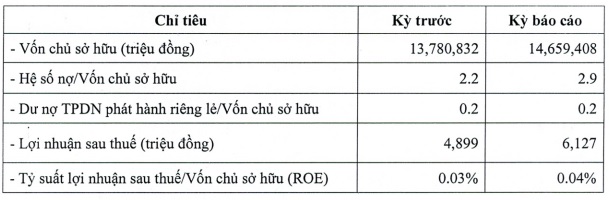

In the first six months of the year, Thaco Agri reported a post-tax profit of VND 6.1 billion, up 25% from the same period last year. This number is relatively small compared to its equity, which stands at nearly VND 14,700 billion (up 6% from the previous year). ROE increased from 0.03% to 0.04%.

|

Financial indicators of Thaco Agri in the first half of 2024

|

Despite the increase in equity, the debt-to-equity ratio also rose from 2.2 to 2.9, indicating that the company’s total debt has increased to approximately VND 42,500 billion. The bond debt-to-equity ratio remained unchanged at 0.2, translating to a debt of VND 2,900 billion.

Currently, Thaco Agri has one lot of bonds with the code THGCH2126001 in circulation. The bonds were issued on October 1, 2021, with a five-year maturity, due on October 1, 2026. The lot comprises 24 million bonds with a par value of VND 100,000 each, equivalent to a total issuance size of VND 2,400 billion. The issuer is VPS Securities.

These bonds are non-convertible, do not have warrants attached, are asset-backed, and are payment-guaranteed by Thaco (THA), its parent company. The initial collateral was 240 million common shares of Thaco owned by Tran Oanh Production and Trading Company, which was later changed to the land-use rights and assets on two plots of land belonging to Thaco in An Loi Dong Ward, Thu Duc City, Ho Chi Minh City, covering an area of over 2 hectares.

The applicable interest rate for the first two interest periods (three-month periods) is 8.2% per annum. For subsequent periods, the reference rate (average 12-month savings rate of joint-stock commercial banks) plus a margin of 2.5% per annum will be applied.

In the first half of 2024, Thaco Agri continued to meet its interest payment obligations for this bond lot.

Pawnshop Chain F88 Profits 89 Billion VND in First Half of 2024, Bouncing Back After a Tough Year

F88 Business Joint Stock Company has released its periodic financial report to the Hanoi Stock Exchange (HNX). The report reveals a significant recovery for the company in the first half of 2024, marking a notable turnaround from the heavy losses incurred in the same period last year.