In its latest report, SSI Securities stated that the Vietnamese stock market was among the fastest to recover after a sharp sell-off in the first week of August. Concerns about “carry trade” activities due to rising interest rates in Japan triggered a sell-off in risky assets, including stocks, but most markets rebounded strongly following a more assertive message from the Fed about potential rate cuts in September.

The intense selling pressure at the beginning of August pushed the VN-Index down to 1,188 points, but it staged an impressive recovery thereafter. Closing at 1,283.87 points on August 30, the VN-Index had bounced back by 8% from its recent low and gained 32 points, or 2.6%, compared to the end of July.

According to SSI, the Vietnamese stock market was well-supported by positive domestic factors that offset unpredictable external fluctuations. These included the recovering economy, listed companies’ improving profits, and diminishing currency risks as the US dollar cooled down and the government and SBV implemented supportive policies.

Vietnamese Stock Market Anticipated as a Destination for Investment Funds

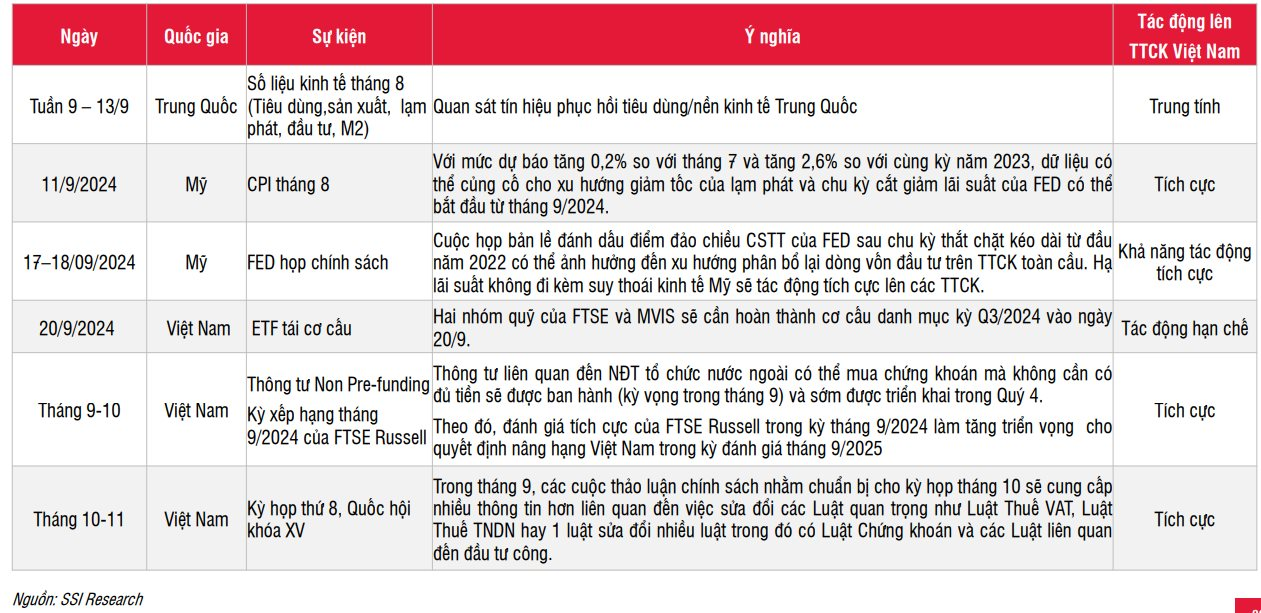

SSI highlighted several events in September that could influence the stock market:

Historically, September has been a relatively stable month for the VN-Index, except for years heavily impacted by exchange rate fluctuations like 2022 and 2023.

In terms of valuation, the VN-Index’s forward P/E ratio edged up to 11.6x on September 6, 2024, making it more attractive compared to some other Southeast Asian stock markets. These markets shone during the rebound in August. With the possibility of emerging markets benefiting from the Fed’s monetary policy easing cycle, attractive valuations could draw investment funds.

The Vietnamese stock market holds an advantage, having rebounded strongly in August due to the recovering economy and widespread profit growth. According to SSI Research’s watchlist, profit growth in the second half of 2024 is expected to reach 21.7%, a significant acceleration compared to the modest 6.2% in the first half.

Meanwhile, domestic investor inflows are anticipated to increase as the SBV may adopt a more accommodative policy stance once the Fed cuts rates and the US dollar cools down.

“Overall, while there may still be fluctuations as we cautiously monitor data on US economic scenarios, there are now more factors that could positively influence the Vietnamese stock market in the latter part of the year, with growth accompanied by supportive monetary and fiscal policies,” the report stated.

SSI analysts expect the market index and liquidity to improve in the last two weeks of September as the focus shifts back to positive domestic factors.

SSI also recommended that investors maintain a balanced portfolio to benefit from the expected recovery in growth sectors such as Consumer (Food, Retail), Exporters, Banks, and Construction/Building Materials.