Render of Diamond Square project in Thong Nhat Ward, Bien Hoa City, Dong Nai, developed by Gotec Land. (Source: Gotecland.vn)

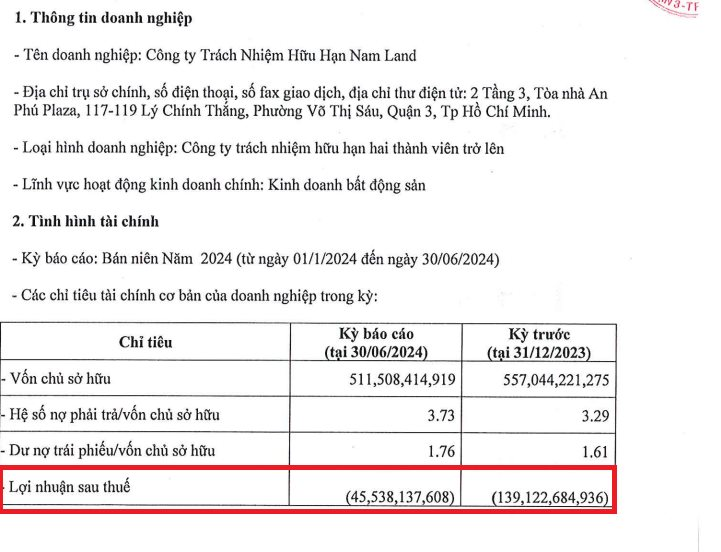

Nam Land JSC has disclosed its semi-annual financial report for 2024 to the Hanoi Stock Exchange (HNX), revealing a net loss of nearly VND 45.5 billion in the first half of the year, a 3.06-fold decrease compared to the same period last year (loss of VND 139 billion).

As a result, the company’s return on equity (ROE) improved significantly to -8.9%, up from -25% in the previous year. In the 2021 fiscal year, Nam Land reported a profit of VND 1.3 billion (ROE 0.16%). In the 2022 and 2023 fiscal years, the company reported net losses of VND 120.7 billion (ROE -17%) and VND 139.1 billion (ROE -25%), respectively.

Over the past 2.5 years, the company has accumulated losses of over VND 305 billion. As of June 30, 2024, Nam Land’s equity stood at VND 511.5 billion, an 8.2% decrease year-over-year. The debt-to-equity ratio was 3.73, with total liabilities amounting to VND 1,908 billion. This includes VND 900 billion in bond debt.

Source: HNX

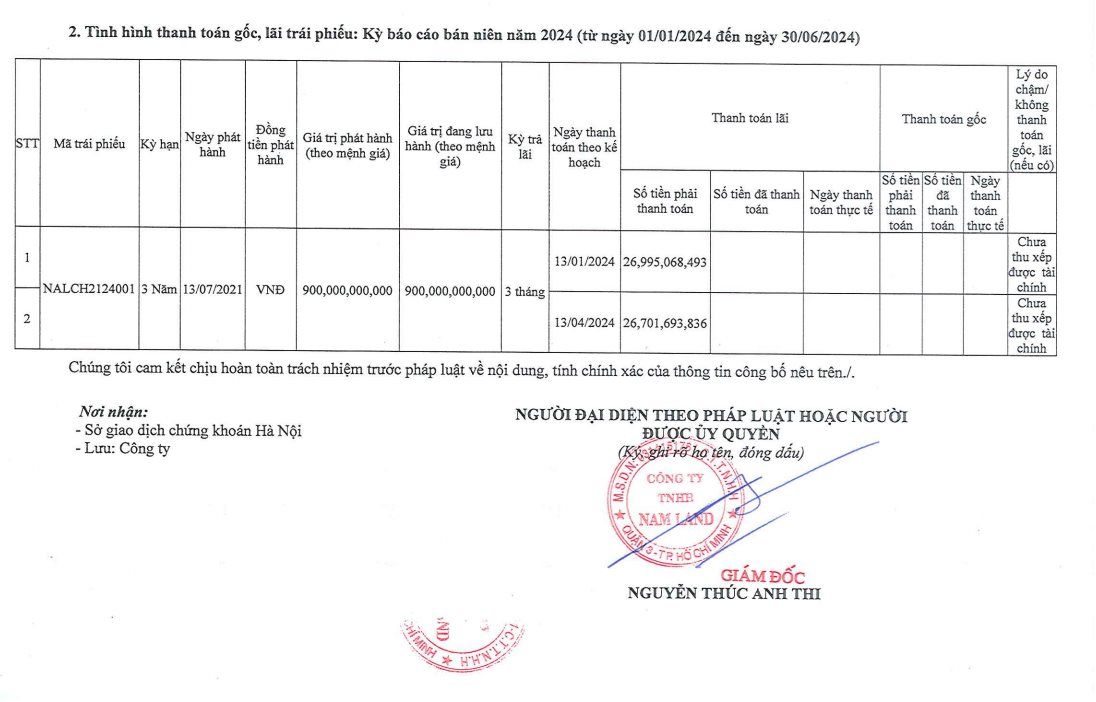

Notably, this period of declining financial performance coincided with the company’s issuance of the NALCH2124001 bond series, valued at VND 900 billion. According to HNX data, on July 13, 2021, Nam Land issued the NALCH2124001 bond series with a value of VND 900 billion, a three-year term, and a maturity date of July 13, 2024.

These non-convertible bonds do not come with warrants and are asset-backed. The collateral includes “The entire equity contribution in Gotec Vietnam JSC; The entire equity contribution in Nam Land JSC (when eligible for mortgage); Real estate and current assets, or those formed in the future (when eligible for mortgage), related to and/or arising from the Project of Commercial Center and High-class Apartment Building (Asiana Riverside) on Ben Nghe Street, Tan Thuan Dong Ward, District 7, Ho Chi Minh City, invested by Gotec Vietnam JSC.”

The bonds offer a combined interest rate, with 10.3%/year for the first year from the issuance date, and a rate equal to the sum of 4.7%/year and the reference interest rate for the respective interest calculation period for the second year onwards. In all cases, the interest rate will not be lower than 10.3%/year.

In its semi-annual report on principal and interest payments for 2024, Nam Land disclosed that it had delayed two interest payments for the NALCH2124001 bond series, totaling nearly VND 54 billion, due to “inadequate financial arrangements.”

In the first half of 2024, Nam Land delayed two bond interest payments totaling nearly VND 54 billion due to “inadequate financial arrangements.” Source: HNX

Established in December 2016, Nam Land JSC primarily operates in the real estate sector, with a current charter capital of VND 335 billion. The company is headquartered at An Phu Plaza, 117-119 Ly Chinh Thang, Ward 7, District 3, Ho Chi Minh City.

At its inception, the company had a charter capital of VND 20 billion, wholly owned by Mr. Nguyen Viet Hoai Tho (born in 1975). In April 2019, ownership was transferred to entrepreneur Nguyen Viet Anh (born in 1969), the founder of Gotec Vietnam JSC (Gotec Land). On June 8, 2019, Nam Land increased its charter capital to VND 215 billion, with Mr. Nguyen Viet Anh’s ownership reduced to 15%, while the controlling shareholder, Ms. Nguyen Thi Ngoc Tran, held the remaining 85%.

As of May 10, 2021, Nam Land’s capital scale had increased to VND 335 billion, with a shareholder structure comprising Mr. Nguyen Thuc Anh Thi (90%) and Mr. Vu Viet Trung (10%). The company’s legal representative is Director Nguyen Thuc Anh Thi (born in 1985, Phu Yen). In addition, Mr. Nguyen Thuc Anh Thi is also the legal representative of We Land Development JSC and Vina Hoa Binh JSC.

As of September 10, 2022, Nam Land held 50.748% of Gotec Land’s charter capital. Mr. Nguyen Viet Anh also owns over 48% of the capital of this company.

In the Southern real estate market, while Nam Land is not as well-known as its parent company, Gotec Land has established itself as a prominent real estate developer with numerous notable projects in Ho Chi Minh City, Dong Nai, Khanh Hoa, Da Nang, and beyond.

Mekong Group (HNX:VC3) Expands its Horizons with a New Project in Dong Hoi, Quang Binh

Mekong Grand Plaza is set to break ground and soar high as one of the tallest structures in Quang Binh. This ambitious project promises to be a game-changer, offering unparalleled investment opportunities and elevating the lifestyle standards for its residents. With its impressive scale and strategic location, Mekong Grand Plaza is poised to become an iconic landmark, transforming the skyline and bringing a new dimension of prestige and prosperity to the area.

Ride the Real Estate Wave: Capitalize on Phu Quoc’s Ascension to a Tier-1 City by 2025

Phú Quốc, a stunning Vietnamese island off the country’s southern coast, has been dubbed the second most beautiful island in the world, after the Maldives. With its pristine beaches, lush landscapes, and vibrant marine life, Phu Quoc boasts immense potential for economic growth, particularly in the tourism and real estate sectors. Aiming to become a Type I Urban Area by 2025, the island’s property market is poised for significant growth and exciting developments.

The Western District of Ho Chi Minh City: A Rising Star with Triple Allure

Long An’s real estate market is experiencing a significant boost thanks to its increasingly well-connected infrastructure and pristine natural environment. The province’s trend towards developing an eco-industrial urban blend is a huge draw, offering a unique and appealing lifestyle choice for prospective buyers and investors.

The Ocean Villa Owners Enjoy a “Coral Garden” at Gran Meliá Nha Trang

At the “peninsula” strip of land between Nha Trang Bay, Gran Meliá Nha Trang is not just built to be a free and happy “billionaire village”, but also a very humane place to enjoy when each owner has a “coral garden” right at their doorstep. Together with the investor, they embark on a mission to protect and propagate rare coral reefs.