Oil hits 14-month lows as demand concerns offset large U.S. stock draw

Oil prices held near 14-month lows on worries about demand in the United States and China, and the potential for increased supply from Libya offsetting a large draw on U.S. inventories and a delay in output increases by OPEC+ producers.

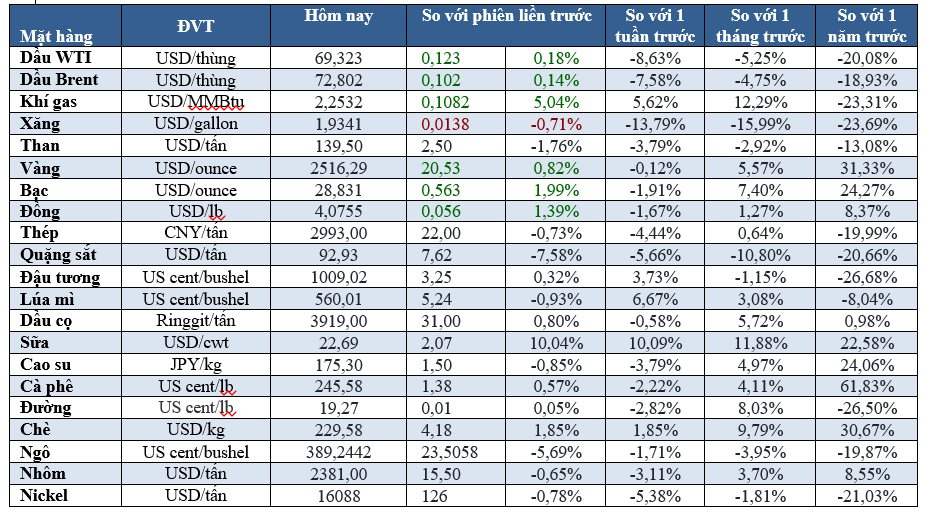

Brent crude futures fell 1 cent to $72.69 a barrel, while U.S. West Texas Intermediate (WTI) crude futures declined by 5 cents, or 0.1%, to $69.15 a barrel. This was Brent’s lowest close since June 2023 for a second straight session and WTI’s weakest finish since December 2023 for a third day in a row.

The U.S. Energy Information Administration said energy companies withdrew 6.9 million barrels of crude oil from storage in the week to Aug. 30.

OPEC+ agreed to postpone a planned production increase for October and November, saying it would respond to market developments and be ready to meet at any time to take immediate additional measures. Analysts at U.S. investment bank Jefferies said OPEC+’s decision effectively tightens fourth-quarter balances by around 100,000-200,000 barrels per day and is enough to prevent inventory builds even if demand from China does not improve.

In Libya, some tankers have been allowed to load crude from storage despite production remaining restricted amid a political standoff related to the central bank and oil revenue.

Gold hits near 1-week high as investors eye super-sized Fed rate cut

Gold prices rose to near a one-week high as a weaker U.S. dollar and lower yields prompted investors to bet on an outsized interest rate cut by the Federal Reserve this month after signs of a slowdown in the labor market.

Spot gold rose 0.9% to $2,515.93 per ounce by 1803 GMT, after rising 1.1% earlier in the session. Prices gave back some gains after data on the U.S. services sector. U.S. gold futures settled 0.7% higher at $2,543.10.

U.S. private employers hired the fewest workers in 3-1/2 years in August, likely pointing to a sharp slowdown in job growth. This follows data on Wednesday that showed a sharp decline in U.S. job openings in July.

Traders now see a 59% chance of a 25 basis point cut by the U.S. central bank this month and a 41% chance of a 50 basis point cut, according to the CME FedWatch tool.

The Fed needs to cut interest rates to keep the labor market healthy, but it now depends on upcoming economic data to determine how much, San Francisco Fed President Mary Daly said on Wednesday.

Silver rose 1.9% to $28.82 per ounce, platinum gained 2.7% to $926.74, and palladium rose 0.9% to $942.36.

Copper jumps

Copper prices jumped after China announced plans to invest nearly $51 billion in power grid construction in Africa, but gains in the metal were capped by technical weakness. Three-month copper on the London Metal Exchange rose 1.5% to $9,092.50 per ton.

The persistent weakness in China’s real estate and construction sector remains the key downside risk for industrial metals, said ING commodities strategist Ewa Manthey.

Zinc fell 2.2% to $2,734 a ton after Russian zinc miner Ozernoye began production earlier than expected following a fire that destroyed its facilities. Aluminum fell 0.7% to $2,381 a ton, nickel fell 1% to $16,060, lead fell 1.4% to $1,992 a ton, and tin rose 0.4% to $30,615.

China’s release of trade, inflation, and credit data for August next week is expected to shed more light on the outlook for metals demand for the rest of the year.

Dalian iron ore hits 1-year low on weak China demand concerns

Dalian iron ore futures fell for a fifth straight session to their lowest in over a year, as a string of weak economic data from China clouded the demand outlook.

The January 2025 iron ore contract on the Dalian Commodity Exchange ended down 2.58% at 678.5 yuan ($95.58) per ton. Earlier in the day, prices touched their weakest since August 21, 2023, at 673 yuan.

The January contract for Singapore-traded iron ore was down 1.87% at $90.80 per ton as of 0710 GMT.

On the Shanghai Futures Exchange, hot-rolled coil steel, used in cars and home appliances, fell 2.16%, rebar declined about 1.4%, stainless steel fell 0.04%, and steel wire remained unchanged.

Corn, soybeans fall on short-covering

Chicago corn and soybean futures fell on short-covering from earlier in the week, analysts said. Wheat followed corn lower, while rapid exports from the Black Sea region continued to cap prices. A weaker dollar and concerns about dry weather and crop damage in the U.S. Midwest also encouraged selling.

Chicago Board of Trade corn futures fell 2 cents to $4.10-3/4 per bushel, and soybeans ended down 2 cents at $10.23-1/2 a bushel. CBOT wheat lost 6 cents to $5.74-3/4 a bushel.

Although the U.S. growing season is over, drought and dryness in Brazil could hamper early planting, and corn and soybean markets are expected to be well-supplied.

Cocoa surges, raw sugar little changed

Cocoa futures in London and New York closed sharply higher, while raw sugar prices were little changed. December London cocoa rose £262, or 5.3%, to £5,250 per ton after touching a 6-1/2 month low of £4,975 on Wednesday. December New York cocoa rose 4% to $7,159 per ton.

Brokers said the market was still underpinned by tight short-term supply with a large global deficit in the current 2023/24 season.

One broker expected ample supply in the first quarter of the 2024/25 season, and this was weighing on prices, although there was still much uncertainty about how the 2025 crop would turn out.

Raw sugar little changed

October raw sugar was unchanged at 19.22 cents per lb. October white sugar fell 0.4% to $536.80 per ton.

Brokers noted the market continued to receive support from expectations of lower production in Brazil due to recent fires and ongoing hot, dry weather.

Citi Commodities Group said it maintained a positive view on sugar prices, expecting them to reach 20 cents per lb in the coming months.

Coffee steady

November robusta coffee was unchanged at $4,911 per ton. December arabica coffee rose 0.2% to $2,442 per lb.

Brokers said supplies from Vietnam remained low, and both buyers and sellers would likely remain on the sidelines until the start of the next harvest picks up pace in November.

Trading remained sluggish in Vietnam as traders and buyers awaited new supplies from the upcoming harvest, while in Indonesia, differentials eased.

Farmers in Vietnam’s Central Highlands, the country’s largest coffee-growing region, were selling beans at 119,000-120,500 dong ($4.81-$4.87) per kg, compared with 120,600-121,600 dong a week earlier.

Traders said heavy rains had hit some areas of the Central Highlands, but traders based in the region said the rain was not harmful to the crop.

In Indonesia, Sumatran robusta beans were offered with a premium of $220 per ton over the September/October contract, down from last week’s premium of $265 over the September contract, a trader said.

Indonesia exported 17,431.3 tons of Sumatran robusta coffee beans in July, up 13.4% from a year earlier and up 140% from the previous month.

Indian rice hits 3-month low on weak export demand, Thai rice rises

Indian rice export prices hit a three-month low this week on weak demand, while Thai rice prices rose for a second straight week to their highest since late June, supported by a stronger baht.

India’s 5% broken parboiled rice was quoted around $535-$540 per ton this week, the weakest since May 16, down from last week’s $540-$545.

“In the past few weeks, rice prices in competing countries have fallen. Indian exporters have been forced to cut prices to remain competitive, but demand is still weak,” a Mumbai-based dealer said.

Thailand’s 5% broken rice was at $585 per ton, up slightly from last week’s $580. Prices rose to their highest in more than two months due to the baht’s strength against the U.S. dollar, a Bangkok-based trader said.

The African market has been quiet, a trader noted, adding that he expected November supplies to be good due to favorable water levels.

Meanwhile, domestic rice prices in Bangladesh rose this week, with traders accusing some merchants of using the flood situation to justify the increase, despite ample stocks and a normal supply chain.

Vietnam’s 5% broken rice was offered at $575 per ton, compared with $578 last week, according to traders.

Japanese rubber hits 2-week low on economic growth concerns

Japanese rubber futures fell for a fourth straight session to close at a two-week low, dragged down by concerns about economic growth in the U.S. and China, while a stronger yen added pressure. The February 2025 contract on the Tokyo Commodity Exchange closed down 4.1 yen, or 1.17%, at 347.5 yen ($2.43) per kg, the weakest finish since Aug. 22.

The January 2025 rubber contract on the Shanghai Futures Exchange (SHFE) closed up 35 yuan, or 0.22%, at 16,180 yuan ($2,279.23) per ton.

The October rubber contract on the SICOM exchange in Singapore closed at 177 U.S. cents per kg, up 1%.

Prices of some key commodities on Sept. 6, 2024