The government has issued Decree 109, dated August 29, 2024, stipulating registration fee rates for domestically produced or assembled cars, trailers, semi-trailers, and similar vehicles.

Effective from September 1, 2024, to November 30, 2024, the registration fee will be halved compared to the rates prescribed in Government Decree 10 of 2022 and other existing resolutions or decisions by local authorities. From December 1, 2024, onwards, the registration fee rates will revert to those specified in Decree 10/2022.

This is the fourth time the government has implemented such a reduction policy. The first instance was from June 28, 2020, to December 30, 2020. The second period ran from December 1, 2021, to May 31, 2022. And the third time was from June 28, 2023, to December 31, 2023.

From December 1, 2024, the registration fee rates will follow those set by the government in Decree 10, issued on January 15, 2022.

As per Decree 109 of 2024, the registration fee for cars, trailers, semi-trailers, and similar vehicles is set at 2%. For passenger cars with nine seats or fewer, the initial registration fee is 10%. Localities may opt for higher rates, provided they do not exceed 50% of the prescribed rates in this decree.

For pick-up trucks with a payload capacity of less than 950 kg and up to five seats, as well as cargo vans with a similar payload capacity, the registration fee is set at 60% of the rate for passenger cars with nine seats or fewer.

Electric cars, on the other hand, enjoy a 0% registration fee for the first three years from the effective date of Decree 10/2022. For the subsequent two years, the registration fee for these vehicles will be 50% of the rate applicable to gasoline or diesel-powered cars with the same number of seats.

The registration fee for subsequent registrations of the above-mentioned vehicles is set at 2%, applicable nationwide.

This reduction in registration fees is one of the government’s policies to stimulate consumption and provide financial support to citizens, with the ultimate goal of boosting the domestic automobile manufacturing and assembly industry.

According to the Ministry of Finance, the 50% reduction in registration fees for domestically produced or assembled cars positively impacts consumers by offering financial relief and encouraging consumption. Moreover, it is anticipated that this reduction may lead to an increase in car sales and registrations, resulting in potential growth in revenue from registration fees, special consumption tax, and value-added tax.

However, there is a concern that this policy may create an imbalance between domestically produced and imported vehicles. Prolonging this situation could lead to violations of WTO agreements and free trade agreements (FTAs) that Vietnam is a part of.

The Ministry of Finance also noted that the 50% reduction in registration fees for domestically produced or assembled cars could result in an average monthly loss of VND 867 billion in registration fee revenue for the state budget (equivalent to the loss under Decree 41 of 2023). Furthermore, this reduction may affect the budget balance of local authorities, as per the Law on State Budget, since the registration fee revenue is allocated to local budgets.

In reality, the increase in revenue from special consumption tax and value-added tax is concentrated in only eight localities where domestic automobile manufacturing companies are based, while other localities experience a decrease in local budget revenue due to this policy. These localities have requested compensation from the central budget to ensure their budget balance, which could potentially impact the budget equilibrium of many provinces and cities.

Therefore, the policy of reducing registration fees for domestically assembled cars is considered a double-edged sword. If utilized skillfully, it can maximize the advantages and effectiveness of the policy.

Sure, I can assist you with that.

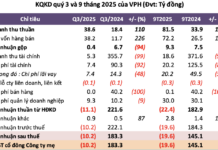

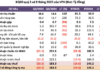

“Mai Linh Group: Chairman Ho Huy’s Struggling Enterprise Plagued by Debt and Insurance Woes”

As of the end of 2023, Mai Linh Group recorded accumulated losses of over VND 1,300 billion, exceeding equity. In addition, the enterprise of Chairman Ho Huy also owes 10 months’ worth of insurance for its employees.