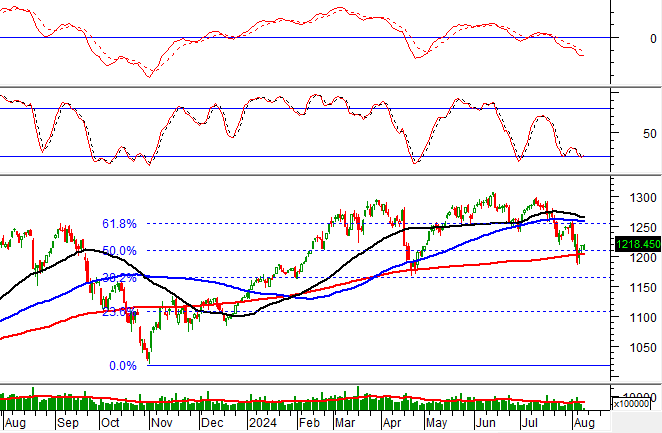

The pressure of rising exchange rates, with the DXY index reaching 106 at one point, has led to net foreign selling throughout the year so far, with a total net selling value of up to VND 65,000 billion, equivalent to USD 2.6 billion. The stock market’s tug-of-war and volatile fluctuations are mainly due to the pressure of capital withdrawal by foreign investors, negatively affecting domestic investors, amid concerns about the world’s largest economy, the US, falling into a mild recession.

However, the exchange rate has cooled down considerably recently as the Fed signaled an interest rate cut in September. Fed Chairman Powell at Jackson Hole officially announced that it was time to reverse monetary policy. The market expects the Fed to cut interest rates by a maximum of 1% from now until the end of the year, and the exchange rate immediately fell to VND 25,000/USD. The DXY index fell to 101.11 points at the close of Thursday’s session, down from 101.36 points in the previous session. This morning, the index continued to fall, approaching the 101-point mark.

The exchange rate has cooled down, but contrary to the expectations of domestic investors, foreign investors have suddenly sold a large amount in the last two sessions, with a net selling value of VND 1,700 billion.

Regarding the sudden net selling by foreign investors, Mr. Nguyen The Minh, Director of Customer Analysis Division of Yuanta Securities, gave three reasons to explain why they sold so much. First, foreign investors mainly sold real estate stocks. Usually, similar to China, the proportion of foreign investors owning real estate stocks is quite high. When the risk in this group increases, they sell, such as VHM stock is one of the three stocks that foreign investors net off the most, in August alone they net sold more than VND 1,000 billion in this stock.

In principle, in other markets, when foreign investors sell real estate stocks, they will invest in other groups such as technology, retail,… However, the Vietnamese market does not have many new and attractive choices but mainly FPT when the stock price is too high, the allocation ratio is large, so they also have to sell this group to ensure their rules.

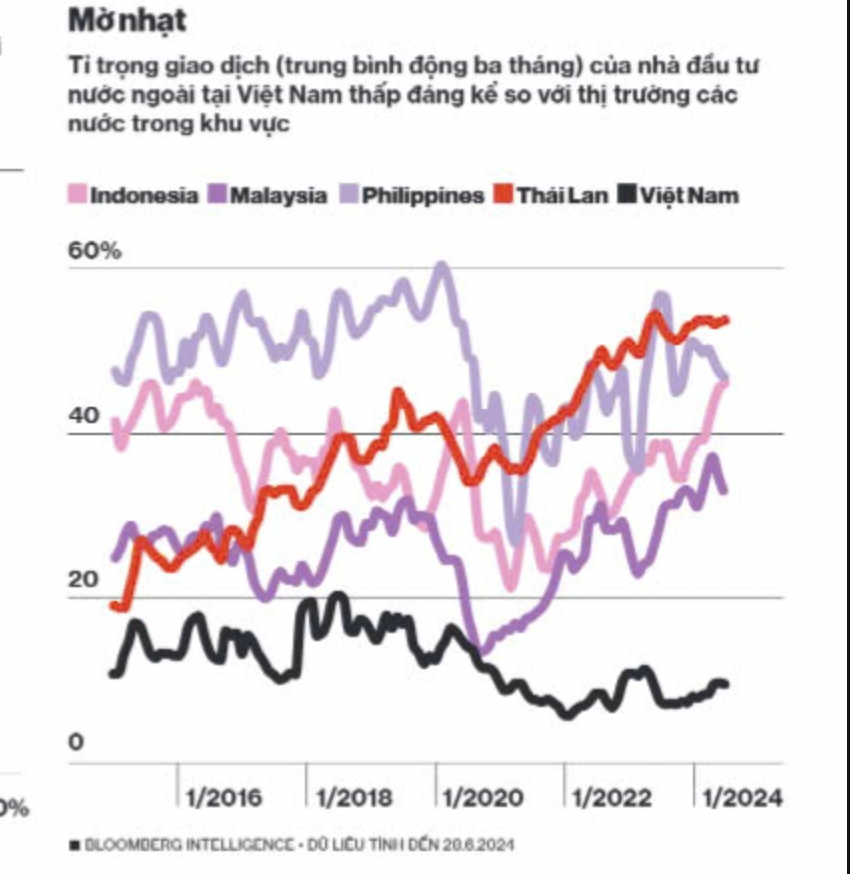

Second, foreign investors buy and sell in cycles. If the period 2017-2018 is the time to attract a lot of capital, the ownership rate of foreign investors once reached 25-30%, now is the cycle they withdraw. We can explain that the strong buying sessions come from repo investment activities, in nature, they lend to businesses with stocks as collateral, when the deadline comes, they collect money and businesses have to sell stocks to repay the debt.

As recently as SK Group sold a lot, the time they bought a lot was in the period 2017-2018.

At the moment, Bloomberg statistics show that the average trading volume of foreign investors in Vietnam in the past three months is the lowest compared to other markets in the region. According to Mr. Minh, the trading volume ratio has decreased significantly, and the remaining investors in the Vietnamese stock market are mainly long-term investors, and they no longer have a need to sell, and the volume of sales may still be small.

“They sold unexpectedly in the last one or two sessions, but in the rest, they will sell less because the supply is not much left. Today’s trading session shows that, as they return to a net buy of VND 233 billion,” emphasized Mr. Minh.

However, according to Mr. Minh, the sharp decline in trading volume among foreign investors will expose the market to more risks when most of the trading volume on the market comes from individual investors. If in the past, when the market fell, foreign investors, who held a large number of stocks, would buy to support the price, ensuring that their assets were less damaged and creating momentum to support the market, but now the fluctuation margin will be large. When the market goes up, it will surge, but when it falls, it will drop sharply.

“Retaining foreign capital is an urgent task. We are a bit late, and although we already have the solutions in the Securities Law, we need to speed up to have attractive products to attract foreign capital. At the same time, we must soon have solutions to promote the process of upgrading to an emerging market as soon as possible,” said Mr. Minh.

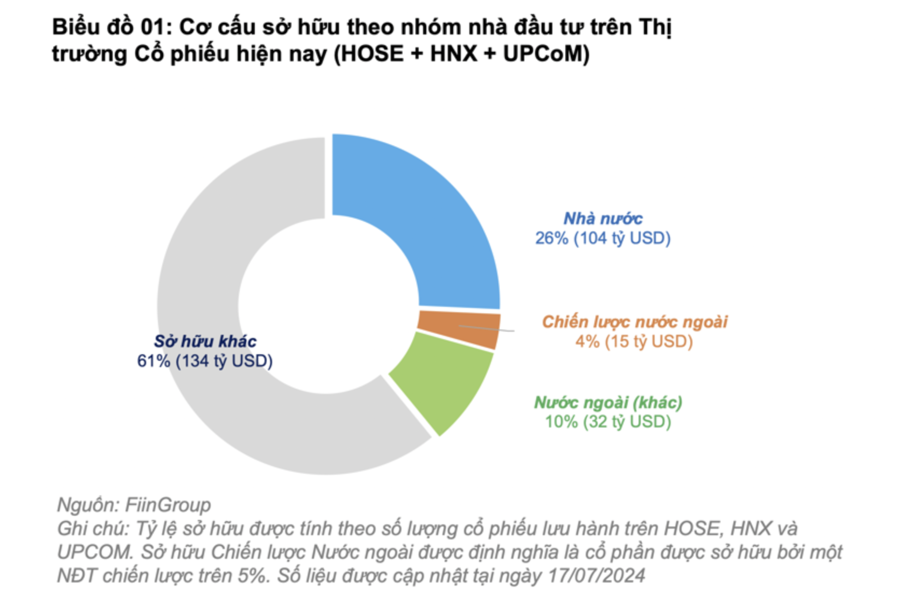

According to data from FiinGroup, the group of foreign investors mainly includes investment funds managed by fund management companies licensed in Vietnam and insurance funds with good growth rates in recent years. The total assets of these funds being managed as of the end of 2023 are VND 592,000 billion. However, the allocation rate for stocks is still very low.

Foreign investors currently own about 14% of the Vietnamese stock market. On the Ho Chi Minh Stock Exchange (HoSE), this figure is 17.3%, on the Hanoi Stock Exchange (HNX) is 5.4%, and on the Unlisted Public Company Market (UPCoM) is 3%. At the end of 2018, the foreign ownership rates were 19.83% (HoSE), 10.99% (HNX), and 4.24% (UPCoM), respectively.

Of the total assets being managed, these funds allocate about VND 101,000 billion to stocks, VND 419,000 billion to government bonds and corporate bonds, and the rest to other assets.

Foreign investment funds tend to invest in sectors associated with the potential of the domestic market, including insurance, retail, securities, food and beverages, banking, and household appliances; and technology.

According to FiinGroup, in order to attract foreign capital, in addition to the goal of upgrading the stock market to an emerging market, it is necessary to consider promoting the goal of upgrading the national credit rating of Vietnam. They often focus on multi-channel asset allocation when participating in a new market.

Not only should the stock market be upgraded to an emerging market, but the national credit rating should also be promoted to the Investment Grade (BBB) level before 2030, because these institutions consider multi-channel assets, not only stocks but also bonds/ debt instruments. This will contribute not only to improving liquidity but also, more importantly, to attracting capital from foreign investors (both equity and long-term debt) for businesses.

In addition, it is necessary to create diverse products that suit the investment tastes of foreign investment institutions (through professional fund management companies) but stocks/ depositary receipts without voting rights.

Tomorrow’s Stock Market Outlook: Will the Force of Bottom-Fishing Persist?

“The stock market witnessed a late surge of buying activity on September 4th, as bargain hunters stepped in to take advantage of the dip. This bottom-fishing pushed the market to trim its losses, instilling hope among investors that this trend could persist and potentially pave the way for a market rebound.”