced operations in March 2002 as a clinker grinding station with an initial capacity of 100,000 tons of cement per year.

Spanning an area of approximately 10 hectares, the factory is strategically located within the Thuy Van Industrial Park.

In mid-July 2022, the Phu Tho Provincial Tax Department publicly announced the first half of 2022’s list of 239 enterprises and 96 business households with tax debts exceeding 90 days (as of May 31, 2022). Among them, Huu Nghi Cement Joint Stock Company owed over VND 24.3 billion.

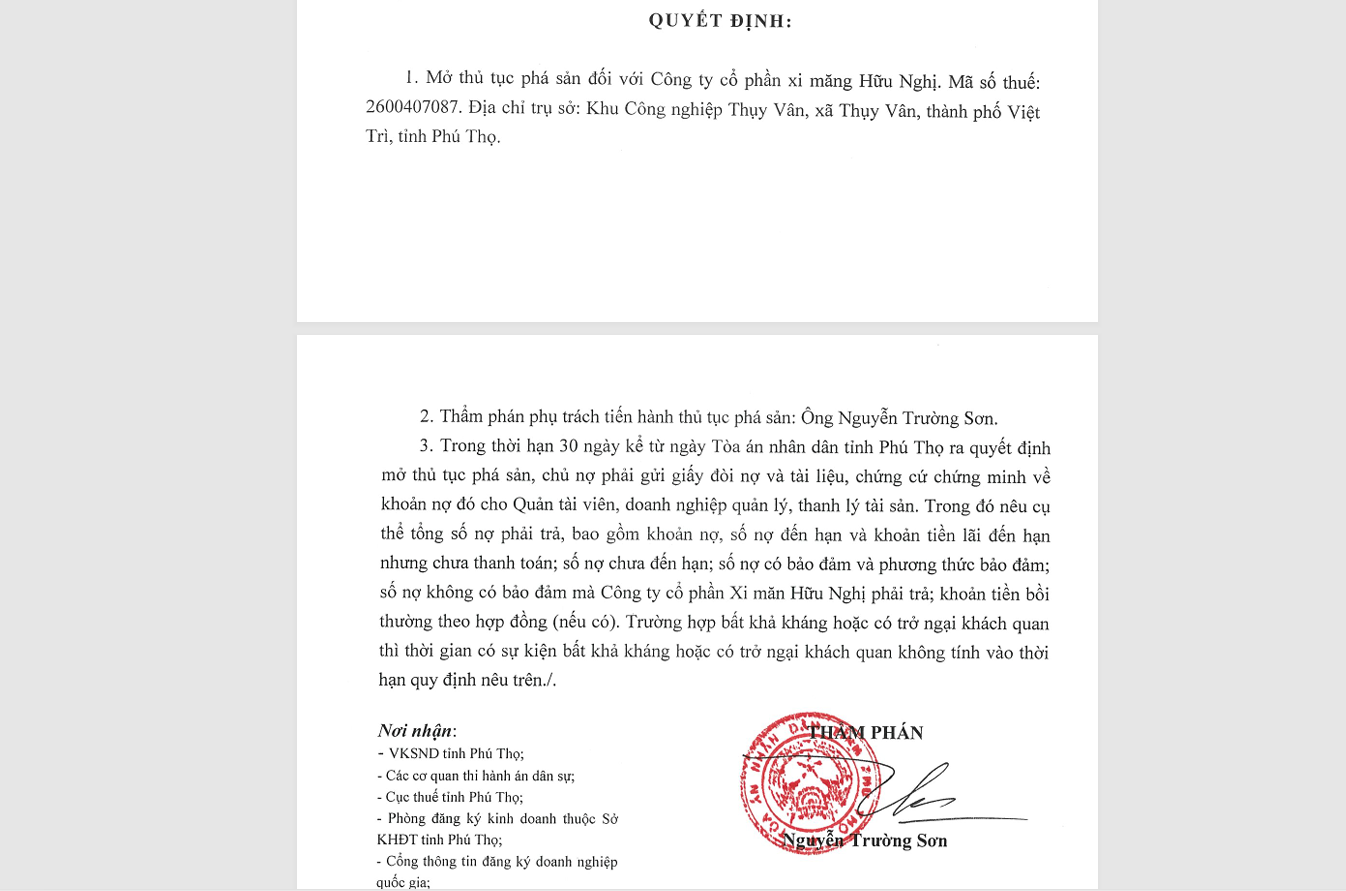

On July 15, 2022, the People’s Court of Phu Tho province issued Decision No. 351 on initiating bankruptcy proceedings against Huu Nghi Cement Joint Stock Company. As per this decision, the bankruptcy procedure was assigned to Mr. Tuong Duy Bac, a financial manager from Hung Viet Private Enterprise, specializing in asset management and liquidation.

Mr. Bac, as the assigned financial manager, was responsible for managing and liquidating the assets of Huu Nghi Cement Joint Stock Company, as per Decision No. 353/2022 of the People’s Court of Phu Tho province.

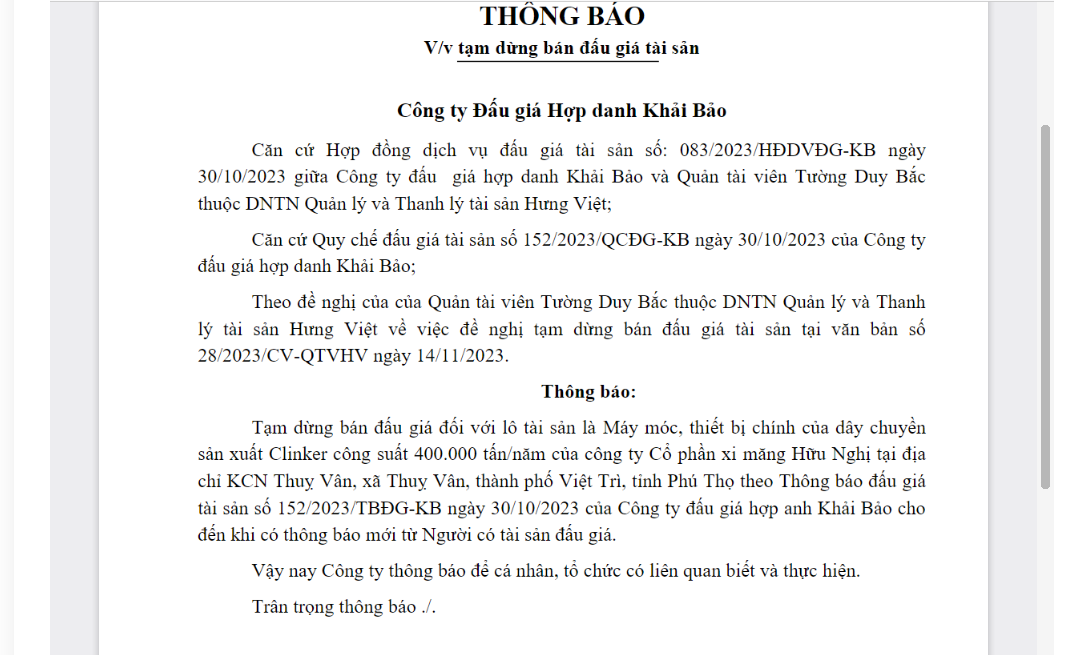

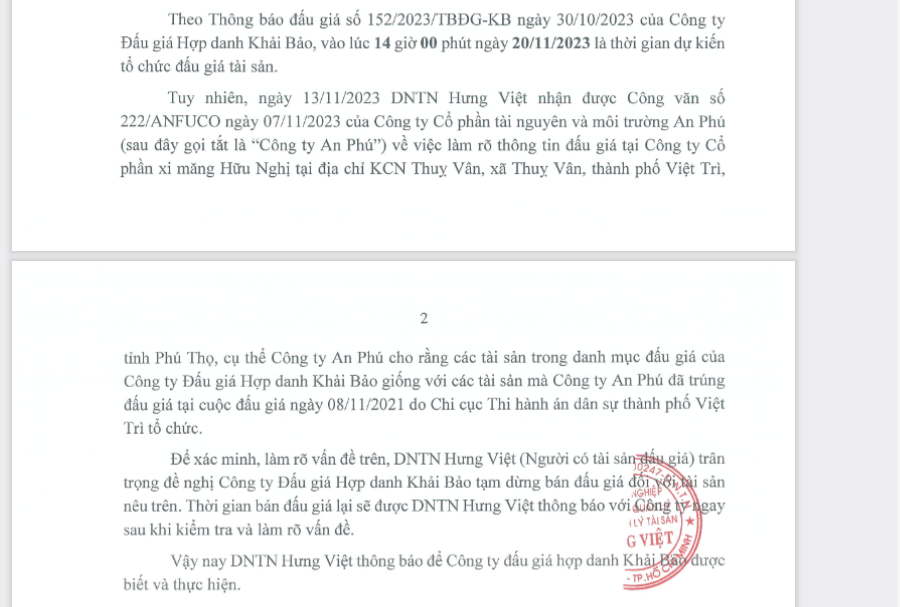

Subsequently, on October 30, 2023, Hung Viet Private Enterprise and Khai Bao Partnership Auction Company signed a service contract to auction off the main machinery and equipment of the 400,000-ton-per-year clinker production line of Huu Nghi Cement Joint Stock Company. The auction was scheduled for November 20, 2023.

However, on November 13, 2023, Hung Viet Private Enterprise received a document from An Phu Mineral and Environmental Joint Stock Company (An Phu JSC), stating that the assets in the auction inventory at Huu Nghi Cement Joint Stock Company resembled the assets that An Phu JSC had won at an auction held on November 8, 2021, by the Civil Judgment Enforcement Division of Viet Tri city. Consequently, the auction of the aforementioned assets of Huu Nghi Cement Joint Stock Company was temporarily halted.

Previously, the functional authorities of Phu Tho province had stated that, upon inspection and evaluation, the investor no longer had the capacity to implement the project.

Regarding the Huu Nghi Cement Factory project, on May 20, 2024, Mr. Bui Van Quang, Chairman of the People’s Committee of Phu Tho province, issued a plan to implement key projects in 2024 to strictly follow the directions of the Provincial Party Committee’s Standing Committee. This plan includes accelerating the progress of eight challenging and long-delayed projects, among which is the Huu Nghi Cement Factory.

In reality, many items in the Huu Nghi Cement Factory have been left unused for an extended period, causing the machinery to rust.

Near the factory’s entrance, there is a large stockpile of materials, and trucks can be seen coming and going.

The current desolate state of the Huu Nghi Cement Factory evokes a sense of sadness and waste.

The Tax Defaulters: Is Newtecons on the Hook in Hai Phong?

The Hai Phong Tax Department has released a list of 893 entities that owe taxes and other financial obligations to the state budget. As of July 31, 2024, the total amount owed exceeded VND 1,728 billion. Among the listed debtors is Newtecons Investment and Construction JSC, a company associated with Mr. Nguyen Ba Duong.

Why Are So Many People Suddenly Owing Taxes?

The General Department of Taxation has revealed that individuals suddenly find themselves in tax debt for a variety of reasons. These include tax code fraud by businesses, which falsely declare expenses, and taxpayers with multiple sources of income who are unaware of or forget about the self-declaration regulations.

The Dying 5-Star Golf Course in Phu Tho: FLC’s Ambitions Turned into a Goat Meadow

After over a year of being “defunct”, the 5-star eco-tourism and resort complex with a world-class golf course developed by FLC in Phu Tho has fallen into disrepair and become a goat pasture. Meanwhile, many households have not yet been compensated for the land area that was recovered to serve the project.

The Power to Prohibit: When Personal Tax Debts Ground You

The proposed amendments to the Law on Tax Administration by the Ministry of Finance suggest that individuals and household businesses who owe taxes may be subject to exit bans. This addition aims to temporarily restrict the outbound movement of those with tax arrears, emphasizing the importance of tax compliance for all entities and individuals in the country.