Fed Chair Jerome Powell’s speech at the late-August Jackson Hole conference further solidified expectations of an interest rate cut at the upcoming September 18th meeting.

The question now is whether this will be a 50-basis point cut or a more compromising 25-basis point reduction, with the latter still aligning better with the Fed’s inflation outlook.

US STOCKS UNLIKELY TO BE SIGNIFICANTLY AFFECTED BY FED RATE CUTS

Mirae Asset maintains its view that interest rate cuts of 25 to 50 basis points in the remaining meetings of 2024 are unlikely to drastically change the current situation due to monetary policy lag. Additionally, the Fed has been slowing the pace of balance sheet reduction since June 2024, from $60 billion in Treasury bills to $25 billion, while keeping the pace of $35 billion per month for mortgage-backed securities (MBS).

As such, the Fed may struggle to meet market expectations of continuous large-scale rate cuts, as this could lead to asymmetric risks in monetary policy.

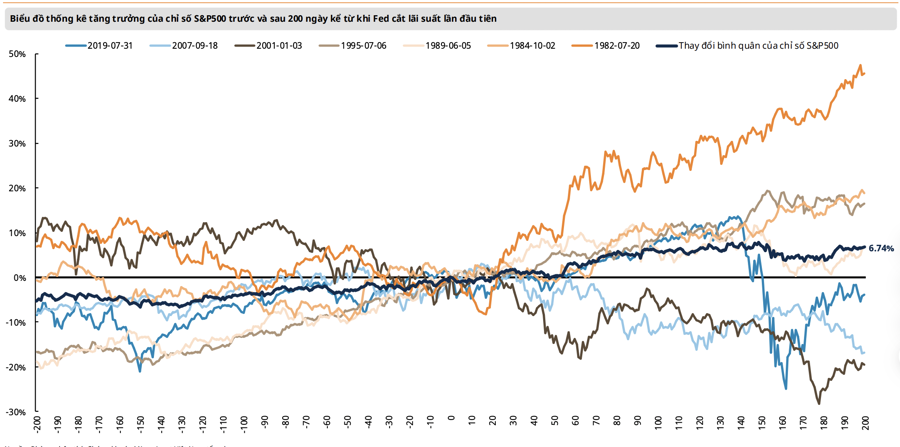

Separately, statistical data suggests that the US stock market doesn’t typically react very positively to the Fed’s first rate cut. Instead, the reasons behind the rate cut and the path of future cuts tend to bring about more significant core changes, especially as the era of near-zero interest rates seems to be over in the US, with the Fed projecting only four more 0.25% reductions in 2025 and a similar outlook for 2026.

Since 1980, the S&P 500 has averaged a 6.74% growth rate 200 days after the Fed’s initial rate cut. However, excluding the period from 1979 to 1982, when the US transitioned from a manufacturing-focused economy to a service-based one and experienced a double-dip recession in the first three years of 1980, the average growth rate of the S&P 500 was much more modest (0.27% after 200 days) following the first rate cut.

Mirae Asset believes that the current economic context may not guarantee a soft landing for the Fed, as economic activities have yet to show significant improvement, with rising unemployment rates, shrinking manufacturing activities, and consumer spending pressures reflected in retail sales data and increasing credit card delinquencies (now at their highest since 2012, according to the Federal Reserve Bank of Philadelphia).

In the medium term, the pressure on NVIDIA’s stock and its potential spread to other tech stocks is an inevitable concern. The AI investment wave only became prominent in late 2022 with the advent of ChatGPT, and the tech stock rally truly took off in early 2023, fueled by explosive user adoption, an AI-powered software and tools boom, and enhanced revenue and profits from the low base of 2023.

Hence, the market’s overly optimistic outlook and premium valuation for NVIDIA stock pose a risk worth monitoring, as 2025 will be the first year of actual growth on top of the already high base of 2024.

From a broader perspective, caution is imperative in the remaining months of 2024, as global growth drivers, such as China, struggle to restore consumer confidence amid a shift away from real estate-dependent economic growth. Additionally, the potential for further monetary policy tightening by the Bank of Japan poses a risk to Carry Trade activities.

OUTLOOK FOR VIETNAM’S STOCK MARKET

For Vietnam’s stock market, as we move into September and look ahead to the remaining months of 2024, the market will continue to navigate mixed signals regarding the growth prospects of major regional and global economies, as well as Vietnam’s specific context.

The market will be seeking new catalysts to drive growth, as the anticipated upgrade of Vietnam’s market status may once again be delayed in the September 2024 report by FTSE, due to the recent approval of draft amendments to laws related to securities trading and brokerage to meet the remaining criteria for the upgrade, with implementation pending the National Assembly session in October.

Given the current timeline for amendments, the most optimistic scenario for a potential upgrade assessment is September 2025, allowing for the practical application and real-world testing of the new policies and trading system, along with any necessary adjustments to ensure their effectiveness.

On another note, the lack of clear growth drivers and the less-than-optimistic performance of many large-cap stocks may lead to more frequent volatile trading sessions, similar to the sideways trend witnessed in the past six months, with the VN-Index fluctuating within a broad range of 1,200 to 1,280 points.

In the medium to long term, there is insufficient evidence to conclude that the market will soon enter a new phase of the trend, and the VN-Index is likely to gravitate towards the psychological mark of 1,300 points, as its P/E ratio remains relatively attractive when trading below the 10-year average.

However, profit-taking sentiment may emerge if the VN-Index surpasses this psychological barrier, potentially prolonging this trend until the index successfully breaches the 1,330-point level. Nonetheless, short-term risks persist, with the VN-Index likely to revert to the equilibrium zone after three consecutive weeks of gains, heading towards the support zone of 1,240 to 1,250 points.

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

The morning of September 10 saw a stagnant domestic gold price, with no significant changes from the previous day’s rates. While the SJC gold price remained unchanged, gold ring prices only witnessed a slight increase of VND 50,000-100,000 per tael.