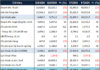

With an execution rate of 30% (1 share receives VND 3,000) and over 3.1 million shares in circulation, HAT is estimated to spend over VND 9 billion in dividend payments to shareholders. The expected payment date is October 23, 2024.

Source: VietstockFinance

|

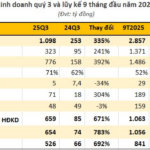

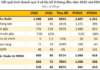

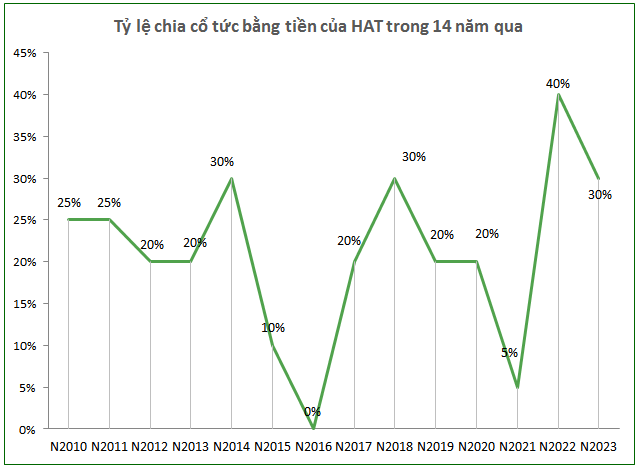

Looking back at HAT’s dividend history from 2011 to 2023, except for 2016 when no dividends were distributed, HAT has consistently paid out cash dividends to its shareholders in the remaining years, with a minimum rate of 5% (in 2021) and a maximum of 40% (in 2022).

Going back to 2016, the Annual General Meeting of HAT’s shareholders decided to temporarily suspend dividend payments as the company’s parent organization, the Hanoi Beer, Alcohol, and Beverage Joint-Stock Corporation (Habeco), was subject to an additional tax collection request of VND 920 billion in special consumption tax by the State Audit Office.

According to the resolutions of HAT’s 2017 Annual General Meeting, the parent company was still in the process of sending petitions to state management agencies and awaiting guidance. Therefore, the additional special consumption tax payment made by the parent company was only considered a provisional payment following the State Audit Office’s recommendation.

“The increase in special consumption tax expenses for draft beer from 2012 to 2015 does not yet meet the conditions to be considered reasonable expenses and may affect after-tax profits from 2012 to 2015 and cumulative after-tax profits up to the end of 2016, which may result in a loss. Therefore, no dividends were distributed from undistributed after-tax profits in 2016. Once there is specific guidance on the additional special consumption tax settlement for the years 2012 to 2015, and these expenses are recognized as reasonable and deductible from corporate income tax, the cumulative after-tax profits for 2016 will not be negative, and dividends for shareholders will be ensured to be compensated in the following periods,” HAT stated in the resolution.

Source: VietstockFinance

|

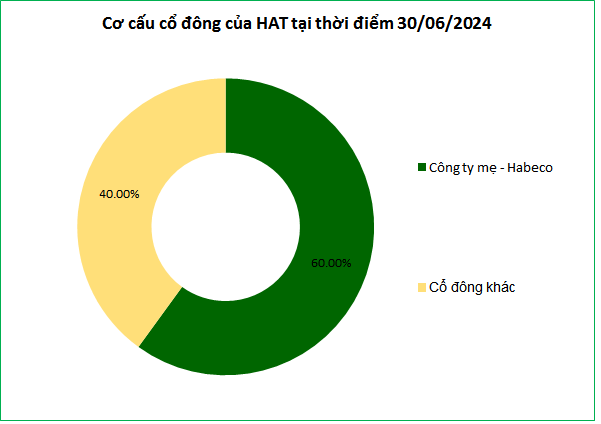

As of June 30, 2024, Habeco remains the parent company and the largest shareholder of HAT, holding 60% of the capital and is expected to receive nearly VND 6 billion in dividends from its subsidiary.

| HAT’s Business Results for the First Half of 2024 |

In the first half of 2024, HAT achieved nearly VND 646 billion in net revenue, a 13% increase compared to the same period last year. However, due to a significant rise in selling expenses (up 22%) year-over-year, HAT’s net profit witnessed a modest 7% increase, reaching nearly VND 13 billion.

For the full year 2024, HAT expects a 25% decrease in net profit compared to 2023, amounting to nearly VND 19 billion. The company has accomplished 68% of its annual plan in the first six months.